Have you ever delivered excellent care to a patient, sent the claim and then months later, found out you won’t be getting paid because you missed the medical claim submission deadline?

If you’re a provider, office manager, or billing team lead, that sting is all too real.

Timely filing limits for claims are a make-or-break aspect of revenue cycle management. If you don’t file claims on time, no matter how valid or necessary the service was, insurance payers can and will deny your payment.

It’s not personal—it’s a stringent policy of insurance payers like Medicaid, Medicare, and other private insurance companies that you must act upon.

Therefore, healthcare providers must submit claims within the specified timeframe, also known as the claim filing limit.

Claim filing limits vary from payer to payer. Sometimes, payers continually change these limits.

In this blog, we’ll break down everything you need to know about timely filing deadlines for 2025, share payer-specific limits, and show you how Medheave medical billing experts help you never miss a deadline again.

The timely filing limit is akin to a ticking clock that begins the moment a patient walks out the door. It’s the maximum period a provider has to submit a claim to the insurer. Miss that window? Say goodbye to reimbursement.

For example, imagine Dr. Patel sees a patient on January 1st, and that patient has a Cigna plan with a 90-day filing limit. That claim must be submitted by March 31st—or it’s toast. Even if everything else is perfect.

Different insurers, different clocks:

- Medicare gives you 12 months.

- Medicaid varies—some states give you 90 days, others up to 180.

- Commercial payers? You’ll need to check your contract.

Timely filing isn’t just a compliance checkbox—it’s a critical safeguard for your financial health.

Here’s a closer look at why prompt claim submission is essential:

Every Missed Deadline Is Money Lost

Let’s revisit the numbers:

- 500 claims/month

- 5% submitted late = 25 claims

- Average value = $150/claim

- That’s $3,750/month or $37,500/year in unrecoverable revenue.

That’s the revenue your team earned by providing care, but won’t receive, simply because the claim was too late.

The Domino Effect of Late Filing

It’s not just about missing out on payments:

- Late Claims = Denials

Most payers have strict filing windows (90 to 180 days). Submit late, and the claim is automatically rejected. - Denied Claims = Rework & Appeals

Denials require staff to investigate, correct, and resubmit the information. This ties up valuable resources. - Appeals = Long, Uncertain Process

Appeals are time-intensive and frequently unsuccessful. Meanwhile, your cash flow suffers.

Timely Filing = Frontline Defense

Submitting claims on time:

- Increases your chances of full reimbursement

- Reduces the need for costly rework

- Helps maintain predictable cash flow

- Keeps your revenue cycle efficient and lean

Timely submission isn’t just good practice; it’s essential. It’s your first line of defense against revenue leakage.

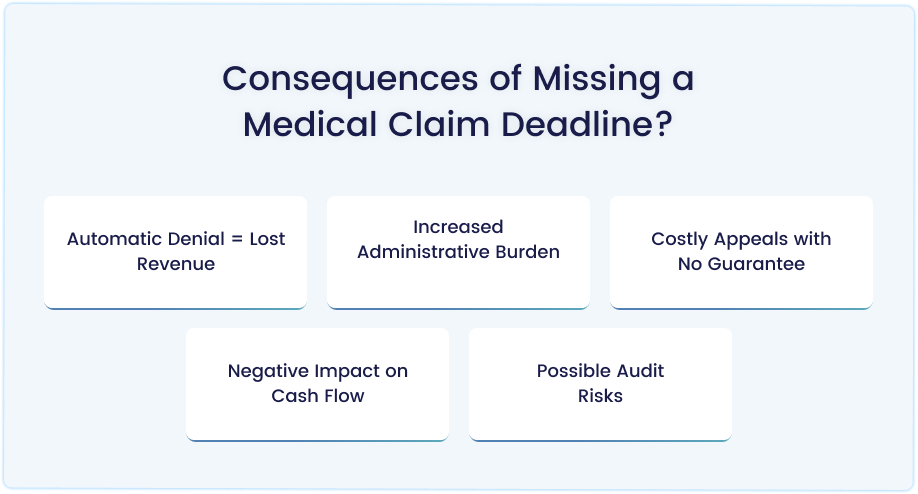

Missing the filing deadline on a medical claim doesn’t just mean a delay—it can result in permanent financial loss and operational strain. Here’s what happens when a claim is filed too late:

Automatic Denial = Lost Revenue

Most insurance payers have strict timeframes (often 90–180 days from the date of service). If you miss that window, the claim will be automatically denied, and you may never receive payment for that service.

Example: One missed $200 claim may not be significant, but 20 missed claims a month add up to $48,000 per year.

Increased Administrative Burden

Denied claims lead to:

- Rework: Staff must research, correct, and sometimes reprocess claims.

- Appeals: Time-consuming, paperwork-heavy, and not consistently successful.

- This pulls staff away from other critical billing tasks, creating a backlog.

Costly Appeals with No Guarantee

Filing an appeal to overturn a denial of a timely filing can be a challenging process. Unless you have clear proof of payer error or extenuating circumstances, most appeals are denied.

Negative Impact on Cash Flow

Late claims result in no payment, disrupting the revenue stream. Practices rely on predictable reimbursement to:

- Pay staff

- Cover overhead

- Invest in technology or growth

- A few late claims per month can destabilize your financial health.

Possible Audit Risks

Consistent late filings or excessive denials can raise red flags with payers. This can trigger audits or closer scrutiny of your billing practices.

Here is a snapshot of the filing deadlines for various payers.

| Payer | Filing Deadline | Notes |

| Medicare | 12 Months | Uniform for all |

| Aetna | 120 Days | No grace period |

| BCBS Texas | 95 Days | Very strict |

| Medicaid (NY) | 90 Days | Requires eligibility proof |

| Cigna | 90 Days (In-net) | 180 for out-of-network |

| TRICARE / ChampVA | 1 Year | Extensions are possible for active duty |

| Magellan (Behavioral) | 60 Days | One of the shortest |

Absolutely — in-network and out-of-network providers operate under different rules, and understanding these differences is crucial for submitting clean claims and receiving fast reimbursement.

They sure do. Here’s how they compare:

| Provider Type | Filing Window | Extra Requirements |

| In-Network | 90–180 Days | Minimal – claims are often tracked automatically in payer systems |

| Out-of-Network | Up to 365 Days | Requires manual documentation and proof of submission |

Why the Difference?

- In-network providers have contracts with the payer. That means streamlined processes, electronic submissions, and fewer steps to complete.

- Out-of-network providers aren’t contracted, so payers impose stricter rules to verify services and prevent fraud.

In the complex world of medical billing, timing is everything. Two of the most critical deadlines providers must track are the claim filing limit and the claim appeal timeline.

While they may seem similar, they apply to different stages of the revenue cycle and carry very different consequences when missed.

Understanding the distinction between these two deadlines is crucial for maximizing reimbursement and preventing avoidable revenue loss.

See this example:

When you provide a service on January 1:

- If the payer’s filing limit is 120 days, you must submit the original claim by May 1.

- If the claim is denied on May 15, and the appeal window is 45 days, your appeal is due by June 29.

The table below breaks down the key differences between claim filing limits and claim appeal timelines, helping providers stay compliant and proactive.

| Criteria | Claim Filing Limit | Claim Appeal Timeline |

| What It Is | The deadline to submit an original claim is after the date of service. | The deadline to appeal a denied or rejected claim. |

| Trigger Event | Date of service | Date of denial or rejection notification |

| Typical Timeframe | 90–180 days (in-network) or up to 365 days (out-of-network) | 30–60 days after denial, depending on the payer |

| Applies To | Initial claim submission | Denied or underpaid claims |

| Consequences of Missing | The claim won’t be paid—no reimbursement | Loss of appeal rights—denial becomes final |

| Documentation Needed | Patient info, coding, proof of service | Original EOB, denial code, appeal letter, supporting documents |

| Can It Be Extended? | Rarely, only with proof of extenuating circumstances | Sometimes, if the payer allows second-level appeals or external reviews |

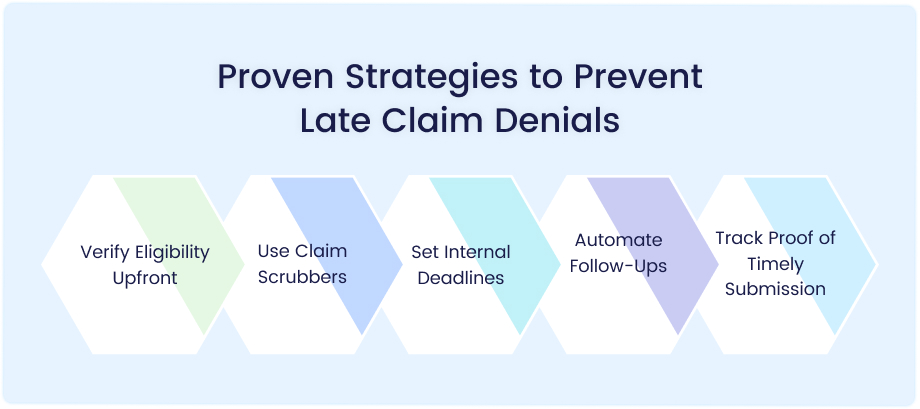

Timely filing denials can drain your revenue and burden your staff. The good news? Most are preventable. Use this proactive playbook to keep your claims clean, compliant, and on time:

Verify Eligibility Upfront

Don’t wait until the claim is denied to realize a policy was inactive. Confirm insurance coverage, plan details, and authorization requirements before providing care. Never rely on old records or what a patient “thinks” is active.

Use Claim Scrubbers

Claim scrubbers act like a first line of defense—catching missing codes, outdated NPI numbers, incorrect modifiers, and other common errors before claims go out the door. Fewer errors mean fewer rejections and faster payment.

Set Internal Deadlines

If a payer allows 120 days to file, don’t wait until the 120th day. Set a buffer—for example, submit by Day 75. This gives time for corrections, resubmissions, or issues outside your control (like EMR lags or mail delays).

Automate Follow-Ups

Don’t manually chase down aging claims. Use tools that automatically flag unpaid claims, track documentation needs, and route tasks to the right staff—for example, trigger alerts for any claim that’s unpaid after 45 days.

Track Proof of Timely Submission

Especially important for out-of-network or paper-submitted claims. Always retain submission receipts, delivery confirmations, or screenshots from the payer portal as proof of submission. This protects you during appeals or audits if the payer denies a claim for being “late.”

Medheave ensures you never miss a filing deadline and gets you paid faster.

- Payer-Specific Timelines Built-In: We load payer rules directly into your workflow. No guesswork, no missed cutoffs.

- Medicaid State Tracking: Every state has its own rules. We track all 50 states’ programs and adjust automatically.

- Real-Time Alerts: Claims getting close to the deadline? Our system flags them. Missing a doc? You’ll know instantly.

- Appeal Tracking: From Medicare redeterminations to state Medicaid appeals, we track every deadline, every level, and every document.

Want peace of mind? Claim your FREE revenue cycle assessment today.

Frequently Asked Questions (FAQs)

What is a timely filing limit, and why does it matter?

A timely filing limit for claims is the maximum amount of time a provider has to submit a claim to an insurance payer after a service is rendered. If the claim is submitted after that deadline—even by a day—it will be denied without payment, regardless of the service’s validity. These limits vary by payer (e.g., Medicare = 12 months; Cigna = 90 days), and missing them can lead to permanent revenue loss.

What happens when you miss a claim filing deadline?

Missing the deadline results in:

- Automatic denial of the claim

- Lost revenue (no reimbursement for the service)

- Increased admin work due to appeals and rework

- Unsuccessful appeals in most cases

- Cash flow disruptions and potential audit risks

In short, missing a deadline can have a severe impact on your bottom line.

How do claim filing limits differ between in-network and out-of-network providers?

Yes, they differ significantly:

- In-network providers typically have 90–180 days to file, with claims tracked electronically.

- Out-of-network providers may get up to 365 days, but must submit proof of timely mailing, patient eligibility, and delivery confirmation.

- Out-of-network claims are subject to stricter documentation requirements.

What’s the difference between a claim filing limit and a claim appeal timeline?

- A claim filing limit is the deadline to submit the original claim, based on the date of service (e.g., 90–180 days).

- A claim appeal timeline is the deadline for appealing a denied claim, based on the date of notification of denial (typically 30–60 days).

Missing the filing limit = no payment.

Missing the appeal window = denial becomes final.

How can I prevent timely filing denials in 2025?

Use this 5-step playbook:

- Verify eligibility upfront to avoid delays later.

- Use claim scrubbers to catch errors before submission.

- Set internal deadlines earlier than payer limits (e.g., Day 75 for a 120-day deadline).

- Automate follow-ups to track aging claims and ensure missing documents are addressed.

- Store proof of submission for every claim, especially those involving paper or out-of-network services.

- Utilizing tools such as Electronic Health Records (EHRs) and Patient Management Systems (PMS) ensures that these steps are seamlessly integrated into your workflow.