Prior authorization in medical billing is a crucial component of the entire process. Like medical coding and documentation, completing the billing process without prior authorization is challenging.

Healthcare professionals must handle each aspect of prior authorization with proper attention. Especially, providers should carefully consider payor guidelines and legal aspects when pre-authorizing services or procedures.

If you are a medical provider having trouble with prior authorization, don’t get frustrated.

This comprehensive guide helps healthcare providers, physicians, billing teams, and revenue cycle management (RCM) companies understand and optimize the PA process, ensuring smoother workflows and better patient outcomes.

Before tackling the prior authorization issues and optimizing the entire process, let’s understand what it is.

The primary purpose of the prior authorization is to control healthcare costs. For example, physicians will only be reimbursed for the actual services they provide to patients.

Hence, prior authorization ensures that only medically necessary services and procedures are approved for reimbursement.

| According to the 2024 American Medical Association (AMA) survey, 61% of physicians report being concerned that augmented intelligence (AI) will increase or has already increased physician assistant (PA) denial rates. |

The prior authorization enables healthcare providers to manage the overall expense for both insurers and patients, reducing unnecessary treatments and controlling fraud.

Certain healthcare services and treatments are more likely to require prior authorization due to their cost or complexity.

The services that usually require prior authorization include:

- Medications: Specialty drugs, biologics, or medications not included in the standard formulary often require prior authorization (PA).

- Imaging: Procedures such as MRIs, CT scans, and PET scans may require prior authorization (PA) for reimbursement justification.

- Surgeries: Elective surgeries or high-cost inpatient procedures usually require PA.

- Home Healthcare/Durable Medical Equipment (DME): Services such as CPAP machines, wheelchairs, and home health visits often require PA approval.

Before seeking approval for medical services and procedures, healthcare providers must understand the process.

This will help them avoid delays and denials by insurance companies.

Here is a complete, step-by-step process of the PA workflow.

Step 1: Patient Evaluation

The process starts when a physician or healthcare provider evaluates a patient and determines the need for a particular service, medication, or procedure.

In this step, the physician checks and identifies the disease. Then he comes to know that the patient needs a particular medical treatment or procedure, as well as medication.

Step 2: Identify if the Service/Medication Requires PA

Next, the provider checks whether the service or medication requires a prior authorization (PA). For this, he will check and verify the patient’s coverage details.

Then, the physician will check and verify the insurance plan under which the patient is covered and the insurance provider.

Insurance plans typically provide a list of services that require authorization, which can vary by insurer.

Step 3: Check Plan-Specific Criteria (Payer Guidelines)

After verifying and confirming the insurance plan, the physician identifies the specific criteria that the plan meets.

Simply put, the physician will review the patient’s benefits under their plan and follow the payer guidelines.

Each payer (CMS, Medicaid, or private insurers like Aetna, Blue Cross) has specific guidelines for prior authorization.

It’s essential to refer to these guidelines to ensure compliance and prevent rework.

Step 4: Submit Documentation and CPT/ICD-10 Codes

Following the payer-specific documentation, the physicians’ next step is to submit the documentation and assign the relevant medical codes, such as CPT and ICD-10, to verify the services.

This justifies the medical necessity of the service and confirms that the service exists in the plan and is billable for reimbursement.

The documentation, codes, and other patient details include:

Patient Information: Patient name, date of birth, insurance ID number, and contact information.

Provider Information: The doctor’s name, NPI (National Provider Identifier), and contact information.

Service Information: Details of the requested treatment or medication, including the service type, start date, and CPT/HCPCS codes.

Diagnosis Codes (ICD-10-CM): The codes that describe the specific medical condition.

Step 5: Wait for Determination (Approval, Denial, Modification)

Once submitted, the physician needs to wait for the insurance company’s response.

The payer reviews the request and either approves, denies, or modifies the PA request based on the criteria.

This process may take several days or even weeks, depending on the insurer and the complexity of the request.

- The approval timeframe typically ranges from 1 to 3 business days for standard requests.

- Urgent requests may be approved within 24 to 72 hours.

- Complex cases or appeals may take several weeks or months to resolve.

Step 6: Notify Patient, Proceed with Care

Once a determination is made, the provider must inform the patient. If approved, care can proceed; if denied, the provider may need to consider next steps.

In this phase, the insurance payer contacts the healthcare provider again. The payer determines and verifies the availability of the service or procedure in the patient’s plan.

The payer gives two signals to the provider:

- The service is in the plan, billable, and approved (Payer will issue a PA reference number)

- The service is not in plan, and the PA request is denied. (Payer will detail the unavailability of the service)

Then the patient takes the next step according to the insurance payer’s response.

Step 7: Submit Claim Using PA Reference Number

When the insurance company approves a service or procedure, the provider submits the claim to the insurer using the PA reference number to ensure proper reimbursement.

There are various types of prior authorization in medical billing. These include:

- Prior authorization for medication

- Prior authorization for procedures and imaging

- Prior authorization for DME and services

- Prior authorization for insurance plans

Prior Authorization for Medication

Medications often require PA when they fall under specialty drugs, tiered formularies, or non-formulary medications. Pharmacy Benefit Managers (PBMs) play a crucial role in ensuring that prescriptions align with formulary requirements.

Prior Authorization for Procedures and Imaging

High-cost outpatient procedures, such as CT scans, MRIs, and elective surgeries, typically require prior authorization (PA). Payers scrutinize these services due to their cost, with some insurers approving procedures only when a clinical justification is provided.

Prior Authorization for DME and Services

Durable Medical Equipment (DME), such as CPAP machines, wheelchairs, and home health services (e.g., nursing visits), also frequently requires a PA to ensure their medical necessity and alignment with coverage policies.

Prior Authorization for Insurance Plans

Different insurance plans (e.g., Medicare, Medicaid, and Commercial insurance, such as Blue Cross or Aetna) may have varying PA requirements. Providers must distinguish between pharmacy and medical benefit classifications when submitting requests for coverage.

Healthcare practices and physicians may also encounter challenges in the prior authorization process.

Therefore, they need to remain informed and have proactive strategies in place to address these issues.

Here are some significant issues that providers may face during the process.

Delays in Approval

One of the most significant challenges in PA is the delay in approval, which can impact patient care and the timeliness of treatments. Delays often occur due to inefficiencies, incomplete documentation, or a backlog at insurance companies.

Manual Documentation & Inefficiencies

A high volume of paperwork and manual tracking can lead to inefficiencies. Many practices struggle with manually managing the PA process, which increases the risk of errors and delays.

Frequent Payer Policy Changes

Payer guidelines for PA are often updated, making it difficult for providers to stay current. Frequent policy changes can lead to denied claims or missed authorizations, which can potentially impact revenue.

Lack of Real-Time EHR Integration

Without Electronic Health Record (EHR) integration, verifying physician assistant (PA) requirements and submitting requests in real-time can be cumbersome, contributing to delays and errors.

Duplicate or Conflicting Requests

Some practices encounter issues with duplicate requests or conflicting PA requests from multiple payers, which complicate workflows and increase administrative burdens.

High Rate of Denials

PA denials are common, often due to lack of medical necessity, incomplete documentation, or failure to adhere to payer guidelines. Denials result in costly delays and administrative burdens for healthcare providers.

Miscommunication Between Departments

Poor coordination between departments, such as those between billing and clinical teams, can lead to miscommunication, missed deadlines, or errors in submitting PA requests.

Negative Impact on Patient Satisfaction

Delays and denials in PA processes can frustrate patients, leading to dissatisfaction and loss of trust in the provider.

Use an Integrated EHR System

An integrated EHR system can automatically verify if a prior authorization (PA) is required and submit requests directly through payer portals (e.g., Availity, Surescripts), thereby reducing administrative overhead.

Maintain Updated Payer Guidelines

Providers should keep updated payer-specific PA cheat sheets and formulary lists to stay informed about which services require prior authorization (PA) and the associated documentation requirements for each payer.

Train Dedicated PA Specialists

Designating a team or specialist to manage the PA workflow helps streamline the process. These specialists can handle coordination with providers, pharmacists, and insurers, ensuring all aspects of the PA process are managed effectively.

Track Key Performance Metrics

Track key metrics, including time to approval, denial rate, appeal success rate, and average days in accounts receivable (AR), to identify bottlenecks and areas for improvement.

Medical billing companies play a key role in optimizing and enhancing the PA process for healthcare providers:

Here’s how?

- End-to-End Authorization Tracking: Billing companies can track PAs from initiation to approval, thereby reducing the burden on providers.

- EHR Integration and Auto-Eligibility Checks: Billing companies ensure that PA requirements are checked and submitted directly from the EHR, minimizing errors.

- Documentation Collection and CPT Code Validation: Billing companies ensure that all necessary documentation and CPT/ICD-10 codes are correctly submitted with the PA request.

- Follow-Ups, Appeals, and Resubmission: If a PA is denied, billing companies can handle the appeals process, ensuring the request is resubmitted with supporting documentation.

- Reducing Administrative Burden: Outsourcing PA management to a billing company enables providers to focus on patient care while increasing reimbursement rates and minimizing delays.

CTA: Learn how Medheave reduces PA delays and boosts your practice’s cash flow.

HIPAA-Compliant Communications

All PA communications must adhere to HIPAA regulations to ensure patient confidentiality and protect sensitive health information during the submission and approval processes.

CMS Guidelines on PA Documentation

The Centers for Medicare and Medicaid Services (CMS) have specific guidelines for documentation and PA submission, which must be followed to avoid claim denials.

State Laws (e.g., Texas Gold Card Rule, California SB-282)

Some states, such as Texas and California, have introduced laws that streamline the PA process for certain services, reducing administrative burdens for providers.

Impact of Non-Compliance: Claim Denial, Penalties

Failure to comply with PA regulations and guidelines can result in claim denials, delays in reimbursement, or even penalties for providers.

When an insurance provider denies a prior authorization request, you must appeal.

To appeal, practices need to follow these steps.

Identify Reasons for Denial

Denials can occur for several reasons, including lack of medical necessity, incorrect coding, or failure to follow payer guidelines. So, healthcare providers must identify and understand these reasons.

Review Denials and Revise the Request

Review the denial letter carefully to understand the cause and revise the PA request with the necessary documentation or adjustments as needed.

Time Limits for Resubmission

Each payer has specific time limits for resubmitting denied PAs, and providers should act quickly to avoid losing reimbursement opportunities.

Appealing Directly with Documentation Support

To appeal, providers must submit additional documentation or clarification that supports the medical necessity of the service.

Provider-Payer Collaboration

Building a strong working relationship with insurers can help resolve PA issues more quickly, reducing the need for appeals.

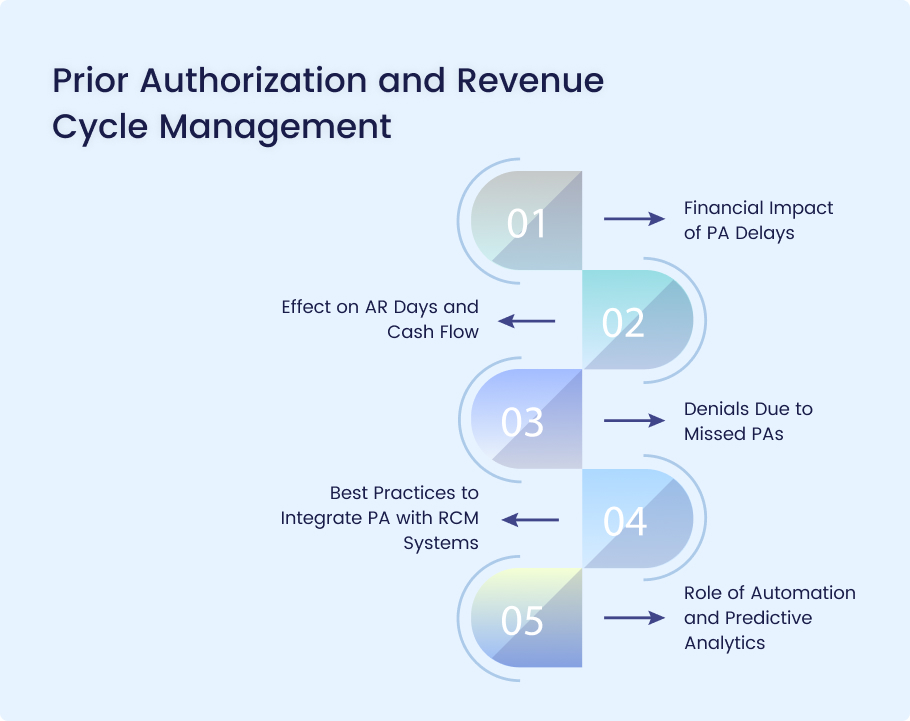

Delays in prior authorization (PA) processes can have significant financial consequences for healthcare organizations.

Here’s how:

Financial Impact of PA Delays

- Delayed Treatments: Patients may experience postponed care, leading to lower throughput for providers and missed revenue opportunities.

- Increased Administrative Costs: Staff spend excessive time following up on PA requests, diverting resources from other revenue-generating activities.

- Patient Leakage: Delays may cause patients to seek care elsewhere, resulting in lost revenue and potential patient attrition.

Effect on AR Days and Cash Flow

- Extended AR Days: PA delays can cause claims to be held until authorization is approved, increasing the number of days in AR.

- Cash Flow Disruptions: Payments are delayed, leading to liquidity issues and challenges in meeting operational expenses.

- Rework Costs: Delayed or denied authorizations result in resubmissions and appeals, slowing down revenue realization.

Denials Due to Missed PAs

- Top Denial Reason: Lack of or improper PA is one of the leading causes of medical claim denials.

- Revenue Loss: Missed authorizations often result in non-reimbursable services, directly impacting revenue.

- Appeal Burden: High denial rates due to PA issues increase the administrative burden for appeals, reducing overall RCM efficiency.

Best Practices to Integrate PA with RCM Systems

- Centralized PA Tracking: Utilize integrated systems to monitor the status of PA requests in real-time.

- EMR-RCM Integration: Ensure PA requirements and status are visible within the EHR to avoid missed steps.

- Standardized Workflows: Implement Standard Operating Procedures (SOPs) for capturing and submitting Physician Assistant (PA) requirements during scheduling and pre-registration.

- Training & Education: Regularly train staff on payer-specific PA rules and documentation standards.

Role of Automation and Predictive Analytics

- Automation:

- Eligibility & PA Verification: Automate insurance verification and flag services that require PA.

- Submission & Follow-Up: Use robotic process automation (RPA) to submit and track PA requests.

- Predictive Analytics:

- Risk Stratification: Identify claims at high risk of denial due to PA issues.

- Process Optimization: Forecast staffing and resource needs based on PA volume trends.

- Proactive Intervention: Alert teams when a PA is missing or likely to be denied.

Top PA Automation Platforms

Several platforms help streamline the prior authorization (PA) process to improve efficiency and reduce delays. Notable options include:

- CoverMyMeds: Automates PA workflows, integrates with electronic health records (EHRs), and accelerates approval times.

- Olive AI: Uses artificial intelligence to handle PA submissions, track status, and eliminate manual work.

- Surescripts: Focuses on electronic prior authorization (ePA) with direct integrations into prescribing systems to simplify approvals.

AI-Based Prior Auth Engines

AI-powered prior authorization engines analyze historical claim data and payer policies to predict and automate approvals. Benefits include:

- Predictive analytics identifies claims with a higher chance of rejection, allowing providers to address them proactively.

- Automated decision-making: AI-driven approvals reduce the need for manual reviews, shortening wait times.

- Adaptive learning: AI continuously refines PA strategies based on payer feedback and denial patterns.

Real-Time Benefit Checks

- Instant verification: Determines a patient’s eligibility and coverage for a prescribed service before submission.

- Cost transparency: Helps providers and patients understand out-of-pocket expenses and alternative treatment options.

- Reduced surprises: Avoids unexpected claim rejections by confirming insurer requirements upfront.

Portal vs. API-Based Solutions

Healthcare providers can use either manual web portals or automated APIs for PA submissions:

- Portal-Based: Providers log into insurance company portals to manually enter PA details, a process that can be time-consuming.

- API-Based: Direct integration with payer systems via APIs automates the submission and approval process, reducing workload and delays.

Cost Savings from Automation

- Lower administrative costs: Reduces manual labor associated with PA submissions and follow-ups.

- Faster approvals: Shortens accounts receivable (AR) days, leading to improved cash flow.

- Higher approval rates: AI minimizes errors, reducing denial rates and unnecessary appeals.

Prior Authorization FAQs

What if prior authorization is not obtained before the service is rendered?

If PA is required but not obtained, the claim may be denied, requiring the provider to either absorb the cost or bill the patient directly. Some insurers allow retroactive authorization in urgent cases, but this is not guaranteed.

Can you bill retroactively for denied prior authorizations (PA)?

Yes, but the process varies depending on the payer. Some insurers allow post-service authorization appeals, but success depends on the medical necessity and whether proper documentation is provided.

How long does PA approval take?

- Standard approvals – Typically 24-72 hours, though some complex cases take longer.

- Urgent requests may be processed within 24 hours if deemed medically necessary.

- Manual reviews – Can take several weeks, especially if additional clinical documentation is required.

Does Medicare Advantage require PA?

Yes, Medicare Advantage (MA) plans often require prior authorization for many services, including diagnostic tests, procedures, and certain medications. Each MA plan has different criteria, so providers must check payer-specific requirements.

What are the alternatives to PA?

Providers can consider these alternatives:

- Pre-approved service contracts – Some payers offer bundled service agreements that reduce the need for prior authorization (PA).

- Value-based care models – Certain healthcare payment structures minimize PA requirements by focusing on patient outcomes rather than procedural approvals.

- Point-of-care benefit verification – Some insurers allow providers to check real-time eligibility and coverage without a formal PA.

Conclusion

Prior authorization (PA) is no longer just a regulatory step—it’s a critical component of the revenue cycle that directly impacts financial health, patient care, and provider efficiency. When mismanaged, it leads to claim denials, delayed treatments, administrative overload, and disrupted cash flow.

However, when optimized using best practices, automation, and data-driven strategies, PA can become a streamlined process that enhances reimbursement rates and reduces AR days.

Healthcare providers must move beyond manual workflows by embracing integrated RCM systems, real-time EHR tools, and AI-powered solutions to stay ahead of payer requirements and minimize revenue leakage.

Struggling with delayed authorizations and denied claims?

Let Medheave simplify your prior authorization workflow. Our AI-driven RCM solutions integrate seamlessly with your EHR, automate approvals, and reduce AR days—so you can focus on patient care, not paperwork.

- Faster approvals

- Fewer denials

- Better cash flow

Schedule your free PA audit today with Medheave and see how we boost your revenue cycle efficiency.