Medicaid serves as a crucial financial safety net for millions of Americans, ensuring access to affordable healthcare. For providers, accurately billing Medicaid is essential to ensure timely and correct reimbursement for services rendered. However, the process can be complex due to state-specific rules, strict documentation requirements, and frequent policy updates. Understanding these requirements is crucial for maintaining a healthy and compliant revenue cycle.

This guide simplifies Medicaid billing, empowering you to manage the process confidently. Whether new to Medicaid billing or looking to streamline existing operations, it offers practical tips and proven strategies to help your practice receive payments faster and reduce errors.

What is Medicaid?

Medicaid is a joint federal and state program that provides health coverage to individuals and families with limited income and resources. Established in 1965, its primary goal is to ensure that people who cannot afford private health insurance still have access to essential medical care. Unlike Medicare, which primarily supports older adults, Medicaid focuses on low-income families, children, pregnant women, people with disabilities, and seniors needing long-term care.

The program covers many services, including doctor visits, hospital stays, preventive screenings, prescription medications, and long-term care. Each state administers its Medicaid program within federal guidelines, meaning coverage details, eligibility requirements, and reimbursement rates can vary from state to state.

Medicaid aims to reduce health disparities and promote equitable access to care. Acting as a safety net for vulnerable populations ensures that financial barriers do not prevent individuals from receiving necessary healthcare services.

Eligibility Criteria and Who It Serves

Medicaid eligibility is based on income, household size, age, disability status, and other qualifying factors. While every state has the right to set eligibility rules, it must follow federal minimum standards.

Generally, Medicaid serves the following groups:

- Low-income individuals and families who meet state-defined income limits.

- Children and teenagers through Medicaid or the Children’s Health Insurance Program (CHIP).

- Pregnant women who need prenatal, delivery, and postpartum care.

- People with disabilities who require ongoing medical or personal assistance.

- Elderly adults who need long-term care or nursing home support.

States have expanded Medicaid under the Affordable Care Act (ACA) to include adults with incomes up to 138% of the Federal Poverty Level (FPL). Eligibility can usually be determined through state Medicaid agencies or the federal Health Insurance Marketplace.

Medicaid’s Impact on Healthcare Access

Medicaid plays a vital role in improving access to healthcare across the United States, ensuring that millions of individuals receive essential preventive and medical services. By covering many healthcare needs, Medicaid helps reduce hospital readmissions, promote early disease detection, and improve overall health outcomes.

Medicaid reimbursement also enables healthcare providers to serve a larger patient population, particularly in underserved or rural areas. This strengthens community health systems and supports the financial stability of clinics and hospitals that rely on Medicaid payments.

In short, Medicaid has transformed healthcare access by bridging the gap for low-income populations, promoting healthier communities, and creating a more equitable healthcare system.

How to Enroll as a Medicaid Provider

Enrolling as a Medicaid provider is the most crucial step in providing services to Medicaid patients and getting paid. Although each state has its specific procedure, most have a similar framework. A basic, step-by-step outline of what to expect is provided below:

Check Eligibility Requirements:

Check the requirements for Medicaid providers in your state. The license, certifications, and enrollment status standards may vary depending on the type of provider, including doctors, nurse practitioners, therapists, or facilities.

Register with the State Medicaid Program:

Visit the Medicaid website or provider enrollment portal in your state. Register and start the online application procedure. Many states also use the Provider Enrollment Chain and Ownership System (PECOS) for electronic submission.

Complete the Provider Application

Complete all required fields accurately. The form generally contains information about your practice, tax information, service locations, and NPI (National Provider Identifier). Approval may be delayed by information that is conflicting or incomplete.

Submit Required Documents

Attach and submit the required supporting documentation, including ownership disclosures, licenses, certifications, and evidence of malpractice insurance.

Undergo Screening and Background Checks

Medicaid requires background checks for all owners and providers to guard against misuse or fraud. Additionally, some applications could require site visits before approval.

Receive Approval and Provider Number

Upon assessment and approval of your application, you will be issued your Medicaid provider ID number. This ID is necessary to submit claims and get paid.

Enroll in Electronic Claims submission (if applicable)

After being accepted, sign up for your state’s electronic claims filing system to expedite the billing and payment process.

Required Credentials and Documentation

The state may require different paperwork for enrollment, but generally, providers need to have the following documents ready:

- Active state medical license or certification.

- National Provider Identifier (NPI) and Tax Identification Number (TIN)

- Proof of malpractice insurance coverage

- Business registration documents, including ownership details.

- W-9 form for tax verification

- Background check authorization and, if applicable, fingerprints.

- Accreditation or certification documents for facilities or specialty services

Ensuring all documents are current and correctly formatted will help avoid delays during review.

Tips to Ensure a Smooth Application

Start Early: Depending on state processing times, enrollment may take a few weeks. Do not start seeing Medicaid patients until you are fully approved.

Double-check Details: Ensure your NPI, tax information, and license number match across all submitted documents. Minor mismatches are a common cause of delays.

Keep Copies of Everything: Maintain hard copies of all submitted forms and correspondence for further reference.

Stay Responsive: Respond immediately if your state Medicaid office asks for more details or adjustments so your application can continue.

Renew on Time: In many states, revalidation is required every three to five years. Mark the date of renewal to prevent enrollment lapses.

Efficient billing and compliance depend on properly enrolling in Medicaid providers. By carefully completing each step and providing appropriate documentation, you can guarantee a smooth approval process and start serving Medicaid patients immediately.

Verify Patient Eligibility

One of the most critical steps in medical billing is confirming a patient’s eligibility before providing services. Medicaid eligibility can change frequently due to fluctuations in household income or state re-evaluations. If eligibility is not verified before the visit, providers risk treating patients not currently covered, which can lead to denied claims and lost revenue.

Confirming eligibility ensures that:

- The patient’s Medicaid coverage is active on the date of service.

- The services provided are covered under the patient’s plan.

- If multiple insurance exists, the correct payer Is billed first.

- The provider avoids compliance risks and billing errors.

A few minutes to verify eligibility upfront can prevent costly administrative rework and improve claim success rates.

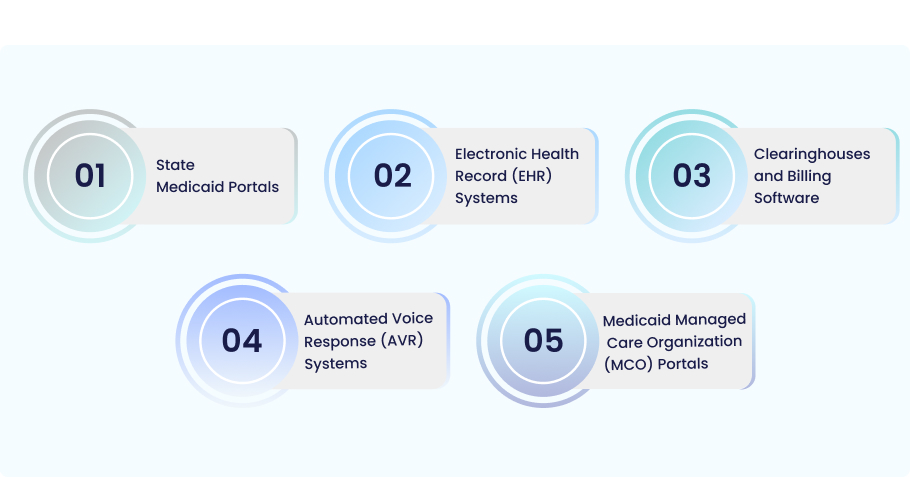

Methods and Tools for Verification

Several states offer multiple ways for providers to verify a patient’s Medicaid eligibility quickly and accurately. Common methods include:

- State Medicaid Portals:

You can verify eligibility in real time by entering the patient’s name, birthdate, and Medicaid ID number on the secure provider portal found on each state’s Medicaid website.

- Electronic Health Record (EHR) Systems:

Numerous EHRs have Medicaid database integration, enabling eligibility checks to be performed automatically during check-in or scheduling.

- Clearinghouses and Billing Software:

Third-party clearinghouses frequently provide batch or real-time eligibility verification capabilities through direct connections to payer databases.

- Automated Voice Response (AVR) Systems:

Many states offer a toll-free phone system for speedy verification utilizing patient identification.

- Medicaid Managed Care Organization (MCO) Portals:

Confirming whether a patient is registered in a managed care plan can be done through the managed care organization’s online provider portal or customer service line.

Regardless of the method, always document the verification results in the patient’s record, including the date and confirmation number (if applicable).

When and How Often Check Eligibility

Eligibility verification cannot be a one-time process. Regular checks are essential because Medicaid coverage can change from month to month. Providers should follow these recommended practices:

- Before every visit: Verify eligibility at scheduling and again on the service date to confirm no coverage changes.

- For recurring patients: Recheck eligibility monthly, especially for long-term treatment plans.

- When patients change plans: Reconfirm coverage whenever a patient reports a change in insurance or personal circumstances.

- Before claim submission: Double-check eligibility to ensure that coverage was active on the exact date of service.

By making eligibility verification a routine part of your workflow, you can prevent denials, reduce claim rework, and maintain a steady revenue cycle.

Understand Medicaid Billing and Coding Requirements

Medicaid billing follows federal guidelines and is governed by state-specific regulations and processes. Unlike private insurance, Medicaid is administered at the state level, with each state setting its own rules for filing requirements, covered services, and fee schedules. Therefore, Keep informed about your state’s latest Medicaid billing rules to ensure accurate claim submission and timely reimbursement.

Here are the key Medicaid billing rules every provider should know:

- Enroll as an approved Medicaid provider: Only enrolled and credentialed providers can bill Medicaid.

- Use state-specific claim forms or portals: Most states require electronic claims through approved portals such as the state’s Medicaid Management Information System (MMIS) or clearinghouses.

- Submit claims within the filing limit: States have strict timelines for claim submission, typically 90 to 365 days from the date of service. Late claims are often denied.

- Follow prior authorization requirements: Some services (like surgeries, durable medical equipment, or specialty care) require prior approval before treatment.

- Maintain proper documentation: All claims must be supported by detailed medical records that justify medical necessity.

- Adhere to the coordination of benefits (COB) rules: If a patient has multiple insurance plans, Medicaid acts as the payer of last resort, meaning all other insurers must be billed first.

Understanding and following these rules ensures compliance and reduces costly claim denials.

Key Coding Standards and Common Codes Used

Accurate coding is essential in Medicaid billing, as it determines both claim approval and reimbursement amount. While Medicaid follows the same national coding systems as other payers, it may include additional state-specific restrictions or modifiers that providers must follow.

The main coding sets used include:

- CPT (Current Procedural Terminology): For reporting medical, surgical, and diagnostic procedures.

- HCPCS (Healthcare Common Procedure Coding System): For non-physician services like ambulance, supplies, and equipment.

- ICD-10-CM (International Classification of Diseases, 10th Revision): This is for reporting diagnoses that explain the reason for the service.

Common Medicaid coding practices:

- Always link diagnosis codes (ICD-10) to procedure codes (CPT/HCPCS) to demonstrate medical necessity.

- Use modifiers (like 25, 59, or 76) accurately to clarify service details or avoid duplicate denials.

- Check state Medicaid bulletins for code updates or restrictions. Some codes may require prior authorization or have limited reimbursement rates.

- Use place of service codes correctly to indicate where the service was rendered (e.g., office, hospital, or home).

Even minor coding errors can result in payment delays or denials, so it is crucial to regularly train staff on current Medicaid coding updates.

Differences in Billing Compared to Other Insurers

Medicaid billing differs from commercial insurance and Medicaid in several important ways:

| Aspect | Medicaid | Commercial/Medicare |

| Program Structure | State-run under federal guidelines | Federally regulated (Medicare) or private plans |

| Coverage Rules | Vary by state | Standardized nationally (Medicare) or by policy (Private) |

| Payment Rules | Typically lower than commercial insurers | Higher Reimbursement Rates |

| Prior Authorization | Common for many services | Depends on the payer or plan |

| Claim Filing Limit | Shorter (90-365 days) | Often 1 year or more |

| Coordination of Benefits | A payer of last resort | May act as primary or secondary payer |

| Coding Policies | May include state-specific edits or modifiers | Generally follow CMS or payer-specific rules |

In short, Medicaid billing requires extra attention to detail because of its state-by-state variability and strict procedural rules. Providers who understand these differences can improve claim accuracy, avoid unnecessary denials, and maintain smoother reimbursement cycles.

Document Services in Detail

Documentation is the foundation of successful medical billing. Every treatment, comprehensive, accurate, and transparent medical records must support your bill. Medicaid auditors and payers rely on this documentation to confirm that services were properly delivered, medically necessary, and correctly coded.

Incomplete or unclear records can lead to recoupments, payment delays, or claim denials during audits. Conversely, thorough documentation increases the likelihood of claim approval, ensures compliance, and protects providers from potential financial or legal risks.

Additionally, complete records support continuity of care, allowing other healthcare providers to understand a patient’s treatment history and make informed clinical decisions.

Essential Information to Include for Medicaid Compliance

To meet Medicaid compliance standards, every patient encounter should include the following key elements:

- Patient Identification: Full name, date of birth, Medicaid ID number, and service date.

- Provider Information: Name, credentials, NPI, and service location.

- Chief Complaint or Reason for Visit: The patient’s presenting problem or medical need.

- History and Examination Notes: Relevant patient history, physical findings, and observations.

- Assessment and Diagnosis: The provider’s professional evaluation using ICD-10 codes.

- Treatment Plan and Procedures: Detailed description of all services rendered, medications prescribed, or therapies performed.

- Time Spent and Units (if applicable): Required for time-based services such as therapy or care management.

- Signatures and Dates: Provider’s signature (electronic or handwritten) and date to authenticate the record.

- Supporting Attachments: When applicable, lab results, diagnostic reports, or referral notes.

Accurate, legible, and complete documentation supports medical necessity and ensures compliance with Medicaid’s strict audit standards.

Best Practice for Record-Keeping

Maintaining organized and compliant records is key to avoiding denials and audit issues. Below are some best practices for effective record-keeping:

Use Electronic Health Records (EHRs): EHR systems simplify patient history management, standardize documentation, and reduce human error.

Follow State Retention Requirements: Most states require Medicaid providers to retain records for five to ten years from the service date or last payment. Verify your state’s unique regulations at all times.

Document Real Time: Immediately record notes after every visit. Delayed documentation increases the risk of errors and missing details.

Be Specific and Objective: Avoid general phrases like “treatment provided” or “Patient doing well.” Instead, include a description of the clinical results, patient response, and care given.

Protect Patient Privacy: Follow HIPAA guidelines when storing, sharing, or transmitting patient information.

Conduct Regular Internal Audits: Review charts and claims to identify documentation gaps before they trigger payer audits.

Train Staff Regularly: Ensure that all billing and clinical staff understand Medicaid documentation standards and any updates issued by your state agency.

Consistent, detailed documentation is not just a billing requirement — it’s a compliance safeguard and a cornerstone of quality patient care.

Submit Your Claims

The first step in submitting accurate Medicaid claims is careful preparation. All information on a claim form must match the patient’s medical record details and comply with state-specific Medicaid regulations. Before submission, review each claim to ensure:

- Patient eligibility was verified for the date of service.

- Provider information (NPI, taxonomy code, and Medicaid ID) is correct.

- Diagnosis and procedure codes are accurate and linked correctly.

- Modifiers are used when required to clarify service details.

- If needed, supporting documents (such as prior authorization or medical notes) are attached.

- Claim totals and units are calculated correctly.

Many denials occur due to minor data-entry errors or missing details, so double-checking claims before submission can save significant time and effort later.

Electronic Versus Paper Claims: Pros and Cons

While some states mandate electronic submission, most actively encourage providers to submit Medicaid claims electronically. Depending on the state and specific circumstances, both electronic and paper methods are still used.

| Method | Pros | Cons |

| Electronic Claims (EDI) |

|

|

| Paper Claims |

|

|

Electronic submission through a clearinghouse or state Medicaid portal is typically the most efficient and reliable option.

Common Submission Channels and Timelines

Each state Medicaid program specifies how and when providers must submit claims. The most common submission channels include:

- State Medicaid Portals:

Most states have online systems like the Medicaid Management Information System (MMIS) where providers can submit, track, and manage claims directly. - Clearinghouses:

Third-party clearinghouses connect to multiple payers, allowing batch submissions and automatic error checking before the claim reaches Medicaid. - Managed Care Organization (MCO) Portals:

For patients enrolled in Medicaid Managed Care, claims are often submitted to the MCO rather than directly to the state Medicaid agency. - Paper Submissions (when allowed):

Used primarily for corrected claims, attachments, or, in rare cases, electronic filing is impossible.

Timelines:

- Medicaid programs generally require claims submitted within 90 to 365 days from the service date.

- Corrected or resubmitted claims usually have a shorter filing window (e.g., 60–90 days after the original denial).

- Always confirm your state’s filing limit — late claims are rarely reimbursed.

Submitting complete, error-free claims electronically helps providers accelerate reimbursements, minimize denials, and maintain a smoother billing workflow.

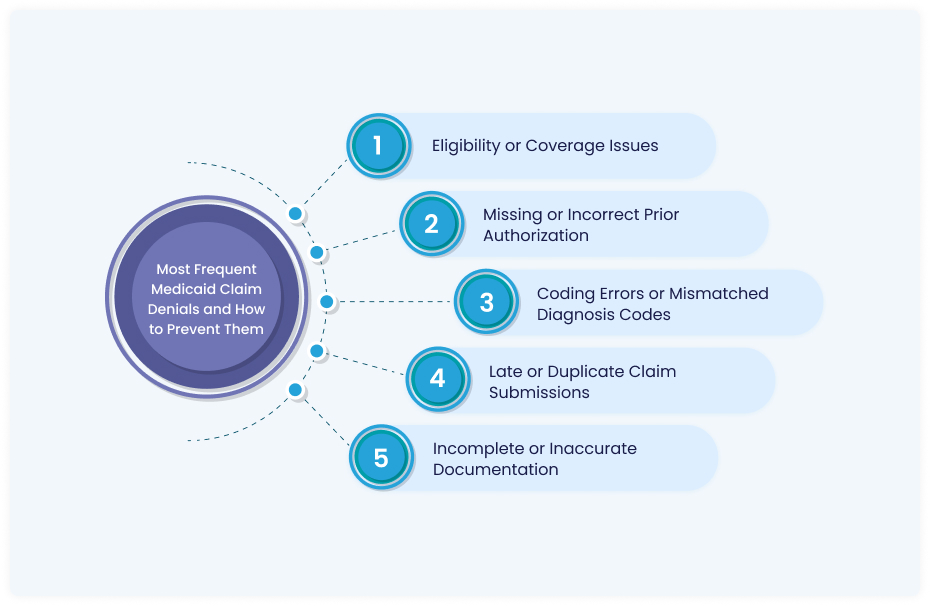

Common Medicaid Claim Denials and How to Prevent Them

Even experienced providers encounter Medicaid claim denials — often due to small but costly oversights like outdated eligibility checks, missing authorizations, or inaccurate coding. These denials not only delay reimbursement but also increase administrative workload and disrupt cash flow. By recognizing the most common reasons for Medicaid denials and addressing them proactively, providers can significantly reduce claim rework, improve payment timelines, and maintain a healthier revenue cycle. The key is to focus on prevention — building accurate workflows, timely verification, and regular training that keep your billing process compliant and efficient.

Most Frequent Medicaid Claim Denials and How to Prevent Them

1. Eligibility or Coverage Issues

Cause: Submitting claims for patients whose Medicaid coverage was inactive or expired on the date of service.

Prevention: Always verify patient eligibility at scheduling and again on the day of the appointment using your state’s Medicaid portal or EHR-integrated verification tools.

2. Missing or Incorrect Prior Authorization

Cause: Providing services that require pre-approval without obtaining or documenting authorization.

Prevention: Maintain an updated checklist of services that need prior authorization. Store authorization numbers in your EHR and attach them to each claim.

3. Coding Errors or Mismatched Diagnosis Codes

Cause: Using outdated or incompatible CPT, HCPCS, or ICD-10 codes that don’t support medical necessity.

Prevention: Regularly review Medicaid coding updates and cross-check that diagnosis codes properly justify the procedures performed.

4. Late or Duplicate Claim Submissions

Cause: Missing the state’s filing deadline or resubmitting claims without correcting errors.

Prevention: Track submission timelines closely using your billing software or clearinghouse. For denials, correct and resubmit promptly within the allowed timeframe.

5. Incomplete or Inaccurate Documentation

Cause: Missing provider signatures, incomplete treatment notes, or unclear service details.

Prevention: Ensure every claim is supported by detailed, legible documentation that clearly demonstrates medical necessity and aligns with Medicaid compliance requirements.

By addressing these issues before claims are submitted, providers can prevent most denials, shorten payment cycles, and maintain steady revenue — all while staying compliant with Medicaid regulations.

How to Track Claim Status and Payment

Tracking your Medicaid claims after submission is just as necessary as submitting them accurately. Active monitoring helps identify potential issues early — such as incomplete information, incorrect codes, or claim rejections — before they cause payment delays. Medicaid provides providers with various tools to effectively track the status of their claims and ensure timely reimbursement.

Here is how to track claims effectively:

- Use your state’s Medicaid provider portal: Most portals display real-time claim updates, including submission status, pending reviews, or adjudicated results.

- Check through your clearinghouse or billing software: Many clearinghouses allow you to view claim acknowledgment reports, rejection notices, and payment status updates in one dashboard.

- Monitor claim aging reports: Regularly review reports that show how long claims have been outstanding. This helps identify unpaid claims before they exceed filing limits.

- Set up alerts or reminders: Automate follow-ups through your billing system to ensure no claims slip through the cracks.

Consistent tracking minimizes claim backlogs, improves cash flow, and ensures you get paid for all services rendered.

Staying Compliant with Medicaid Regulations

Compliance with Medicaid regulations is not optional; it is a critical responsibility for every participating provider. Medicaid enforces strict standards to ensure that claims are accurate, services are medically necessary, and billing practices align with federal and state rules and regulations.

Key compliance requirements include:

- Accurate billing and coding: Providers must use correct CPT, HCPCS, and ICD-10 codes that reflect the services performed. Upcoding, unbundling, or submitting false claims can result in penalties.

- Medical necessity: Every billed service must be supported by documentation proving it was necessary for the patient’s care.

- Proper documentation: Maintain complete and legible records of all patient encounters, including treatment notes, authorizations, and follow-up care.

- Provider enrollment integrity: Ensure your Medicaid enrollment, NPI, and license information are accurate and current.

- HIPAA compliance: Protect patient data and use secure systems for billing and communication.

- Avoiding conflicts of interest: Do not bill for services provided by excluded individuals or engage in prohibited referral practices.

These requirements protect your practice from audits, fines, or exclusion from the Medicaid program.

Staying Up-to-date with Medicaid Policies

Medicaid policies and billing rules frequently change due to federal updates, state amendments, and CMS regulations. Staying informed about these changes helps providers maintain compliance, avoid unintentional billing errors, and ensure timely, accurate reimbursement. Regularly reviewing policy updates, attending training sessions, and leveraging reliable billing software can make navigating these changes easier and keep your practice running smoothly.

Ways to Stay Updated:

- Subscribe to state Medicaid bulletins and newsletters: These announcements share updates on fee schedules, coding changes, and policy adjustments.

- Attend webinars and training sessions: Medicaid agencies and billing associations regularly offer compliance education.

- Review CMS updates: The Centers for Medicare & Medicaid Services publishes regular policy changes affecting federal and state Medicaid programs.

- Use reliable billing software: Choose platforms that automatically update coding databases and notify users about regulatory changes.

- Partner with billing experts: Professional billing services can help monitor changes and ensure your claims stay compliant.

Staying informed prevents compliance violations and strengthens financial performance by keeping billing practices accurate and up to date.

Conclusion

Consistent attention to detail, accuracy, and compliance forms the foundation of effective medical billing. Every stage is essential to ensure seamless reimbursement and avoid costly denials — from verifying patient eligibility to applying correct coding, maintaining thorough documentation, and submitting timely claims. Providers should keep organized records, understand Medicaid’s specific billing rules, and stay updated on policy changes to navigate the process confidently. Regular staff training, internal audits, and reliable billing software further reduce errors and improve efficiency. A proactive and structured approach to medical billing safeguards compliance and supports the financial stability and long-term success of your healthcare practice.

Partner with Experts Who Simplify Medicaid Billing

Is your Medicaid billing process truly efficient, accurate, and audit-ready?

At MedHeave, we specialize in helping healthcare providers eliminate billing errors, reduce claim denials, and accelerate reimbursements. Our experienced billing and coding team ensures every claim is submitted correctly — backed by thorough documentation, compliance with Medicaid regulations, and ongoing monitoring for accuracy.

With MedHeave managing your Medicaid billing, you gain:

- Faster reimbursements through clean, compliant claims

- Fewer denials thanks to proactive error prevention

- Greater peace of mind knowing your billing is fully audit-ready

Let our experts handle the complexities of Medicaid billing — so you can focus on delivering quality patient care.