Insurance credentialing is a crucial step for healthcare providers who want to expand their practice, increase client access, and ensure steady revenue.

However, the process can be complex and time-consuming.

Like many other healthcare providers and specialty physicians, mental health professionals also need to be in-network with insurance payers.

So, they may be able to get timely reimbursements for the services they deliver to their patients.

If you are a mental health professional, like a psychologist, psychiatrist, or running a rehabilitation center anywhere across the USA, and you are not yet credentialed, don’t worry.

We will help you through this helpful guide to know how to get credentialed with insurance companies as a mental health professional.

Insurance credentialing is the process of applying to become an in-network provider with health insurance companies.

It involves verifying your professional qualifications, licenses, and experience to ensure you meet the insurer’s standards.

Insurance Credentialing for Mental Health Professionals is the process of applying to become an in-network provider with health insurance companies.

This allows therapists, psychologists, social workers, and counselors to bill insurance directly for their services and be reimbursed at contracted rates.

Credentialing

The process where insurance companies verify a provider’s qualifications (license, education, malpractice insurance, etc.).

The key purpose of insurance credentialing for mental health professionals is to meet the insurer’s standards to provide care.

Contracting

Contracting is the process of signing a legal agreement with the insurer that outlines:

- Reimbursement rates (fee schedule).

- Billing rules (claim submission deadlines, covered services).

- Provider obligations (compliance, audits).

It establishes the business relationship and payment terms.

Paneling

In paneling, mental health professionals are included in the insurer’s directory. Hence, they become in-network providers.

The patients can then easily reach them to seek services.

This allows clients with that insurance to find and choose you as a covered provider.

Comparison Table: Credentialing vs. Contracting vs. Paneling

| Aspect | Credentialing | Contracting | Paneling |

| Definition | Verification of qualifications (license, training, etc.). | Signing an agreement on rates & rules. | Being listed in the insurer’s provider directory. |

| Purpose | Proves you’re qualified to be in-network. | Sets payment terms and obligations. | Makes you visible to clients with that insurance. |

| When It Happens | First step (before contracting). | After credentialing approval. | After the contract is finalized. |

| Key Requirements | License, NPI, CAQH, malpractice insurance. | Agreeing to the fee schedule and policies. | Active contract with the insurer. |

| Timeframe | 30-90 days. | 1-4 weeks (after credentialing). | 1-2 weeks (after contracting). |

| Can You Negotiate? | No (must meet standards). | Yes (rates sometimes negotiable). | No (automatic after contracting). |

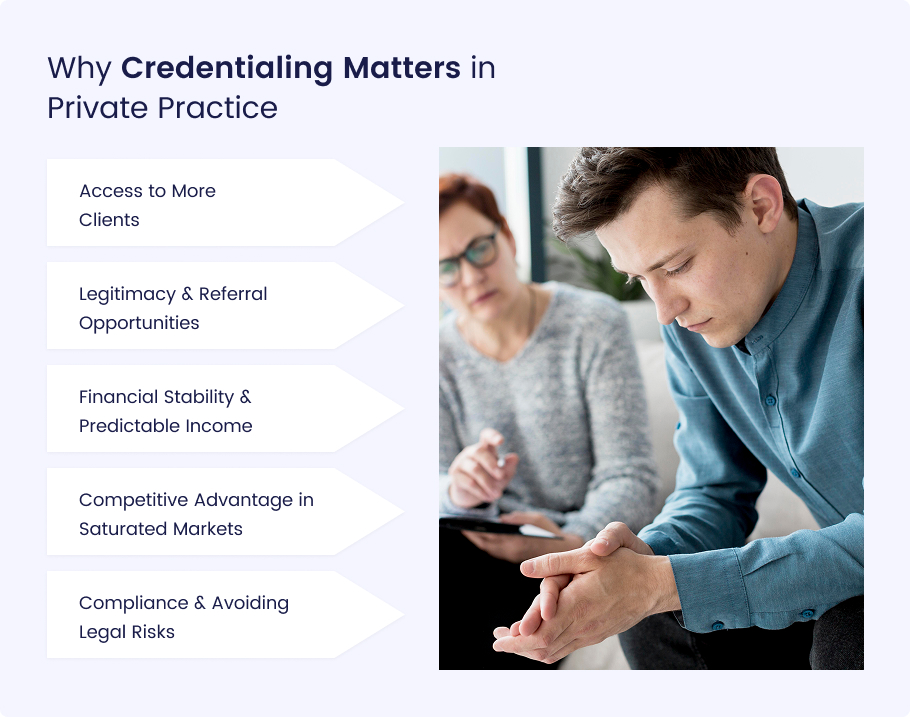

For mental health professionals in private practice, insurance credentialing is a crucial step that can significantly impact business growth, client access, and professional credibility.

Here’s why it matters for private medical practices in the USA:

Access to More Clients

A large majority of therapy clients rely on insurance to afford mental health care.

According to the American Psychological Association (APA, 2022), 85% of therapy clients use insurance to cover sessions.

By becoming credentialed, you open your practice to a much broader client base.

The patients who are not able to afford private-pay rates will get benefits from you.

Insurance-based referrals (from directories, primary care doctors, and employee assistance programs) can fill your caseload faster than relying solely on self-pay clients.

Without credentialing, you may miss out on a steady stream of potential clients who need in-network providers.

So, being in-network with payers is a crucial mental practice.

Legitimacy & Referral Opportunities

As an in-network mental health provider, you can enhance your professional reputation and referral network.

Many Employee Assistance Programs (EAPs), hospitals, and primary care doctors only refer clients to credentialed therapists.

Additionally, clients often perceive in-network providers as more trustworthy and affordable because their insurance covers part (or all) of the cost.

This credibility can lead to more consistent referrals from both healthcare networks and satisfied clients.

Financial Stability & Predictable Income

Remember, private-pay therapists may charge higher rates.

On the other side, insurance credentialing provides steady, predictable income.

Because credentialing provides a consistent client flow. Insurance reimbursements though sometimes lower than private-pay rates.

This ensures a reliable revenue stream, especially when starting a mental practice or during slower periods.

Some therapists use a hybrid model, balancing insurance clients with a smaller caseload of private-pay clients for financial flexibility.

Competitive Advantage in Saturated Markets

Insurance credentialing gives mental health professionals a competitive edge.

Clients searching insurance directories will easily find you. While private-pay-only providers must rely solely on marketing efforts.

Insurance panels also automatically list you in their directories.

This is also more beneficial for you by reducing the need for expensive advertising.

Compliance & Avoiding Legal Risks

Meeting healthcare regulations in the USA, like HIPAA, is critical for mental health professionals, like others.

Credentialing ensures you meet industry and legal standards set by insurers.

This helps reduce the risk of audits or payment denials.

It also keeps your practice aligned with HIPAA and mental health billing regulations.

As a result, you will be safe from compliance issues like legal and financial penalties.

Most insurers require credentials from professionals like:

- LCSWs (Licensed Clinical Social Workers)

- LMFTs (Licensed Marriage & Family Therapists)

- LPCs (Licensed Professional Counselors)

- Psychologists (Ph.D./Psy.D.)

- Psychiatrists (MD/DO)

Requirements for Credentialing

- Active state license (no disciplinary actions)

- Malpractice insurance (typically $1M/$3M coverage)

- NPI number (National Provider Identifier)

- CAQH ProView profile (used by most insurers)

- Clean background check

Step 1: Gather Your Documents (Don’t Skip Anything!)

Before you even think about applying, you need to have all your paperwork in order. Missing one document can delay you by months. Here’s what you’ll need:

License Verification

- Insurers want proof you’re legally allowed to practice.

- Get a copy from your state licensing board (usually downloadable from their website).

Malpractice Insurance Certificate

- Most insurers require $1M/$3 coverage.

- If you don’t have it yet, companies like HPSO or CPH & Associates offer affordable rates (~$30-$60/month).

Updated CV/Resume

- Highlight your education, licenses, and clinical experience.

- No need for fluff—just the facts.

W-9 Tax Form

- This tells insurers how to pay you.

- Download it from the IRS website and fill it out.

(Download W-9 Form Here)

Professional References

- Usually, 2-3 colleagues can vouch for you.

- Some insurers want them to be fellow in-network providers.

Step 2: Set Up Your CAQH Profile (The Universal Credentialing Hub)

CAQH ProView is like LinkedIn for healthcare providers. It’s where insurers go to verify your info.

How to Nail Your CAQH Profile:

- Register at caqh.org (it’s free).

- Fill out every single section—work history, education, malpractice insurance, etc.

- Upload all your documents (license, malpractice cert, etc.).

- Attest your profile (fancy way of saying “confirm everything is accurate”).

Remember: You must re-attest every 90 days or your profile goes inactive. Set a phone reminder.

Because some insurers won’t even look at your application if CAQH isn’t 100% complete.

Step 3: Apply to Insurance Panels

Now comes the insurance credentialing application submission step.

How to Do It Right:

- Pick the right insurers: Focus on the big ones in your area (e.g., Blue Cross, Aetna, United, Cigna). Ask colleagues which pays the best.

- Find their provider portals: Google “[Insurer Name] provider credentialing” (e.g., “Aetna therapist credentialing”).

- Submit applications online: Most use CAQH, but some make you fill out their forms (groan).

- Follow up every 2-3 weeks: Call or email to check your status. Be politely persistent.

Thing to Remember: Apply to 3-5 insurers at once—don’t put all your eggs in one basket.

Step 4: Wait for Approval (The Patience Test)

Here’s the frustrating part. You may be waiting for a long time.

Or you may get approval from the insurance payor early.

What to Expect:

- 30-90 days is typical.

- Some insurers do site visits (rare for therapists, but possible).

- They might call your references (so give them a heads-up).

How to Speed It Up:

- If it’s been 60+ days with no word, call and ask for a credentialing specialist.

- Resend any missing docs immediately if they request them.

Step 5: Sign Contracts & Set Up Billing (Don’t Get Lowballed!)

Once approved, you’ll get a contract and fee schedule.

What to Do Next:

- Review reimbursement rates: Some insurers pay $70-$120 per session (others pay peanuts).

- Negotiate if needed: If you have experience, ask for higher rates.

- Sign and return the contract: Keep a copy for your records.

- Set up billing: Use an EMR system (like SimplePractice or TherapyNotes) to file claims smoothly.

Watch Out For:

- “Par” vs. “Non-Par” contracts: “Par” means you’re in-network; “Non-Par” means you’re out-of-network (different rules).

- Timely filing limits: Most insurers require claims within 90 days of service.

The credentialing process for mental health providers varies widely depending on the insurance company, completeness of your application, and external factors. Here’s a breakdown of what to expect:

Typical Credentialing Timelines

Fastest: 30 Days (Rare)

Some smaller or regional insurers may approve applications within a month if all documents are submitted correctly. Electronic submissions (via CAQH ProView) can speed up verification.

Average: 60–90 Days

Most major insurers (e.g., Blue Cross Blue Shield, Aetna, UnitedHealthcare) take 2–3 months to complete credentialing.

This includes verification of your license, education, malpractice insurance, and work history.

Longest: 120+ Days

Delays happen if applications are incomplete, require additional reviews, or if the insurer has a backlog.

Medicare and Medicaid often take longer due to stricter compliance checks.

Key Factors That Cause Delays

Missing or Incorrect Documents

A single missing form (e.g., an unsigned contract, expired malpractice insurance) can set you back weeks.

Slow Responses from References or Past Employers

Some insurers contact supervisors or employers for verification—if they don’t reply quickly, the process stalls.

High Application Volume

Insurers process applications in batches—if they’re overwhelmed, approvals take longer.

Manual Processing Errors

If an insurer hasn’t fully automated credentialing, human errors (e.g., misplaced files) can add delays.

State Licensing Board Delays

Some insurers re-verify licenses directly with state boards, which can be slow.

Insurance credentialing can be a lengthy and complex process. Many delays and frustrations stem from avoidable mistakes.

Here are the most common pitfalls and mistakes that you should avoid.

Incomplete Applications

Missing documents (e.g., unsigned forms, outdated malpractice certificates) lead to instant rejections or long delays.

How to avoid:

- Use a credentialing checklist (ask insurers for one).

- Submit all required items in one batch (don’t trickle in documents).

- Follow up within 1-2 weeks to confirm receipt.

Missing CAQH Re-Attestation Deadlines

CAQH requires quarterly re-attestations (updating your profile every 90 days). Missing this freezes your applications with insurers.

How to avoid:

- Set calendar reminders for re-attestation deadlines.

- Log in to CAQH ProView every 3 months to confirm no updates are needed.

Mismatched Information Across Systems

Discrepancies between your:

- NPI number (e.g., individual vs. organizational)

- License details (e.g., old address still on file)

- CAQH profile (e.g., outdated work history)

…can trigger audits or denials.

How to avoid:

Audit your details before applying:

- Compare your NPI registry, state license board profile, and CAQH.

- Ensure your name, address, and taxonomy codes match everywhere.

Final Thoughts

Insurance credentialing is more than just paperwork.

It’s a strategic business decision that unlocks growth, stability, and accessibility for your practice.

While the process can feel daunting, the long-term benefits far outweigh the temporary hurdles. By becoming credentialed, you:

- Expand your client base to serve the 85% of therapy clients who rely on insurance.\

- Gain professional credibility and referrals from doctors, EAPs, and insurance directories.

- Stabilize your income with consistent reimbursements, even in slower seasons.

- Stand out in competitive markets by being visible where clients search first—insurance panels.

Let Medheave Handle Your Mental Health Insurance Credentialing

Tired of dealing with the complex, time-consuming world of insurance credentialing alone?

Medheave is here to help! As a leading credentialing provider across the USA, we specialize in fast, stress-free credentialing for mental health professionals and practices.

Why Choose Medheave?

- Expert Guidance: Our team knows the ins and outs of CAQH, NPI, and insurer requirements—no more guesswork.

- Faster Approval: We streamline submissions to avoid delays, getting you paneled in as little as 30-60 days.

- Maximized Reimbursements: We help negotiate better rates so you earn what you deserve.

- Ongoing Support: From initial applications to re-credentialing, we handle it all.

Don’t let paperwork keep you from growing your practice.

Let Medheave take care of credentialing and speed up things for you, so you receive reimbursement faster.

Get Credentialed the Easy Way

Frequently Asked Questions (FAQs)

What is insurance credentialing for mental health professionals?

Insurance credentialing is the process of applying to become an in-network provider with health insurance companies. It involves verifying your professional qualifications, licenses, and experience to ensure you meet the insurer’s standards.

Why is credentialing important for mental health professionals?

Credentialing helps mental health providers:

- Expand your client base (85% of therapy clients use insurance).

- Gain referrals from doctors, EAPs, and insurance directories.

- Ensure steady income through consistent reimbursements.

- Enhance credibility as an in-network provider.

- Stay compliant with healthcare regulations (HIPAA, billing rules).

What are the key steps in the credentialing process?

The process includes:

- Gather documents (license, malpractice insurance, CV, W-9, references).

- Set up a CAQH ProView profile (used by most insurers).

- Apply to insurance panels (e.g., Blue Cross, Aetna, UnitedHealthcare).

- Wait for approval (typically 30-90 days).

- Sign contracts & set up billing (review rates and policies).

How long does mental health credentialing take?

The mental health credentialing timeline is:

- Fastest: 30 days (rare, usually for smaller insurers).

- Average: 60–90 days (most major insurers).

- Longest: 120+ days (if delays occur due to missing documents or high volume).

What are the common mistakes that delay credentialing?

The most common mistakes mental health providers usually encounter are:

- Incomplete applications (missing signatures, expired documents).

- Not re-attesting CAQH every 90 days (freezes applications).

- Mismatched information (NPI, license details, or addresses not updated).

- Slow responses from references or employers.

Can I negotiate reimbursement rates with insurers?

Yes, but only during the contracting phase (after credentialing approval). If you have experience or specialize in high-demand services, you may negotiate higher rates. However, credentialing itself is non-negotiable; you must meet the insurer’s standards.