What do you do when you’ve just filled out a medical claim and all you see is a CO 226 denial code on your screen? This appears to be quite harmless and is really a simple code, but it can prove disastrous to your medical billing process, making you scratch your head wondering what went wrong.

This guide reveals the mystery of this code and digs deep into its practical application in medical billing to provide you with the knowledge and tools necessary to combat CO 226 denials and escalate your practice’s claim processing to new heights.

CO 226 is a denial code, and it works as a sort of red flag to those involved in the medical billing process that there is an issue with the data that has been put on a claim. However, unlike other denial codes that directly indicate a certain problem, CO 226 has two directions of interpretation.

The first of these interpretations deals with gaps in knowledge or incomplete data. Consider the insurance company as a financier. They need all the information necessary to ensure the proper handling of the claim. This could range from the simple features of the source, such as the patient’s name and date of birth, to more detailed features regarding the service the patient received. The lack of prior authorization for some procedures is another cause of CO 226 denial if the insurance company deems it necessary.

The second interpretation is more serious and implies the possibility of billing twice for the same procedure.This is called duplicate billing. Here, the insurance company has cause to believe that the same service was provided to a particular patient within one day and was billed several times. This may be due to bugs in the billing system, or else it may be technical mistakes made while preparing the claims for submission.

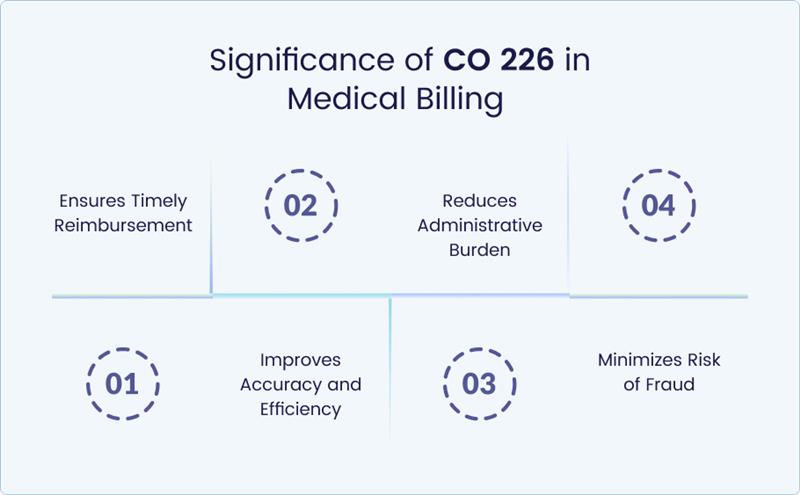

Medical billing and coding cannot function correctly without understanding denial codes, including CO 226. Here’s why it holds such importance:

Ensures Timely Reimbursement

An unpaid claim or a claim that has been rejected means a financial loss to the healthcare facility. Understanding the reason behind this rejection enables you to figure out what went wrong with CO 226 and attend to the matter before the claim is reprocessed. It helps maintain a good cash flow base for the practice and the financial health of the practice.

Reduces Administrative Burden

Denials are more time-consuming to look into and address compared to other cases. Knowing about CO 226 should help you avoid exacerbating the already complex relationship that your staff has with the insurance company, thereby saving time that can be used to complete more important patient care work.

Improves Accuracy and Efficiency

Understanding the root cause of why you receive CO 226 denials can be helpful in starting to take action. This can entail enhancing data entry practices, purchasing a billing software program that will alert the organization to mistakes, or having better organizational correspondence to reduce the number of errors. In the long run, this means cleaner claims, fewer denials, and a more efficient billing process.

Minimizes Risk of Fraud

CO 226 mainly points to missing data, but when seen, it is generally suggestive of duplicate charges. By having this possibility in mind, you would be more cautious and may try to avoid situations where such fraudulent schemes can take place in your practice.

Broadly, knowledge of CO 226 enables you to take preventive measures to reduce the chances of denials, ensure finances run smoothly in the practice, and work towards enhancing the billing system in the practice setting.

The cryptic nature of denial code CO 226 stems from its ability to represent two distinct issues: missing information and duplicate billing. Let’s delve into the common causes behind each interpretation:

Missing or Incomplete Information

- Patient Demographic Errors: Inadequate patient details such as name, date of birth, address, or insurance identification number lead to a CO 226 denial. A single-character typographical error can create a lot of problems in the claims processing system.

- Incorrect Provider Information: Like patient data, errors made on taxonomy codes or National Provider Identifier (NPI) numbers can also result in CO 226 denials.

- Missing or Invalid Procedure Codes: Medical procedures are always assigned codes. Filing errors, omissions, or invalid codes will create a situation where the insurance company does not have insight into the services that were provided, hence the CO 226 denial.

- Incomplete Diagnosis Codes: Diagnostic codes are useful in demonstrating why the services provided are necessary. Incomplete diagnosis codes can lead to a CO 226 denial because the insurer may ask why the service was needed.

Duplicate Billing

- Accidental Errors: At times, issues resulting from technical malfunctions of a computer system and reporting errors for submission of the claim can result in the same service code being coded twice by the same patient on the same day. This leads to the possibility of CO 226 denial due to unintentional duplicate billing.

- Manual Data Entry Errors: Many times, when claims are submitted manually, there are high risks of the entry of wrong figures or even multiple entries leading to the denial of CO 226.

However, if you are aware of these main causes, you can avoid CO 226 denials more effectively and avoid possible problems with the claim processing in your medical practice.

The CO 226 denial code can be quite problematic at times, but worry no more! Here are the methods that patients, healthcare providers, and insurance companies can use to reduce the chances of such an event. Let’s delve deeper into each approach with actionable steps:

For Patients: Have Power in the Billing Process

Maintain Accurate Medical Records: This forms the basic structure for efficient claim processing. Be sure your phone number, your address, and your email are updated with your primary care physician as well as with all your specialists. Always confirm your insurance information, including the plan name, member ID number, and group number, if any.

Review EOBs Carefully: The EOB is not something that should be thrown in the bin after the bills are paid. Search for denial codes and descriptions of the reasons for denial. If you are taking CO 226, do not hesitate to ask any questions.

Ask Questions: If you have any concerns or questions about a denial, it is advisable to contact the billing department of your health care provider or the customer care department of the insurance company. Do not hesitate to request details regarding the root cause of the refusal and how the issue is to be addressed.

For Healthcare Providers: Invest in Efficiency and Communication

Automated Eligibility Verification: This feature makes sure that you are charging the correct insurance plan for the given patient. It eliminates the possibility of denials because of the wrong insurance details, which costs you and the patient a lot of time and money.

Coding Compliance Tools: These built-in tools are used as a safety measure because they detect coding errors before the claim is processed. By emphasizing the relevance and correctness of medical codes, this proactive approach reduces the likelihood of denials that originate from obsolete codes or improper code selection.

Pre-Service Communication: Transparency is one of the most important aspects that cannot be overlooked. Before any service is provided, explain to patients how much they will be expected to pay for their procedures. This keeps patients informed and reduces the chances of billing shock that results in disputes and denials.

Track and Analyze Denials: Monitor the frequency and reasons for denials to head off future such circumstances. Denial analysis enables you to identify specific aspects of your billing processes that may need remediation so that you can address a denial’s root causes.

For Insurance Companies: Foster Transparency and Collaboration

Provide Clear and Concise Explanations: When you decide to deny a claim, make sure that you offer detailed explanations in your denial code. This enables healthcare providers to seek the reason for the denial and also try to make the necessary adjustments that will ensure that such incidences are not repeated in the future.

Invest in Automation: Leverage technology to minimize manual work in repetitive tasks like checking patient eligibility and processing claims. This helps in creating space for more resource-demanding cases and simplifies the entire process.

Collaboration with Providers: It is in the best interest of the patient and the healthcare provider to have an open dialogue about the main reasons for denial. It can also be helpful to organize conferences and conduct online seminars that inform providers on the right practices for coding and documentation. This project shows that everyone stands to gain from working together.

Conclusion

To sum up, although denial code CO 226 remains a pain, it is not an insurmountable problem. Through collaboration with patients, healthcare providers, and insurance companies, the strategies outlined above can be put into practice.

By improving the technology, reducing ambiguity, and having competent strategies for handling denials, we can achieve more efficient health care billing for all. This partnership means the future could hold fewer denials of CO 226 and healthcare costs could be way more efficient in the long run.

For professional medical coding services, contact Medheave Medical Billing Services. We offer top-notch services to providers across the USA.