The healthcare providers are no doubt more concerned about the revenue collection of their practice.

An insurance payer like Medicare usually reimburses them.

To maximize their reimbursements and payment collections, they must have a detailed understanding of insurance payers.

Remember, insurance payers, whether they are government (Medicare, Medicaid) or commercial payers like Aetna and Unitedhealth, have their own set of rules and regulations.

These all rules apply to physicians when they seek reimbursement from an insurance company.

So, payer contracting is a critical step that requires special attention from providers.

Because this step enables them to successfully get in-network to bill the services they provide to their patients.

For physicians and medical practices, it’s critical to understand the ins and outs of these agreements to ensure fair reimbursement and avoid costly mistakes.

This guide will walk you through everything you need to know about payor contracting, from basics to negotiation strategies, and how Medheave can support your practice in optimizing revenue and avoiding pitfalls.

What is a Payor in Healthcare?

Before diving into payor contracting, it’s essential to understand the role of a payor.

In the healthcare industry, a payor is any organization that reimburses healthcare providers for services they offer.

Payors can be insurance companies, government agencies, or employers.

What is a Payor?

A payor in healthcare is a third-party entity that covers or reimburses healthcare costs. This can include insurance companies, government programs like Medicare and Medicaid, employers offering health plans, or even health sharing ministries.

Types of Insurance Payers

There are various common types of insurance payors in the US healthcare market.

These include:

- Commercial Insurance: These are private health insurers such as Aetna, United Healthcare, and Blue Cross Blue Shield.

- Government Programs: Includes Medicare, Medicaid, and other government-funded healthcare programs.

- Employers: Many employers provide health insurance plans for their employees.

- TPAs (Third-Party Administrators): Often handle claims processing on behalf of employers or insurance companies.

- ACOs (Accountable Care Organizations): Groups of providers that come together to offer coordinated care, often under value-based payment models.

- Health Sharing Ministries: Groups that pool funds for healthcare costs based on shared religious beliefs.

Why the Identity of the Payor Matters in Contract Negotiation

The type of payor you are dealing with influences your reimbursement rates, terms, and even your obligations under the contract.

For instance, government programs may offer lower reimbursement rates compared to commercial insurance but come with fewer administrative requirements.

That’s why you must understand and identify the most suitable payor that fits with your billing and RCM needs.

Then, you will be able to negotiate the favorable terms and ensure long-term financial health for your practice.

How Physicians Get Paid Through Payor Contracts

When you sign a contract with an insurance payor, this means you become an in-network provider.

You can now deliver and bill the services according to USA healthcare billing regulations.

The payor contract is a piece of agreement that determines how physicians get reimbursed for their services.

Because it outlines the billing terms and conditions, payor policies, and more.

When it comes to the payment process, there are various models that you can choose to receive payments from an insurance company.

Let’s discuss these payment models.

Fee-for-Service (FFS) Models

The Fee-for-Service (FFS) model is a traditional approach where physicians are paid a set fee for each service they provide.

For example, if you perform a procedure, the payor reimburses you based on the negotiated rate.

Value-Based Care Models (Shared Savings, Risk-Sharing, Capitation)

In value-based care, the focus shifts to the quality of care rather than the volume of services. These models include:

- Shared Savings: If you can reduce costs while maintaining quality, you may receive a portion of the savings.

- Risk-Sharing: You and the payor share both the risk and rewards, meaning if costs exceed expectations, you share in the losses.

- Capitation: You receive a fixed amount per patient, regardless of how many services are provided. This incentivizes preventive care but also requires careful management of patient needs.

Bundled Payments and Quality Incentives

In bundled payment models, you receive a lump sum for a specific group of services related to a particular episode of care, such as a hip replacement.

This incentivizes cost-efficient care. Quality incentives are bonuses or penalties based on how well you meet specific health outcomes or performance metrics.

Direct-to-Employer Arrangements

Some practices enter into direct agreements with employers, bypassing insurance companies.

In these arrangements, employers may pay directly for healthcare services provided to their employees, offering flexibility and potentially lower costs.

Key Considerations Before Signing a Payor Contract

Before committing to any payor agreement, there are several essential factors that a provider must consider.

In-Network vs. Out-of-Network Trade-offs

Being in-network with a payor generally means higher patient volume due to broader access, but you will be reimbursed at lower rates. Conversely, going out-of-network may result in higher reimbursement, but fewer patients may choose to use your services because of higher out-of-pocket costs.

Payor Market Share & Patient Access

Understanding the market share of the payor can give you insight into how many of your patients may be covered by the plan. A payor with a significant market share may provide you access to a broader patient base, which could be beneficial for your practice’s growth.

Operational Alignment with Payor Requirements

Payors often have specific operational requirements such as prior authorizations, utilization reviews, and data-sharing protocols. Make sure your practice is capable of handling these requirements, as non-compliance could result in denials or delays in payment.

Payor’s Track Record & Provider Profiling

Investigate the payor’s history with providers. Are there frequent payment delays or denials? Do they have a history of treating physicians fairly? Payors with poor reputations can negatively impact your revenue cycle.

Essential Clauses in Payor Contracts

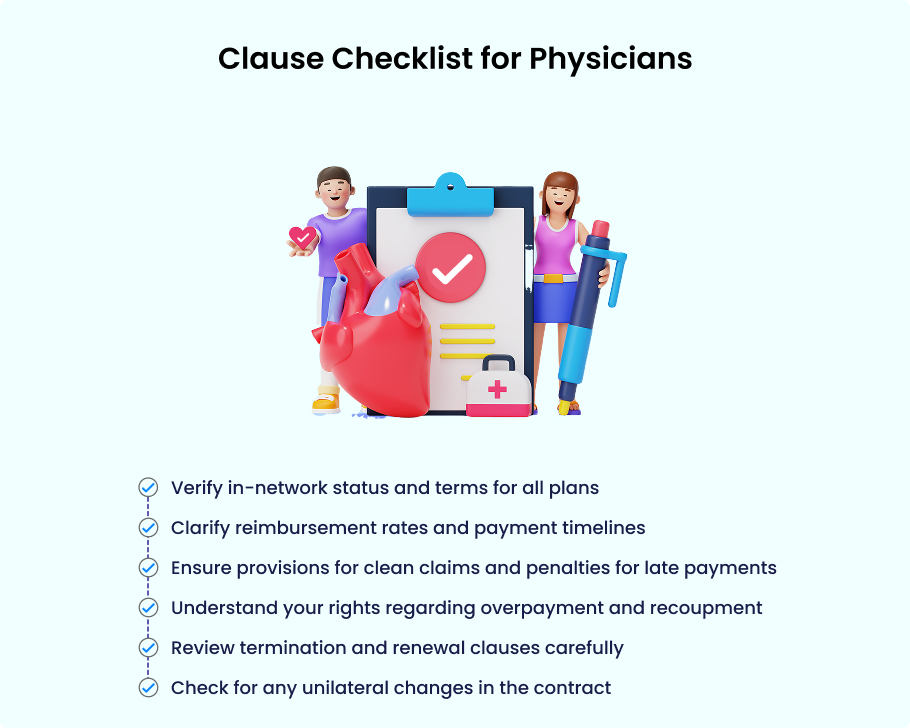

When reviewing a payor contract, specific clauses are non-negotiable.

Every practice owner or physician must clearly understand these clauses.

Parties & Plans Covered

This clause defines which parties (insurance companies, providers, etc.) are covered and which health plans you’ll participate in.

Ensure that it’s clear whether the payor includes all their plans or just specific ones.

Credentialing & Provider Requirements

This section outlines the requirements for becoming an in-network provider. Be sure to understand the credentialing process, including timelines and specific qualifications needed.

Payment Provisions

The payment clause details the payor’s obligations for reimbursing you. Pay attention to:

- Clean Claims: Ensure the payor will only deny payments for clearly erroneous claims.

- Late Payment Penalties: Make sure there are clauses penalizing payors for delayed payments.

- Electronic Funds Transfer (EFT): Understand how payments will be made.

- VCC Issues: Verify if the payor will cover Virtual Care Claims and any related policies.

Overpayment, Offsets & Recoupment

Payors can sometimes claim they’ve overpaid and seek reimbursement. This clause will outline how overpayments are handled and what rights you have to dispute them.

Appeals & Dispute Resolution

Make sure your contract has a straightforward process for appealing denials or disputes with payors. This is crucial in ensuring you aren’t left with unpaid claims.

Termination & Renewal Terms

This outlines how the contract can be terminated and the conditions under which it will automatically renew. Understanding this helps prevent unwanted surprises.

Amendments & Unilateral Policy Changes

Be cautious of clauses that allow the payor to make changes to the contract unilaterally. It’s essential to ensure you are given adequate notice and the ability to negotiate such changes.

Clause Checklist for Physicians

Emerging Challenges in Payor Contracting

Physicians are facing new challenges in payor contracting.

The significant challenges are:

Downcoding & Bundling Practices

Some payors may attempt to downcode your claims, meaning they reimburse you at a lower level than your billed amount.

Be aware of these practices, and ensure your contract allows for dispute resolution if a dispute arises.

Specialty Pharmacy Mandates

Some payors may mandate the use of certain specialty pharmacies for prescription medications, which can impact your patients and your reimbursement.

Electronic Payment Requirements & Hidden Fees

Electronic payments are now standard, but some payors may include hidden fees or additional costs that reduce your overall reimbursement. Always read the fine print.

Data Sharing and Privacy Concerns

In today’s data-driven world, payors may require access to patient data for claims processing and compliance. Ensure your practice is aware of privacy regulations and safeguards patient data.

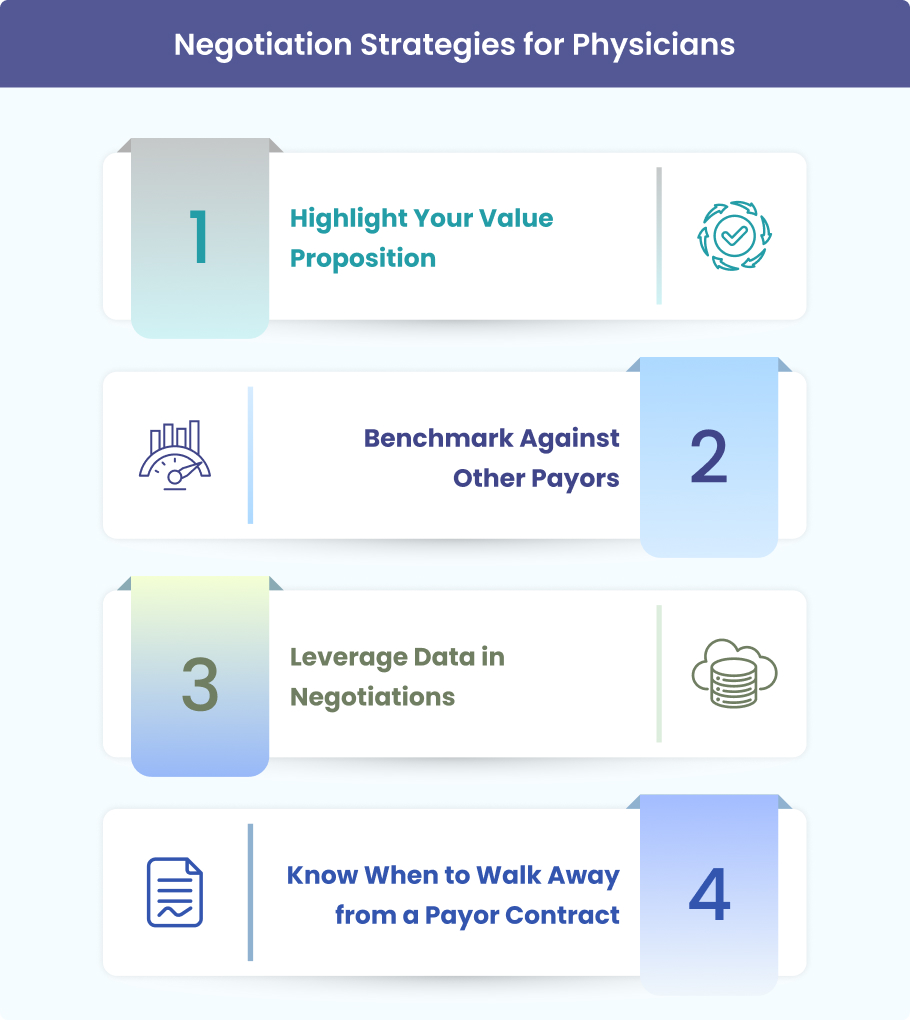

Negotiation Strategies for Physicians

Negotiating payor contracts is an essential skill for ensuring fair reimbursement.

For successful payor contracts, as a provider, you must:

Highlight Your Value Proposition

Highlight what sets your practice apart. Whether it’s your patient outcomes, specialized services, or efficiency, use these factors to justify higher reimbursement rates.

Benchmark Against Other Payors

Use data to compare your rates against those of other payors in your region. This can help you make informed decisions and negotiate better terms.

Leverage Data in Negotiations

Data is a powerful tool. Show payors how your practice meets or exceeds quality metrics, patient satisfaction, and cost efficiency to support your position during negotiations.

Know When to Walk Away from a Payor Contract

If the payor isn’t offering reasonable terms, it might be better to walk away. Trust your practice’s worth and don’t settle for underpayment.

How Medheave Helps Practices with Payor Contracting

Medheave is a US-based billing and payor contracting firm.

It understands the complexities of payor contracting and can guide your practice through every step of the process.

Here’s how we help healthcare providers and medical practices to streamline the payor contracting process.

Contract Review and Audit Support

We provide thorough contract reviews and audits to ensure you aren’t missing any crucial clauses or falling victim to unfavorable terms.

Negotiation Assistance & Benchmarking

We help you negotiate favorable rates and terms, backed by data from your market and payer comparisons.

Revenue Cycle Optimization Aligned with Payor Rules

Our solutions streamline your revenue cycle, ensuring you stay compliant with payor requirements while maximizing reimbursements.

Protecting Practices Against Underpayment and Hidden Clauses

We help safeguard your practice from underpayments and hidden contract clauses that could negatively affect your revenue.

Frequently Asked Questions (FAQ)

What is the difference between PPO and HMO contracts?

A PPO (Preferred Provider Organization) contract gives patients more flexibility to choose their healthcare providers, even out-of-network, though at a higher cost. On the other hand, an HMO (Health Maintenance Organization) contract requires patients to choose from a network of providers. It typically involves lower out-of-pocket costs but less flexibility in provider choice.

How do I know if my rates are fair compared to Medicare benchmarks?

To determine if your reimbursement rates are fair, you can compare them to Medicare’s rates for similar services. Medicare often serves as a benchmark for many payors, and understanding these benchmarks can help you negotiate more effectively with commercial insurers.

What should I do if a payor changes my contract unilaterally?

If a payor changes your contract without your agreement, it’s crucial to review the contract’s amendment clauses. Some contracts allow payors to make changes, but they must notify you in advance. If this happens, you should consult a legal advisor to understand your options for either renegotiating or terminating the agreement.

Can I terminate a contract with one plan but stay with others?

Yes, in most cases, you can terminate a contract with a single payor while remaining contracted with others. Be sure to review the termination clauses of your agreement to ensure compliance and avoid penalties. It’s also a good idea to inform your patients about any potential service disruptions.

How can outsourcing billing help with payor contract compliance?

Outsourcing billing to experts can help ensure your practice remains compliant with payor contract terms. A professional billing service can handle the complexities of contract compliance, provided you meet payor requirements, avoid missed payments, and improve your reimbursement rates.

Final Thoughts

Payor contacting may be difficult, but it is easy if handled with a practical approach. By understanding the basics and strategically negotiating your agreements, you can turn contracts into opportunities for growth, financial stability, and fair reimbursement.

Working with trusted experts like Medheave can ensure that your practice is well-positioned to succeed in today’s ever-changing healthcare landscape.

Are you ready to optimize your payor contracts and revenue cycle?

Contact Medheave today for a free payor contract review and take the first step toward improving your financial health and practice operations!