Smooth medical billing can be challenging for medical practices. Providers must prioritize treatment procedures to ensure patients receive quality care on time. Financial management often takes a back seat, leaving many administrative tasks incomplete.

As a patient recovers from illness, the physician focuses on their recovery, while medical bills become the last concern.

This is where a guarantor comes in. A guarantor could be the patient’s spouse, parent, or any close relative responsible for paying the medical bills.

There are different types of guarantors based on their relationship to the patient and their financial responsibility including Primary, Secondary, and a third-party Guarantor.

In this blog, we’ll explore the definition of a guarantor in medical billing, the types of guarantors, and why having one can be crucial in the whole process. This can help providers and practices ensure smoother financial operations and better patient care.

After seeing a patient, the next step is to get paid for the procedures or services you rendered. You will receive payment from the insurance payor if your patient has insurance.

But who will cover your medical bills if your patient doesn’t have insurance or, in another scenario, you aren’t an in-network provider?

At this stage, a guarantor becomes essential. The guarantor may be the patient, spouse, parent, or a close family member.

A guarantor is responsible for paying a patient’s medical bills if insurance does not cover all costs. This individual settles any remaining balance, ensuring financial security for the medical practice.

Put, a guarantor in medical billing is an individual or organization that accepts to pay for a patient’s medical expenses if that individual cannot afford to do so. A guarantor, usually a close friend or relative, has a stake in the patient’s health and welfare. If a medical procedure is necessary, the guarantor signs documents promising to fulfill the financial commitment if the patient defaults. The patient gets the required care in return. The patient and the healthcare professionals can rest easy knowing that the guarantor acted honestly.

Sometimes, practice owners may confuse who is responsible for the medical expense: the patient or another person or entity.

Let’s clarify the difference between patient and guarantor and understand this situation.

The patient is the individual receiving medical care, while the guarantor is the person who takes on the financial responsibility for the patient’s medical expenses. In many cases, the guarantor and the patient can be the same person, while in some cases, they can be different.

For this, consider this example:

In this case, a child undergoes surgery and is the patient. The child’s parent, responsible for paying any medical bills not covered by insurance, acts as the guarantor. This means the parent will handle any outstanding costs, ensuring the medical practice receives payment for the services provided.

In another scenario, an adult patient receives treatment and is insured by a private insurance company or a government agency, such as Medicare or Medicaid.

In this case, the patient will be a guarantor and will pay the expenses himself.

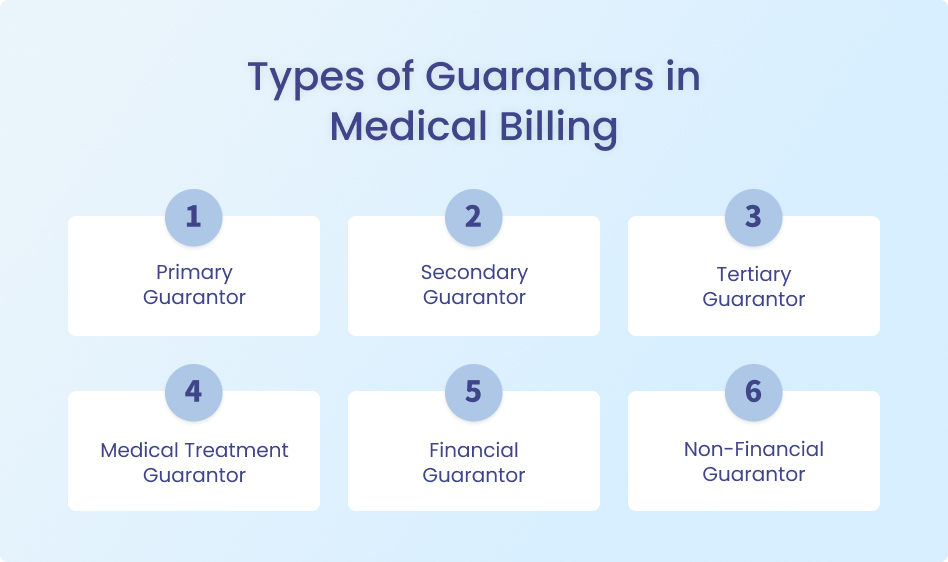

Types of Guarantors in Medical Billing

Now that you should have a solid grasp of guarantors let’s discuss the various types of guarantors in medical billing and how they handle medical bills and payments.

In medical billing, the main types of guarantors are:

- Primary Guarantor

- Secondary Guarantor

- Tertiary Guarantor

- Medical Treatment Guarantor

- Financial Guarantor

- Non-Financial Guarantor

Let’s discuss each type in detail:

Primary Guarantor

The primary guarantor is the first person or entity responsible for paying the medical bills. This is typically the person receiving the treatment or, in the case of minors, the parent or legal guardian. They are the first people insurance companies and medical providers will look to for payment.

For example, if you’re an adult getting treatment, you’re usually your primary guarantor. You’re responsible for making sure the bill is paid by insurance or out-of-pocket if needed.

The parent or guardian will be the primary guarantor for a child since the child isn’t legally responsible for paying their own bills yet.

Secondary Guarantor

If the primary guarantor cannot pay the medical bill, a secondary guarantor assumes financial responsibility. This may occur if the patient lacks the necessary funds or cannot make the payment.

If the patient (the primary guarantor) cannot pay their bill, a spouse could act as the secondary guarantor and take on that financial responsibility.

Or, a relative, such as a sibling or even a close friend, could be listed as a secondary guarantor. They’re not the first person responsible, but they’ll step in if the primary person can’t pay.

Medical Treatment Guarantor

A guarantor for medical treatment is someone who agrees—usually in writing—to take on the responsibility for another person’s medical bills. This could be a more formal agreement, especially for ongoing treatments.

A spouse could be the guarantor for their partner’s medical treatment, meaning they agree to pay for it, even if they’re not directly receiving care.

A parent might take on this role for their child, especially if the child is older and able to manage their care but still needs someone to take financial responsibility.

Tertiary Guarantor

Tertiary guarantors are a backup plan, a third layer of financial support if the primary and secondary guarantors cannot pay for the medical treatment, a tertiary guarantor steps in.

Imagine a relative or friend who isn’t immediately responsible but willing to help in case the other two can’t pay. They’d act as a tertiary guarantor.

Sometimes, charitable organizations or special funds may act as tertiary guarantors. They help cover the costs when family or friends can’t.

Financial Guarantor

A financial guarantor is a person legally responsible for paying any remaining medical expenses after insurance has covered their part. This person is listed on the medical account as the one who will settle unpaid bills.

For an adult patient, the primary guarantor may also be the financial guarantor, meaning they’re ultimately responsible for any outstanding balance after insurance.

If the patient is a child, the parent or legal guardian might be listed as the financial guarantor, handling unpaid balances.

Non-Financial Guarantor

Finally, there’s a non-financial guarantor, which can be confusing because this person isn’t responsible for the money. Instead, they’re more of a point of contact for the billing process.

A family friend might be listed as a non-financial guarantor if they handle the communication with the medical provider or insurance company. They aren’t paying the bills themselves, but they’re helping coordinate the billing or ensure everything gets sorted out.

A healthcare proxy, someone who handles medical decisions for a patient, could also be a non-financial guarantor if they’re only responsible for making sure the treatment is paid for but aren’t paying for it.

Why is a Guarantor Important in Medical Billing?

A guarantor plays a critical role in medical billing, helping to ensure that the financial side of healthcare runs smoothly. Here’s why they are so important, broken down conversationally:

Ensures Financial Responsibility

Healthcare providers must know that someone is responsible for paying the bill, and the guarantor fills this role. When insurance doesn’t pay or only covers part of the cost, the guarantor helps cover the remaining balance.

Without a guarantor, medical providers risk losing out on payments for services they’ve rendered, especially if there are gaps in insurance coverage or if certain charges aren’t fully covered.

Helps with Insurance Verification

Insurance information often links directly to the guarantor, who is the one who verifies coverage, submits claims, and handles anything that might go wrong with insurance processing. This includes situations like denied claims, delayed payments, or issues verifying the patient’s coverage.

If there are any hiccups, the guarantor usually communicates with the insurance company and works to resolve any issues.

Handles Unpaid Bills

Sometimes, unpaid medical bills need follow-up, either because insurance hasn’t covered everything or because payment has been delayed. The guarantor steps in to handle these situations, making sure the bill gets paid, either by negotiating payment plans or handling outstanding claims.

The guarantor handles any outstanding or unpaid balances. If the balance is not being paid on time, the guarantor may need to follow up with insurance or set up a payment plan with the medical provider.

Keeps Billing Information Up to Date

Having accurate, up-to-date billing information is essential. The guarantor often ensures the medical provider has the correct contact and billing details. This helps avoid mistakes like missing invoices, which could lead to payment delays or confusion.

Important bills or payment reminders might be missed if the wrong address or contact information is on file. The guarantor ensures the healthcare provider has the right details so that invoices reach the correct place and payments aren’t delayed.

Conclusion

Identifying the right guarantor is crucial in medical billing because it serves as the financial safety net when insurance doesn’t cover the full cost of care. A guarantor ensures that a physician, a medical office owner, or an outpatient services provider pays for their services, helps with insurance verification, keeps billing details up-to-date, and handles unpaid bills or claims.

A financially responsible guarantor is crucial for providers to receive their payments on time. The right guarantor can prevent billing delays, ensure claims are processed correctly, and ensure that payment issues don’t disrupt care or cause financial stress for both the patient and provider.

Ensure accurate and up-to-date guarantor information today with Medheave By verifying this simple detail, healthcare providers can prevent billing issues, reduce payment delays, and streamline financial processes.

Don’t wait—take action now to avoid future headaches and improve your revenue cycle management.

Medheave helps you maintain smoother, more efficient financial interactions every step of the way.

To Get Started Today- Connect Now