Handling payment disputes with insurance payers can be tricky.

That’s where claim arbitration in medical billing steps in.

It is a way to settle disagreements faster, cheaper, and without going to court.

If you’re a healthcare provider or run a medical practice, understanding this process can save you time, money, and headaches.

Let’s break down what claim arbitration is, when to use it, and how to prepare your practice for it.

What Is Claim Arbitration in Medical Billing?

Claim arbitration is a formal method used to resolve disputes between healthcare providers and payers over medical billing claims.

Instead of filing a lawsuit, both sides agree to let a neutral third party, the arbitrator review the case and make a decision that both must follow.

So, we can say that a third party settles payment disputes among payer and provider and issues a final decision on which both parties agree, this process is called arbitration in medical billing.

In simple terms, arbitration is a payer-provider dispute resolution process which is a fair and efficient alternative to legal battles.

It helps settle disputes like unpaid or underpaid claims, balance billing disagreements, and conflicts about out-of-network payments.

Arbitration speeds up resolution and reduces legal costs, keeping your revenue cycle running smoothly.

How Arbitration Fits into the Medical Billing Dispute Process

Usually, arbitration comes into play only after attempts to resolve the dispute directly with the payer fail.

You might start with claim denials, appeals or negotiations.

If these don’t work, arbitration offers a clear, formal path to settle things—without the delays and expense of court.

Here are the most common reasons providers turn to arbitration:

- Underpaid or denied claims: When payers pay less than expected or reject a valid claim.

- Out-of-network payment disputes: Disagreements over rates for services provided outside payer networks.

- Balance billing conflicts: Especially under the No Surprises Act, when billing patients for differences in payment amounts.

- Contract interpretation issues: Conflicts about how contract terms apply to billing or payments.

Claim Arbitration vs. Litigation

When disputes escalate, providers might wonder, should I go to arbitration or file a lawsuit?

Because, it helps understand providers, the provider payer dispute legal options and difference between arbitration and lawsuit medical claims

Here’s the major differences between arbitration vs litigation in healthcare billing.

Key Procedural Differences

Arbitration is generally faster than litigation.

While court cases can take years due to crowded dockets and procedural requirements, arbitration can often resolve disputes within months.

The specific timeframe for each varies depending on the complexity of the case and other factors.

- Arbitration: Private, informal, quicker, and involves a neutral arbitrator reviewing the case.

- Litigation: Formal court process, public, slower, and involves judges and possibly juries.

Cost and Time Considerations

Arbitration usually costs less and takes weeks or a few months, while litigation can drag on for years with much higher legal fees.

So, we can say that arbitration is a more cost-effective process for healthcare providers as compared to litigation.

Impact on Provider–Payer Relationships

Arbitration is less adversarial, helping preserve working relationships. Litigation often damages trust and can hurt future contract negotiations.

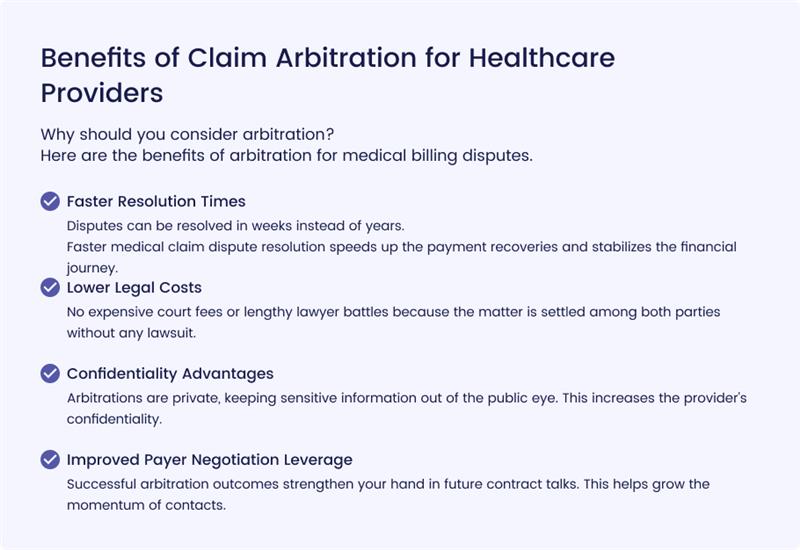

Benefits of Claim Arbitration for Healthcare Providers

Why should you consider arbitration?

Here are the benefits of arbitration for medical billing disputes.

Faster Resolution Times

Disputes can be resolved in weeks instead of years.

Faster medical claim dispute resolution speeds up the payment recoveries and stabilizes the financial journey.

Lower Legal Costs

No expensive court fees or lengthy lawyer battles because the matter is settled among both parties without any lawsuit.

Confidentiality Advantages

Arbitrations are private, keeping sensitive information out of the public eye. This increases the provider’s confidentiality.

Improved Payer Negotiation Leverage

Successful arbitration outcomes strengthen your hand in future contract talks. This helps grow the momentum of contacts.

When Is Claim Arbitration the Right Choice?

Arbitration can be a useful tool when dealing with disputes related to medical claims, but it’s important to know when to use it effectively.

As a healthcare provider, understanding when arbitration is the best course of action can save you time and effort in the long run.

Arbitration is generally considered when claims are underpaid, denied, or involve out-of-network services.

Here’s when arbitration makes the most sense:

Disputes Over Underpaid or Denied Claims

If payers repeatedly undervalue your claims or deny them without sufficient reason, arbitration may be the solution.

After exhausting all appeals and attempts to resolve the issue through negotiation, arbitration offers an impartial third party to help determine the payment owed.

This is particularly useful for complex claims where manual review and negotiation haven’t yielded results.

Out-of-Network Payment Conflicts

When your practice provides services outside the insurance plan’s network, disputes can arise over the payment rate.

Under the No Surprises Act, which seeks to protect patients from unexpected medical bills, out-of-network claim arbitration helps resolve disagreements between healthcare providers and insurers regarding what is a “reasonable” payment amount for out-of-network care.

This ensures you are fairly compensated for your services without burdening patients with unexpected bills.

Balance Billing Disputes Under the No Surprises Act

Under the No Surprises Act, when patients receive care from out-of-network providers, balance billing is strictly regulated.

This law allows for arbitration between healthcare providers and insurers to resolve disagreements over payments.

If you’ve provided services outside an insurance network, arbitration is a tool to avoid balance billing disputes by setting a fair reimbursement rate.

State vs. Federal Arbitration Pathways

It’s crucial to understand that arbitration can be governed by state-specific rules or federal regulations, depending on the type of dispute.

Some states have their own arbitration programs for medical billing issues, especially in cases of underpayments, while others follow the federal arbitration process under laws like the No Surprises Act.

- State Arbitration: Many states have their own states arbitration laws and eligibility medical claim disputes programs that handle out-of-network claims and balance billing disputes.

- Federal Arbitration: Under federal law, the No Surprises Act IDR process eligibility determines when a healthcare provider can initiate arbitration for certain types of disputes, like balance billing or underpayment in emergency services.

Before initiating arbitration, it’s essential to determine whether state or federal arbitration laws apply.

Understanding this distinction can save time and improve the chances of success.

Claim Arbitration Process

Here’s a complete medical claim arbitration step by step process that you should follow:

Step 1: Filing an Arbitration Request

So, the first step is getting the ball rolling.

You’ll need to submit a formal arbitration request, either to the payer (like the insurance company) or to the designated arbitration body, depending on your situation.

This request is basically a demand to start the process and usually has to include a detailed explanation of why you’re asking for arbitration.

Make sure all the information is clear—any ambiguity could delay the process.

Step 2: Submitting Supporting Documentation

Next up, it’s time to get all your paperwork together.

This is critical. You’ll need to provide all the supporting documentation that backs up your case.

This includes things like your medical records, the billing statements that show what you’re owed, any contracts you have with the payer, and any previous communication you’ve had regarding the dispute.

Consider this as your “evidence packet”—the more thorough and organized, the better.

Step 3: Arbitrator Selection and Case Review

Once everything’s submitted, the next step is picking the arbitrator or arbitration panel.

Typically, both you and the payer will agree on who this is.

In some cases, a specific body or organization might assign the arbitrator, but it’s often a collaborative decision.

The arbitrator is the one who’ll go through all the documentation you’ve submitted and get familiar with your case.

This is the step where they decide whether or not the dispute is worth moving forward with arbitration.

So, it’s important to make sure your documents tell a clear story.

Step 4: Hearing or Paper Review Process

Here’s where things can vary a bit. Some cases might go to a formal hearing where both parties (you and the payer) present your side of the story.

Others may bypass this step and have the arbitrator make a decision based purely on the documentation submitted—this is called the “paper review” process.

It all depends on the arbitration rules for your specific case.

Either way, be prepared to present your side in a clear and organized way, as the arbitrator will be basing their decision on what’s in the record.

Step 5: Decision Issuance and Enforcement

The final step is when the arbitrator hands down their decision.

This decision is binding, meaning it’s final and both parties have to follow it.

If either party doesn’t comply with the ruling, legal enforcement might come into play.

That’s why it’s crucial to have all your documentation in order and present your case as solidly as possible during the process.

Key Legal and Compliance Considerations

Arbitration isn’t just paperwork, you need to stay compliant.

Understanding the No Surprises Act and IDR

The No Surprises Act is a big deal when it comes to arbitration.

This federal law aims to protect patients from surprise medical bills, especially when they receive care from out-of-network providers at in-network facilities.

For many out-of-network billing disputes, arbitration is now a required step, but there are strict rules and timelines for initiating the process.

The Independent Dispute Resolution (IDR) process under this law is specifically for out-of-network charges, and both parties (the provider and the payer) must comply with the timeframes and conditions for arbitration.

If your case falls under this law, understanding the exact rules and how they apply is essential.

You don’t want to miss deadlines or fail to meet requirements.

State-Specific Arbitration Rules for Medical Billing

While federal laws like the No Surprises Act apply across the U.S., some states have their own arbitration regulations.

These rules can vary, so you’ll need to familiarize yourself with your state’s requirements.

Some states may have additional steps or specific timelines, while others might allow alternative dispute resolution methods outside of arbitration.

For example, California and New York have specific state-level laws that govern how arbitration should be conducted for medical billing disputes.

It’s crucial to know both the federal and state regulations that apply to your case, so you don’t end up out of compliance.

Documentation Standards for Arbitration Cases

Arbitration isn’t just about having a good case; it’s about presenting it well. Proper documentation is critical.

The arbitrator will look at medical records, billing statements, contracts, and any communication between you and the payer. So, make sure that everything is organized and thorough.

- Medical records: These should include patient details, diagnosis, treatment plans, and billing codes.

- Billing data: Accurate and detailed billing statements with line items are necessary.

- Contracts: Include agreements with the payer regarding reimbursement rates or terms.

- Communication logs: Keep a record of all emails, letters, and phone calls with payers regarding the dispute.

Having these documents neatly prepared will help the arbitrator make a fair, informed decision.

Working With Legal Counsel or Billing Advocates

Navigating arbitration can be complex.

Working with legal counsel or specialized billing advocates can help ensure you follow all the necessary steps and present a strong case.

These professionals can also advise you on:

- How to interpret your contracts and payer obligations.

- The best strategies for presenting your case during arbitration.

- Identifying any loopholes or strengths in your position.

They’re particularly useful when you face intricate or high-stakes disputes.

Preparing Your Practice for Potential Arbitration Cases

Setting Internal Dispute Resolution Protocols

The best way to handle disputes is to prevent them from escalating to arbitration.

You can do this by creating internal protocols for resolving issues early. This might include:

- Setting up a team to review denials.

- Having a clear escalation process for when issues with payers arise.

- Offering alternative solutions before turning to arbitration.

The goal is to resolve things quickly and efficiently, without the need for formal arbitration.

Training Billing Staff on Arbitration Processes

Your billing staff should be well-versed in the arbitration process.

Training them on what to look for when preparing for potential arbitration and how to gather and organize the necessary documentation is key.

They should know:

- How to track payer communications.

- How to prepare evidence for arbitration hearings.

- How to respond to payer denials or disputes in ways that minimize the risk of escalation.

The better trained your staff, the smoother the arbitration process will go if it ever becomes necessary.

Maintaining Payer Communication Records

Keep detailed records of all interactions with payers.

This includes:

- Emails and phone call logs.

- Letters or notices sent and received.

- Notes on any verbal agreements or disputes.

These records are essential when building your case for arbitration in medical billing.

They can also help prevent future disputes if you can show a history of good-faith communication with the payer.

Final Thoughts and Best Practices

Preventing medical billing disputes is essential to avoid further headaches.

With careful preparation, strong documentation, and a good understanding of the legal and compliance landscape, you can navigate it effectively.

The key takeaway: proactive management and attention to detail can make a world of difference when a billing dispute arises.

Preventing Disputes Through Proactive Revenue Cycle Management

Rather than dealing with disputes after they happen, be proactive.

- Monitor claims closely from the beginning, address any discrepancies early

- Maintain open lines of communication with payers.

- Handling denials quickly and keeping your records up-to-date

Choosing the Right Arbitration Strategy for Your Practice

Understand the dispute resolution options in your contracts and be strategic.

For example, some insurance contracts have clauses specifying arbitration for certain types of disputes, while others may offer a negotiated settlement process.

Knowing your options ahead of time can give you an advantage if a dispute arises.

Frequently Asked Questions (FAQs)

How long does medical billing arbitration take?

Typically, arbitration can take anywhere from a few weeks to a few months, depending on the complexity of the case and the rules set by the arbitration body. It’s much faster than traditional litigation, which could take years.

Who pays for claim arbitration in healthcare?

Costs are usually split between the two parties, but the specific agreement might be outlined in your contract or by the arbitration body’s rules. It’s important to clarify this upfront, so you aren’t caught off guard by unexpected costs.

Is arbitration binding in medical billing disputes?

Yes, the decision made by the arbitrator is generally final and enforceable by law. Both parties must comply with the ruling, or legal enforcement may follow. This is why having a solid case is critical.

What documentation is needed for arbitration?

For a smooth arbitration process, you’ll need complete medical records, billing data, contracts, communication logs, and any appeal attempts you’ve made with the payer. Make sure your documentation tells a clear and coherent story to the arbitrator.