Out-of-network (OON) billing occurs when a patient is not covered by your plan, complicating the billing process.

It presents regulatory, administrative, and financial challenges, including disputes with insurance, collecting payments from patients, and complying with laws like the No Surprises Act.

This act, which took effect in 2022, restricts surprise billing for emergency and ancillary services, prohibiting providers from billing patients.

To navigate these complexities and maximize revenue, healthcare providers must understand OON billing rules, challenges, and best practices for improving the billing process.

What is Out-of-Network Medical Billing?

Healthcare providers and practice owners must understand the major difference between out-of-network billing vs in-network billing.

As names indicate, the out-of-network billing is related to providers who are credentialed with patients insured with an insurance plan or a company like Medicare, UnitedHealth and Aetna, etc.

While out-of-network billing is the process of claim submission for an uninsured patient.

- In-network providers have a contract with your insurance company to provide services at a pre-negotiated, often lower rate. When you see an in-network provider, you typically only pay your co-payment, co-insurance, or deductible, and the provider handles billing with the insurer directly.

- Out-of-network (OON) providers do not have a contract with your health plan. They are not subject to the pre-negotiated rates so that they can charge more for their services. This can result in higher costs for patients, as the insurance plan will cover a smaller percentage, or sometimes none, of the bill. OON care is common with specialists or in emergencies.

Why OON Billing Creates Financial Opportunities

It is a fact that out-of-network billing can create financial opportunities for providers because the discounted rates dictated by insurers do not constrain them.

OON providers can set their own fee schedules, which are often higher than in-network rates, potentially leading to increased revenue.

This is particularly relevant for specialized services or in areas with limited in-network options.

However, this also means the provider assumes more risk and administrative burden.

Patients are responsible for the difference between the provider’s charge and the insurer’s payment, known as balance billing, and the provider must have a strong billing strategy to manage these complexities.

By negotiating payment and managing the collections process, providers can realize higher revenues on a per-service basis, though this is often offset by the administrative costs and potential for unpaid patient responsibility.

How Insurers Process Out-of-Network Claims

To process an out-of-network claim, an insurer first uses the Usual, Customary, and Reasonable (UCR) methodology to set the maximum allowed amount for a service.

The patient typically pays the out-of-network provider upfront and then submits a claim, often with a “superbill” invoice, for reimbursement.

The insurer assesses the claim and applies the patient’s higher out-of-network deductible and cost-sharing percentages.

Usual, Customary, and Reasonable (UCR) Fees

Usual, Customary, and Reasonable (UCR) is the standard fee that health insurers consider acceptable for a medical service within a specific geographical area.

For example, if a provider charges $400 for a service and the plan’s UCR rate is $250, the patient with 40% coinsurance would pay $100, and the insurer would cover the remaining $150, making the patient potentially responsible for the $150 difference between the provider’s charge and the UCR amount.

The “usual” fee is what a provider typically charges, the “customary” cost is the average charge by similar providers in that area, and the “reasonable” fee is what is justified for the complexity of the service.

Since out-of-network providers have not agreed to the insurer’s negotiated rate, the UCR sets the maximum amount the insurer will pay for their services.

If the provider charges more than the UCR, the patient is responsible for the difference.

Balance Billing and Patient Responsibility

Balance billing occurs when an out-of-network provider bills a patient for the difference between their total charge and the amount paid by the insurance company.

Since there is no contractual rate, the provider can bill the patient for this unpaid balance.

The patient is also responsible for meeting any separate, and typically higher, out-of-network deductibles and coinsurance before the insurer will pay.

For example, if an out-of-network provider charges $1,000 for a service and your insurance plan’s allowed amount is $250, the provider could balance bill you for the remaining $750. Your total patient responsibility would be that $750, plus any deductibles or coinsurance you owe on the $250 allowed amount.

While recent laws like the No Surprises Act protect patients from balance billing in certain emergency or in-network facility situations, it does not always apply, and out-of-network care often leaves the patient with higher costs.

After processing, the insurer sends an Explanation of Benefits (EOB) to the patient.

The EOB breaks down the provider’s original billed amount, the insurer’s allowed amount (based on UCR), the amount the insurer will pay, and the patient’s responsibility.

Crucially, the out-of-network provider is not bound by a contract with the insurer and can bill the patient for the remaining balance after the insurer’s payment.

This often results in a significantly higher financial burden for the patient compared to in-network services.

Understanding OON Coverage by Plan Type

When it comes to billing for services provided to an out-of-network (OON) patient, one of the key considerations is understanding which health insurance plans will cover those services. Typically, the level of coverage varies depending on the type of health insurance plan.

The most common plans that provide OON coverage include Preferred Provider Organization (PPO) plans and Point of Service (POS) plans.

Let’s break down the coverage details for each plan type.

PPO Plans – Flexible but Higher Costs

PPO plans are among the most flexible when it comes to out-of-network coverage. These plans allow members to seek care from any healthcare provider, whether they are within the network or outside of it. However, the reimbursement for services rendered by an out-of-network provider will be significantly lower compared to in-network services.

- OON Benefits: PPO out-of-network benefits generally cover a portion of the cost, but the member will be responsible for paying a higher share of the bill, including a higher deductible and coinsurance rate.

- Costs: Out-of-pocket costs for OON care are typically higher for PPO plans because of higher deductibles, co-pays, and coinsurance percentages.

- Reimbursement: Reimbursement for out-of-network services is often based on the “Usual, Customary, and Reasonable” (UCR) fee schedule, meaning that the insurer will pay a percentage of what they consider the reasonable cost for the service, which may be lower than what the provider charges.

POS Plans – Hybrid Option

Point of Service (POS) plans combine elements of both HMO and PPO plans, making them somewhat hybrid in nature. While POS plans are typically designed to encourage members to use in-network providers, they do provide out-of-network coverage, albeit at a higher cost.

- OON Billing: In POS plans, if a patient chooses to see an out-of-network provider, the plan may cover a portion of the costs, but members must often pay higher deductibles and co-pays than for in-network services.

- Flexibility: POS plans generally require members to select a primary care physician (PCP) who coordinates care, and any OON services usually need a referral from the PCP.

- Costs and Reimbursement: Similar to PPO plans, OON services may be reimbursed at a lower rate, often with higher deductibles, coinsurance, and out-of-pocket expenses.

HMO Plans – Strict and Limited

Health Maintenance Organizations (HMOs) plans are typically the most restrictive when it comes to OON coverage. HMO plans generally cover only in-network services and often do not provide any OON benefits except in the case of an emergency.

- OON Restrictions: If a patient with an HMO plan seeks care from an out-of-network provider without an emergency, the plan will likely not cover the service at all. In some cases, members may be responsible for the entire cost of OON care.

- Emergency Exceptions: If an emergency arises and the patient requires out-of-network care, the HMO plan may cover the expenses as if they were in-network, depending on the specifics of the policy.

EPO Plans – Very Limited OON Coverage

Exclusive Provider Organization (EPO) plans are similar to HMO plans in that they require members to use a specific network of providers. Like HMO plans, EPOs typically do not cover OON services except in emergencies.

- OON Services: If you seek care outside the network, the plan will generally not reimburse any portion of the cost, unless it’s an emergency.

Coverage Comparison Table

| Plan Type | In-Network Coverage | Out-of-Network Coverage | Deductibles | Reimbursement |

| PPO | Full coverage, lower costs | Partial coverage, higher costs | Higher than in-network | Based on UCR rates, lower reimbursement for OON |

| POS | Full coverage, lower costs | Partial coverage, higher costs | Higher than in-network | Lower reimbursement for OON with higher member responsibility |

| HMO | Full coverage, lowest costs | No coverage (except emergencies) | Lowest | Emergency services covered at in-network rates |

| EPO | Full coverage, lowest costs | No coverage (except emergencies) | Lower than PPO | Emergency services covered at in-network rates |

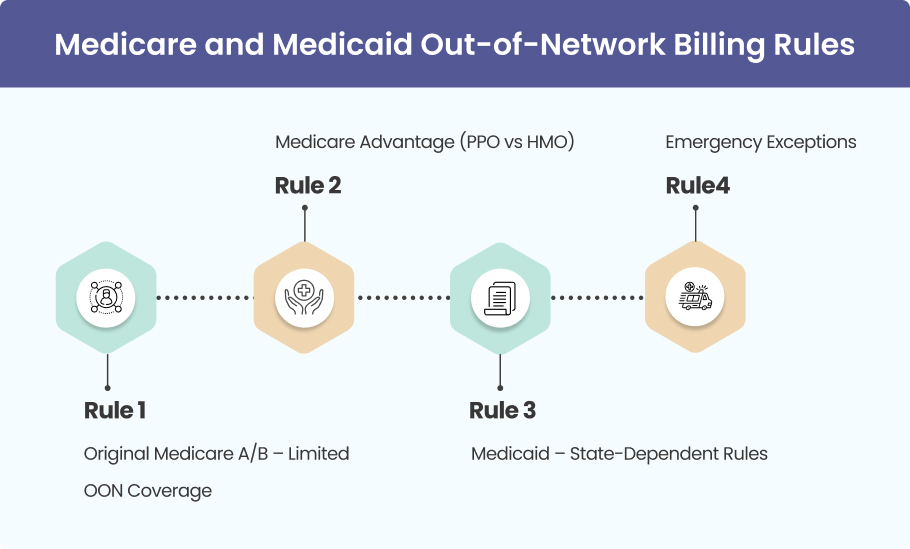

Medicare and Medicaid Out-of-Network Billing Rules

Out-of-network (OON) billing can be complicated, especially for patients covered by Medicare or Medicaid. Understanding the OON billing rules for these programs is essential for both providers and patients to ensure correct billing and minimize surprises.

Original Medicare A/B – Limited OON Coverage

Original Medicare (Parts A and B) provides limited OON coverage. Patients are generally encouraged to use Medicare-approved, participating providers, as Medicare will only cover services provided by non-participating providers to a limited extent.

- Medicare OON Billing: If a patient receives care from a non-participating provider, Medicare may still cover part of the costs, but the provider is allowed to bill the patient for the remaining amount. This is known as the limiting charge, which is typically up to 15% more than what Medicare pays.

- Non-participating Providers: These providers are not bound by Medicare’s payment limits and can charge more than Medicare’s approved amount, but they still must accept the limiting charge as the highest amount for which they can bill the patient.

Medicare Advantage (PPO vs HMO)

Medicare Advantage plans (Part C) are managed by private insurance companies and vary in terms of out-of-network coverage, depending on whether the plan is a PPO or HMO.

- Medicare Advantage PPO: These plans offer more flexibility and may cover out-of-network services, but at a higher cost to the patient. If you see an OON provider, the plan typically reimburses at a lower rate and requires higher copayments and deductibles.

- Medicare Advantage HMO: These plans usually do not provide coverage for OON services unless it’s an emergency. They require members to see in-network providers for most non-emergency care, and out-of-network care is rarely covered.

Medicaid – State-Dependent Rules

Medicaid coverage, including OON services, varies significantly from state to state. Each state administers its own Medicaid program, and OON coverage rules can differ depending on the state’s regulations.

- Medicaid OON Rules: Some states may provide limited OON coverage for certain services, but in most cases, Medicaid will only cover in-network services. There may be exceptions for urgent or emergency care.

- State Variability: Since Medicaid is state-managed, providers need to check the specific OON rules for each patient’s state program to ensure proper billing.

Emergency Exceptions

In both Medicare and Medicaid, emergency services are often an exception to the OON rules. Both Medicare and Medicaid plans are required to cover emergency services, even if an out-of-network provider provides them, and typically, the patient will not be charged more than the in-network cost.

The No Surprises Act and Balance Billing Compliance

The No Surprises Act (effective 2022) addresses out-of-network billing in an effort to protect patients from surprise medical bills. This federal law aims to eliminate unexpected out-of-pocket costs related to OON care, particularly in emergencies and for ancillary services.

Federal Rules on Surprise Billing

Under the No Surprises Act, health insurance providers are prohibited from charging patients more than the in-network rate for certain OON services, even if the patient didn’t know an out-of-network provider was treating them. This law primarily targets emergencies and out-of-network services provided by certain ancillary providers (e.g., anesthesiologists, radiologists) in in-network facilities.

What Providers Can/Cannot Do

Providers are prohibited from engaging in balance billing for emergency services or for ancillary services rendered at in-network facilities. This means that they cannot bill the patient for the difference between the OON charge and the in-network reimbursement. Instead, they must negotiate the payment directly with the insurance company.

- Balance Billing Restrictions: The No Surprises Act restricts balance billing for most emergency services and certain non-emergency services provided by out-of-network providers at in-network facilities.

Emergency & Ancillary Provider Exceptions

The act specifically protects patients from surprise billing in emergencies. For example, suppose a patient goes to an emergency room and is treated by out-of-network doctors or receives services from non-participating providers. In that case, they are still protected from surprise billing.

- Ancillary Providers: If a patient receives care from an OON provider at an in-network facility, that provider must adhere to the balance billing restrictions.

State-Specific Restrictions

While the No Surprises Act sets federal guidelines, states may have additional rules and protections related to OON billing. Some states may have even more stringent laws regarding surprise billing, which providers must follow in addition to federal regulations

The Out-of-Network Claim Submission Process

Submitting out-of-network claims can be a complex process, requiring attention to detail and adherence to specific procedures. Here’s a step-by-step guide to ensure clean claim submission and avoid common pitfalls.

Step 1: Verify Patient Benefits

Before providing care, always verify the patient’s insurance benefits to understand their OON coverage. This helps determine whether the patient’s plan will cover out-of-network services and what their financial responsibility will be.

Step 2: Obtain Pre-Authorization

Many insurance plans, especially PPOs and HMOs, require pre-authorization for OON services. This step ensures that the insurer agrees to cover the treatment and may reduce the risk of claim denials or underpayments.

Step 3: Submit Claims Correctly (Direct vs. Patient Submission)

Claims can be submitted directly to the insurance company or through the patient, depending on the insurer’s procedures. Submitting clean claims with all necessary documentation is crucial for ensuring proper reimbursement.

- Clean Claim Submission: Double-check that all fields are completed accurately and all necessary supporting documents (e.g., medical records, referral information) are included.

Step 4: Track and Follow Up on Claims

After submission, track the status of the claim. If the claim is not processed promptly, follow up with the insurance company. Delays can result in denied or late payments.

Step 5: Appeal Denials or Underpayments

If a claim is denied or underpaid, you have the right to appeal. Submit additional documentation or a detailed explanation of the services rendered. A well-documented appeal increases the chances of reimbursement.

Strategies to Maximize Out-of-Network Reimbursement

Maximizing reimbursement for out-of-network services requires a proactive approach. Here are strategies to optimize your revenue:

Use UCR Data & FAIR Health Database

UCR (Usual, Customary, and Reasonable) data can help determine the fair reimbursement amount for OON services. The FAIR Health Database is a useful resource for checking the UCR rates for specific procedures based on geographic location and provider type.

Secure Pre-Authorization to Reduce Risk

Always obtain pre-authorization when required. This reduces the likelihood of claims being denied or underpaid due to a lack of insurer approval.

Submit Clean & Accurate Claims

Ensure that all claim forms are accurate and complete. Any missing or incorrect information can delay payment or lead to denials.

Appeal Denials with Documentation

When claims are denied or underpaid, appeal with comprehensive supporting documentation, including medical necessity and other relevant information.

Negotiate Directly with Insurers

Don’t hesitate to negotiate directly with insurance companies for a better reimbursement rate. Sometimes, insurers may offer more than their initial payment, especially if the claim was underpaid.

Strategic Balance Billing with Patient Communication

In some cases, balance billing may be a viable option. However, always communicate with the patient about their potential financial responsibility upfront.

Educating Patients on OON Coverage

Educate patients about the implications of seeking OON care. Ensure they understand their financial responsibility, including what their insurance will cover.

Leveraging Billing Experts & Outsourcing

Consider outsourcing OON billing to billing experts who specialize in denial management and revenue cycle optimization. Outsourcing can free up your practice’s resources and improve collection rates.

When Should Providers Outsource Out-of-Network Billing?

Outsourcing OON billing can be a smart solution for practices that face high volumes of denials or struggle to manage the complexities of OON claims.

Signs Your Practice Needs External Help

- Frequent claim denials or underpayments

- Inability to keep up with evolving insurance policies

- Lack of in-house billing expertise

- Increased time spent on administrative tasks rather than patient care

Benefits of Outsourcing OON Billing

- Increased reimbursement rates through expert negotiation

- Reduced administrative burden

- Streamlined claims submission and follow-up processes

Medheave helped a medical group increase its OON reimbursement by 25% within six months by streamlining the claim submission process and improving denial management. Outsourcing allowed the group to focus on patient care while Medheave handled billing challenges.

Conclusion

Out-of-network billing presents both challenges and opportunities for providers.

By understanding the complexities, following best practices, and staying compliant with laws like the No Surprises Act, providers can maximize reimbursement and reduce patient disputes.

Contact Medheave an expert billing and RCM services provider across USA for expert OON billing services and improve your practice’s revenue cycle management.

FAQs

Can Providers Balance Bill OON Patients?

Providers may balance bill OON patients depending on the type of insurance and the state regulations. However, under laws like the No Surprises Act, providers are restricted from balance billing in certain emergency and ancillary situations.

What is UCR, and How Does it Affect Billing?

UCR (Usual, Customary, and Reasonable) rates are the standard rates that insurers use to determine what they will reimburse for OON services. Providers should use UCR data to ensure they are receiving fair reimbursement for their services.

Does Medicare/Medicaid Cover OON?

Original Medicare provides limited OON coverage, while Medicare Advantage plans may cover OON services depending on the plan type (PPO vs. HMO). Medicaid coverage for OON services depends on the state.

Can Patients Appeal OON Claim Denials?

Yes, patients can appeal OON claim denials, but the process varies by insurer. Providers should assist patients with the appeal process when necessary.

How Does the No Surprises Act Impact OON Claims?

The No Surprises Act prevents providers from balance billing patients for emergency services or for certain non-emergency services provided by out-of-network providers at in-network facilities.