In today’s environment, where billing and coding of healthcare services are a focus, medical coding audits are a vital practice for compliance and financial perspective. These audits help to code and bill medical services and check for proper documentation at every possible point. Both internal and external coding audits assist healthcare providers by determining coding problems and compliance standards, as well as averting revenue loss.

In this blog, we will discuss what a coding audit is, the various types of coding audits, why it is important, the process, and how it should be done effectively.

A medical coding audit is a process of peer reviewing and analyzing coded accounts used in billing to conform with the right code standard. This includes auditing the codes that are used to describe patient diagnosis, treatment, and procedures with the services offered with the aim of conforming to existing rules and standards established by various bodies, such as the Center for Medicare & Medicaid Services (CMS), and payers more often. The audit concerns coding errors, including upcoding, under coding, or improper use of modifiers that result in denial of claims, compliance problems, or lost revenues. Medical coding audits should be done on a consistent basis to protect the revenue cycle, improve coding precision, and ensure compliance with state laws and statutes.

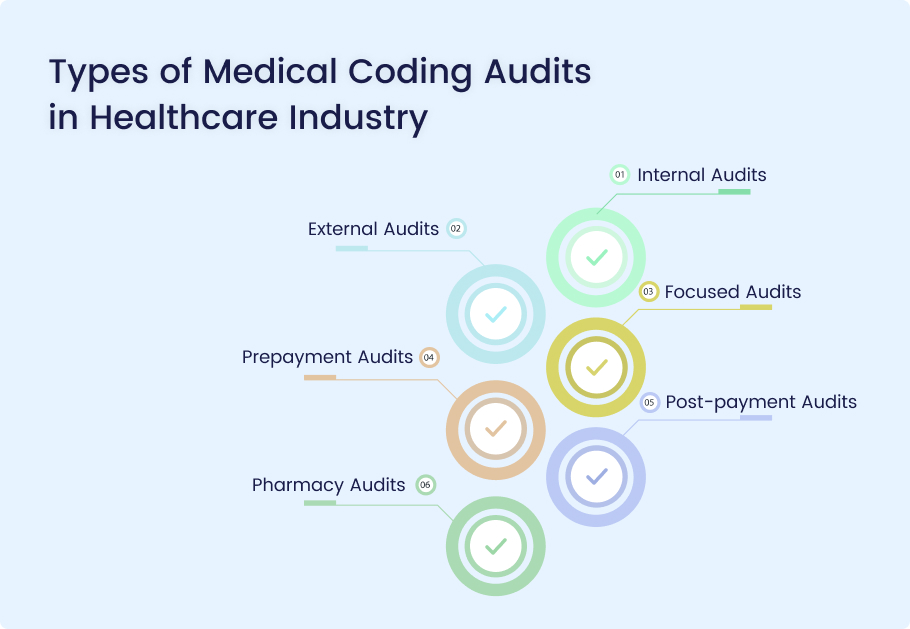

Medical coding audits come in various forms, each designed to serve specific purposes and address different areas of the coding process.

Internal Audits

Objective

When conducted, internal audits are designed to evaluate the coding precision and conformity of a healthcare organization.

Process

- Review: Healthcare internal staff analyze the medical record and claims submitted by other parties.

- Identify Gaps: An audit establishes inconsistency, regulatory violation, and need for training.

- Reporting: Implementation results are described, while suggestions for improvement are given.

Significance

Internal audits play important roles in setting up high standards of coding accuracy, maintaining compliance in terms of internal guidelines, and also strengthening the development of coding teams.

External Audits

Objective

External audits involve assessments of coding standards done by outside auditors.

Process

- Independent Review: There is a checking process to determine compliance of the coding being done within the organization to code of the standardized regulatory and standard bodies.

- Benchmarking: Comparisons are made with other external organizations in order to determine where improvements can be made.

- Feedback: To help the organization, a full report analysis of the organization’s strengths and weaknesses is offered.

Significance

External audits help to maintain credibility and increase accountability by holding codes to standards based on best practices and laws.

Focused Audits

Objective

Focus audits are aimed at distinct segments or fields to achieve primary objectives.

Process

- Target Selection: Detailed coding specialties or services that need focus are determined.

- In-Depth Review: The audit includes a detailed assessment of specific records and coding processes.

- Analysis: The data collected is assessed to identify the prevalence of certain phenomena or consistency in experiences.

Significance

The focused audits can be applied to specific issues, allowing for a targeted and precise management of an organization’s coding adequacy and precision.

Prepayment Audits

Objective

A prepayment audit is used to check the work done in coding and documenting particular claims before it is submitted for payment.

Process

- Review Before Submission: Coders examine medical records and claims for completeness and accuracy by other coders.

- Identify Errors: Before submitting inputs or documentation, any coding error or other form of documentation inadequacy is detected and eradicated.

- Prevention: Amounts that passed an audit are used to make the claims, thereby minimizing the probability of denial.

Significance

Prepayment audits greatly increase one’s likelihood of getting a claim paid and doing so with greater efficiency to the revenue cycle.

Post-payment Audits

Objective

After payment has been made, the other kind of audit is the post-payment audit, which evaluates the claims for accuracy.

Process

- Review Paid Claims: Auditors scrutinize claims that have been prepared, submitted, and paid by the various payers.

- Identify Irregularities: All sorts of problems or differences in any part of the coding and documentation processes are discussed.

- Reporting: This is in the form of a report that summarizes teaching findings in addition to fraud or abuse.

Significance

The key post-payment audit benefits include helping an organization find coding mistakes that lead to monetary loss and make the necessary changes for subsequent claims, as well as sustaining compliance.

- Compliance Audits

Objective

Regulatory compliance audits focus on assessing the degree of conformity to healthcare rules, coding practices, and payer requirements.

Process

- Regulatory Review: Professional auditors compare coding practices to the applicable laws and guidelines.

- Identifying Non-Compliance: They point out gaps within operation that may not conform to the set standard—compliance with regulatory authority.

- Action Plan: Suggestions for the correction of compliance deficiencies are offered.

Significance

The effect of compliance audits is to reduce risks of legal actions and also improve general compliance of the organization’s coding standards.

Pharmacy Audits

Objective

Pharmacy audits primarily target assessment of coding and billing for pharmacy services.

Process

- Pharmacy Record Review: Medication records and billing practices related to pharmaceutical services are audited by auditors.

- Compliance Assessment: They evaluate compliance with provisions regulating the billing of pharmacies.

- Error Identification: Differences in medication coding and billing practices are detected and evaluated.

Significance

The audits for pharmacies check proper coding and billing of pharmaceutical services to minimize revenue losses and violations of rules.

Here are the key benefits of medical coding audits:

Enhanced Coding Accuracy

Medical coding audits have a direct impact on enhancing the accuracy of code by pointing out various mistakes, such as wrong codes, misplaced modifiers, or upcoding. This guarantees that coding corresponds to the specific services offered in the medical field, thus working around claim rejections.

Regulatory Compliance

Audits confirm compliance with coding standards, including ICD-10, CPT codes, and payers’ individual requirements. This is important in order to prevent the occurrence of legal consequences and reduce the chances of being penalized for nonadherence to coding standards.

Detection of Specific Coding Errors

Prepayment audits are especially beneficial in cases where frequent coding mistakes, including undercodes or overcodes, are looked for as a pattern. These audits are useful in identifying exact locations where coders may need further education or if certain processes need refinement.

Optimized Revenue Integrity

Audits involved meticulous coding to guarantee medical services. billing to prevent revenue loss due to underbilling and overbilling that may attract payer’s audit. This targeted approach safeguards the organization’s revenue cycle.

Accurate Modifier Application

Misuse of modifiers has the potential to cause resource wastage in the coding of claims and wrong outcomes. Audits focus on the use of modifiers to check their correct compliance with coding rules that help in proper reimbursement rather than denials.

Identifying Specialty-Specific Coding Issues

Subspecialty coding audits, including neurology, cardiology, etc., look into the details of coding in various specialties. These audits also help to update the coding team on requirements and the rules that apply to specific medical specialties.

Early Detection of Fraudulent Coding

Employing coding audits focuses on identifying fraudulent coding schemes like billing for services that were never provided or coding for more severe service than actually delivered. Prompt detection saves the organization from fines and legal repercussions.

Here’s a step-by-step outline of the medical coding audit process:

- Determine the Scope of the Audit: Identify the scope and coverage of an audit, as well as the goals and time frame expected from the audit.

- Select an Audit Team: Select the right internal or external auditors who are competent in the required field.

- Gather Relevant Documentation: Assemble such paperwork as medical records, billing details, coding instructions, and any other relevant papers.

- Review and Analyze Records: Check for compliance and accuracy of the documentation and the coding system.

- Identify Coding Errors or Discrepancies: Identify any disparity, gaps, or failure to meet the standard of coding.

- Evaluate Documentation Quality: Determine the degree of documentation supporting services coded that is complete and accurate.

- Provide Feedback and Recommendations: Provide practical tips and recommendations as to how coding can be done better and how documentation should be executed.

- Implement Corrective Actions: Resolved through providing awareness to concerned staff, alteration of process, or adjustment in coding system.

- Follow-Up and Monitor Progress: Supplemental observations or checks should then be carried out to verify if the measures that were implemented have been efficient.

- Report Findings to Stakeholders: Prepare an audit report to management summarizing audit findings and recommendations.

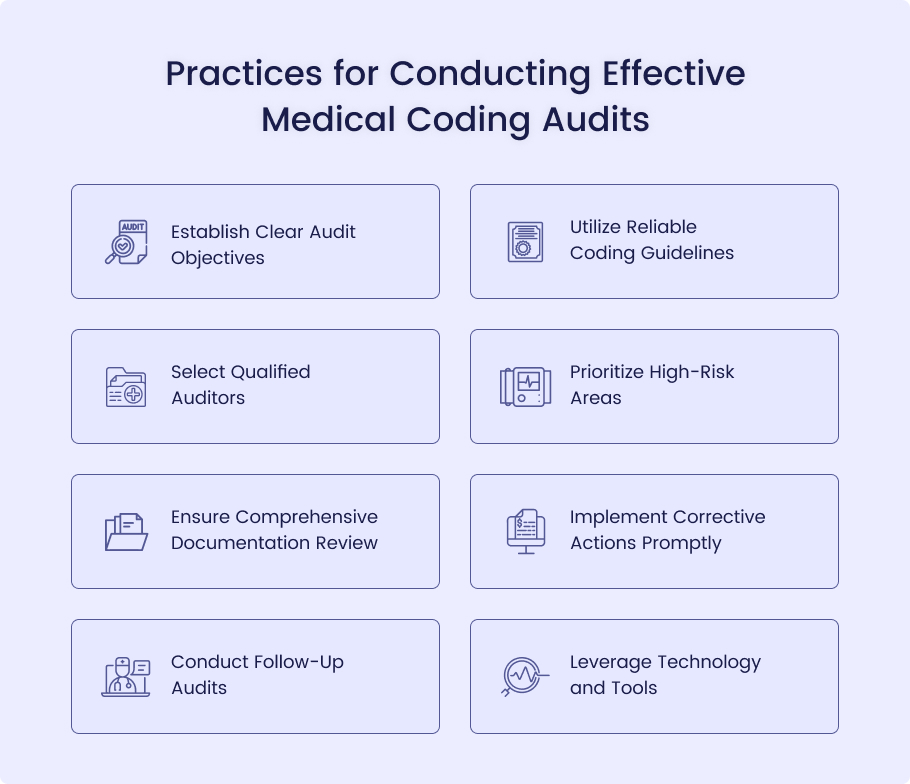

Establish Clear Audit Objectives

Actionable Insight: Establish measurable objectives for the audit, including coding precision, compliance, or claim rejection rate. Specific goals help in the execution and completion of an audit and make certain that the results produced will be relevant to the strengths and weaknesses of an organization.

Utilize Reliable Coding Guidelines

Actionable Insight: Make sure that the audit is contemporary to the prevailing coding standards and current rules laid down by the ICD-10, CPT, the various insurance companies, and the rest of them. This is effective for the consistency of the audit findings as well as accuracy in determining the adequacy or otherwise of the internal controls.

Select Qualified Auditors

Actionable Insight: Ensure that you select auditors with prior experience in medical coding and also auditing. Regardless of whether they are employed internally or externally, auditors should possess good knowledge of the healthcare laws and be able to spot even the slightest of irregularities.

Prioritize High-Risk Areas

Actionable Insight: Concentrate more on those services that are most likely to be coded ineffectively or not in compliance with the standard, arduous procedures and services, or frequently rejected claims. It also assists in solving the most important problems before dealing with the others on a mass scale.

Ensure Comprehensive Documentation Review

Actionable Insight: Closely examine all the documents submitted in support of the coded services. It is crucial that information is both precise and exhaustive in order that it substantiates the coding as well as presenting conformation to the billing rules.

Implement Corrective Actions Promptly

Actionable Insight: Following problem detection in the audit, corrective measures should be taken immediately through staff training, changing practices, or enhancing documentation procedures. Immediate remedial action countervails the risk of repeating the same mistakes while making the audit more efficient.

Conduct Follow-Up Audits

Actionable Insight: It is important to plan repeat audits within a prescribed time frame to evaluate the adequacy of measures taken and check compliance with the requirements in the long run. This ongoing evaluation assists in describing compliance and coding in the long run.

Leverage Technology and Tools

Actionable Insight: Ensure that coding audit is done systematically and by use of software that has auditing tools in order to discover more about the patterns as well as the reports. Auditing also becomes easier because technology can be used to manage the large volumes of data involved in the process.

Conclusion

Overall, it is crucial to perform medical coding audits consistently to maintain accuracy, compliance with the standards, and financial stability of the healthcare facilities. Audits help to identify errors, make sure proper documentation is being made, and implement the corrective measures that are vital to fixing the problems and frauds in the overall revenue cycle. However, performing extensive audits can be daunting due to the time and effort required, especially for in-house teams.

MedHeave Medical Billing Services promises its clients meaningful audits through expert analysis, utilizing the latest technology to produce high-quality reports on your medical coding. It also improves your coding competence while at the same time relieving your staff to prioritize service delivery to patients.

Contact us today for hassle-free medical coding audits.