The medical billing process from start to end can be confusing, especially when you encounter terms like “ABN” (Advance Beneficiary Notice). While this might sound like just another piece of paperwork, understanding what ABN is in medical billing and why it’s essential can make a significant difference in how healthcare providers manage their billing and how it impacts patients and healthcare providers financially.

At its core, the ABN helps clarify the financial responsibilities of both the healthcare provider and the patient when it comes to services that Medicare may not cover. It’s not a “denial notice” but rather a heads-up that a service may not be fully covered. This proactive approach helps patients avoid surprise bills and ensures that providers can manage their revenue cycle effectively.

Let’s understand ABN in medical billing in detail and learn how it works for patients and providers while dealing with Medicare’s billing aspects.

What Is an Advance Beneficiary Notice (ABN)?

An Advance Beneficiary Notice (ABN) is a notice that healthcare providers give to patients when Medicare might not cover a particular service or procedure.

Essentially, it’s a written notice that warns patients about the potential for Medicare to deny coverage. This is not a bill but rather an informational document that helps patients make more informed decisions about their healthcare.

What is the ABN Form?

The ABN form is a Medicare form that you can use to send the notice to the payor. ABN is a standard government form CMS-R-131, also known as a waiver of liability.

Here is a Sample of the Medicare ABN form for commercial insurance used by providers:

Why Medicare Requires ABNs

Medicare, the government-run health insurance for seniors above the age of 65 and some disabled individuals, covers a wide range of services, but not everything. Medicare wants to ensure that beneficiaries know up front whether a particular service might not be covered.

An ABN is a way to fulfil that transparency, allowing patients to decide whether to go forward with the service despite the potential cost.

Key Points to Remember About ABNs:

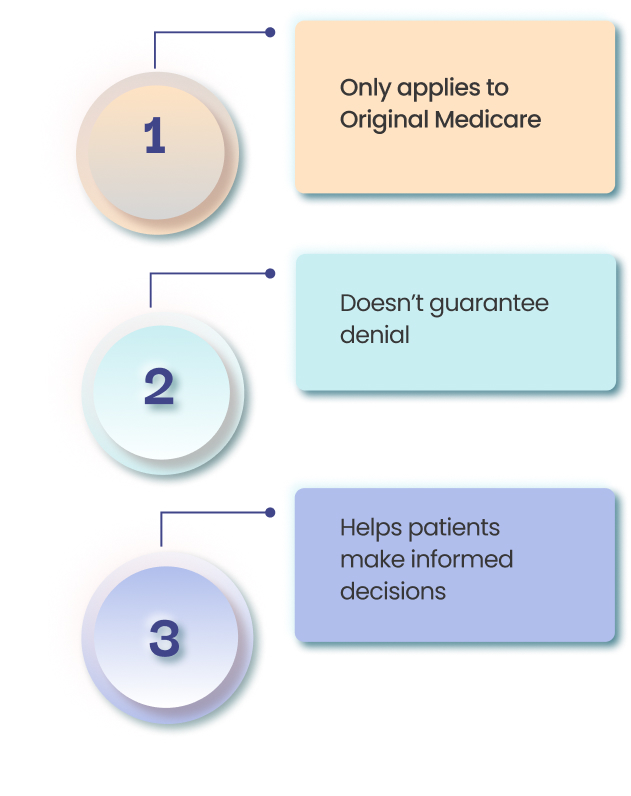

Only applies to Original Medicare:

As a provider, you must remember that ABNs only apply to beneficiaries enrolled in Original Medicare (Parts A and B). They do not apply to patients with Medicare Advantage Plans, which private insurance companies manage.

Doesn’t guarantee denial: Receiving an ABN doesn’t mean Medicare will definitely deny the claim, but it serves as a warning that it could happen.

Helps patients make informed decisions: By knowing about the possibility of non-coverage, patients can decide whether to proceed with the service and take on the potential financial burden or choose alternative options.

When is an ABN Required?

There are a few situations when an ABN is required. As a medical practice, you must have to know these crucial situations to avoid claim denials and payment delays.

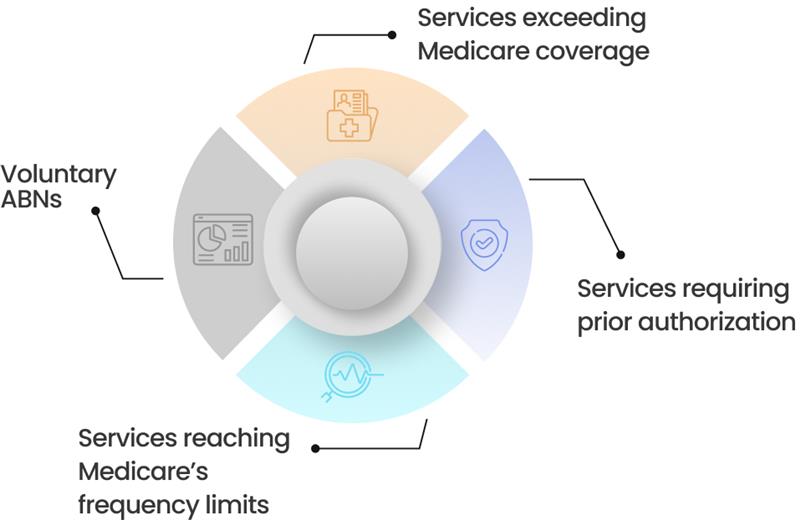

These situations are:

Services exceeding Medicare coverage

As a provider, you are required to utilize ABN when services exceed Medicare coverage. Here, you may be confused about what it means. This usually means a service that Medicare may not cover. For instance, if a patient opts for a cosmetic procedure like Botox or elective surgery that Medicare doesn’t cover, an ABN is required.

Services requiring prior authorization

You know very well that some services may require prior approval from Medicare before coverage is granted. If a provider can’t get prior authorization or expects it to be denied, they may issue an ABN.

Services reaching Medicare’s frequency limits

For example, Medicare limits certain services, like physical therapy or durable medical equipment, to specific quantities within a particular time frame. If a patient exceeds these limits, an ABN might be issued.

Voluntary ABNs

Sometimes, even when Medicare coverage is expected, a provider might issue an ABN to clarify cost-sharing details, particularly if the patient is responsible for a co-payment, co-insurance, or deductible.

A properly completed ABN form contains key pieces of information to ensure clarity for both the patient and the provider:

Provider Information

This includes the provider’s name, address, and contact details so patients know where to turn for more information.

Patient Information

The patient’s name, Medicare ID, and contact details are essential so that the notice is tied to the correct individual.

Description of the Service

A detailed description of the service or item that Medicare could deny should be included.

Reason for Potential Non-Coverage

The provider must explain why they believe Medicare might not cover the service.

Estimated Cost

The patient needs to understand how much they might be charged if Medicare refuses to pay for the service.

Patient’s Choice Acknowledgment

The patient needs to acknowledge whether they are accepting or rejecting the service after receiving the ABN, which helps ensure that their decision is clear.

How Does an ABN Protect Healthcare Providers?

An ABN provides healthcare providers with several protections:

- Prevents financial losses: If Medicare denies a claim, the provider has an opportunity to collect payment from the patient. The ABN is the documentation that informs the patient of their financial responsibility.

- Ensures transparency: By issuing an ABN, the provider is ensuring the patient understands that there’s a possibility they will have to pay out-of-pocket.

- Reduces claim denials: Issuing an ABN properly can help avoid unexpected claim denials, which might otherwise result in delays or non-payment.

- Improves revenue cycle management: When patients are aware of their financial obligations, providers can manage billing and payments more efficiently.

Patient Understanding and the Role of ABNs

How ABNs improve transparency in patient care.

ABNs are crucial for ensuring that patients understand their financial responsibilities. This transparency helps avoid confusion when Medicare does not cover a service. It also ensures that patients know they can appeal Medicare’s decision if they feel the service should be covered.

How to Explain an ABN to a Patient

When explaining an ABN to a patient, it’s essential to be clear and empathetic. Here’s how you might approach the conversation:

- Explain the purpose: Let the patient know that the ABN is not a bill but a notification to inform them about potential non-coverage.

- Discuss alternatives: Provide the patient with alternative options, whether it’s a different service or even paying out-of-pocket.

- Encourage questions: Patients may have concerns, so make sure they feel comfortable asking questions and ensure they understand their choices.

Patient Rights in Medicare Claim Appeals

If Medicare denies a claim, patients have the right to appeal the decision. They can provide additional information, request a re-evaluation, or even have a hearing. Patients need to have the proper documentation, such as an ABN, to support their case in the appeal process.

ABN Modifiers and Their Role in Billing

Several ABN modifiers are used during the billing process. These modifiers help clarify the status of a service:

- GA: Used when the provider expects Medicare to deny the service and has issued an ABN.

- GX: Used when the provider believes the service is statutorily excluded from Medicare coverage and the ABN is issued.

- GY: Indicates that Medicare does not cover the service, but the provider has informed the patient of the non-coverage.

GZ: This shows that the provider performed a service despite knowing it would not be covered, and an ABN was not issued.

ABN vs. ACN (Advance Coverage Notification)

The ABN (Advance Beneficiary Notice) and the ACN (Advance Coverage Notification) are both essential documents used in medical billing, but they serve different purposes and are used in various situations.

Here are some significant differences between the two and when each document is required.

ABN (Advance Beneficiary Notice):

- Purpose:

- The ABN is used to inform Medicare beneficiaries that Medicare may not cover a particular service or item, and they may be required to pay for the service out-of-pocket. It is typically used when the healthcare provider believes that Medicare may deny payment for a service or item.

- The ABN serves as a warning to the patient that Medicare may not pay, and they may be financially responsible for the cost if Medicare does not cover the service.

- Used By:

- Used mainly by Medicare providers.

- Impact on the Patient:

- The patient is informed in advance about the possibility of paying out-of-pocket. They have the option to accept or decline the service, and if they choose to receive it, they may be responsible for payment.

- Example:

- A patient needing a specific diagnostic test, such as a genetic test, may receive an ABN if the provider believes that Medicare might not cover it, depending on the patient’s medical history or current coverage.

ACN (Advance Coverage Notification):

- Purpose:

- The ACN is used in situations where Medicare may deny a service or item, but this time, the notice is sent to inform the patient about coverage requirements and options before the service is provided. It is meant to notify the patient that certain conditions or coverage rules need to be met for Medicare to approve the service.

- The ACN typically indicates that a service may require prior approval or that certain conditions must be met for Medicare to provide coverage. It might also suggest that a service is conditionally covered based on specific criteria.

- Used By:

- Used by Medicare Advantage plans or private insurers working with Medicare, and sometimes by providers offering services that require pre-authorization from Medicare.

- Impact on the Patient:

- The patient is notified of the conditions under which Medicare coverage might apply and is often provided with instructions on how to ensure coverage (e.g., meeting specific medical necessity requirements or obtaining pre-authorization).

- The patient may still be responsible for certain out-of-pocket costs or may need to take action to meet requirements for Medicare approval.

- Example:

- A patient needing a specific surgery may receive an ACN if their Medicare Advantage plan requires prior approval for the surgery. The ACN will detail the necessary steps to take for coverage approval.

When Each Document is Required

ABN (Advance Beneficiary Notice):

- When to Issue:

- When the healthcare provider suspects that Medicare may not cover a service or item.

- The ABN must be given before the service is provided to the patient (at least advance notice) so they can make an informed decision about whether to proceed with the service.

- Examples of Situations:

- When a non-covered service (such as a cosmetic procedure) is performed, the provider knows that Medicare will not pay.

- When a service is deemed not medically necessary by Medicare, but the provider believes it is essential for the patient’s care.

ACN (Advance Coverage Notification):

- When to Issue:

- When a Medicare Advantage plan or Medicare private insurer requires prior approval or a specific notification process before a service is covered, this includes situations where services are conditional based on meeting specific criteria.

- Typically required before a service that needs pre-authorization can be performed.

- Examples of Situations:

- A Medicare Advantage plan may require prior approval before approving coverage for an MRI, and the ACN will notify the patient about the steps to take to secure approval.

- Services that are only covered under certain conditions (e.g., durable medical equipment or specific procedures) may require an ACN to inform the patient of the coverage process.

ABN Vs CAN: Major Differences

| Feature | ABN (Advance Beneficiary Notice) | ACN (Advance Coverage Notification) |

| Purpose | Inform the patient that Medicare may not cover a service. | Inform the patient of conditions required for Medicare coverage or pre-authorization. |

| Used By | Medicare providers (original Medicare). | Medicare Advantage plans or private Medicare insurers. |

| When Required | When a provider believes Medicare may not cover a service or item. | When services require prior approval or coverage conditions. |

| Impact on Patient | Patients may need to pay out-of-pocket if Medicare denies coverage. | The patient is informed about coverage requirements or pre-authorization needed. |

| Example | Non-covered services like cosmetic surgery or unnecessary treatments. | Pre-authorization is required for specific procedures like MRIs. |

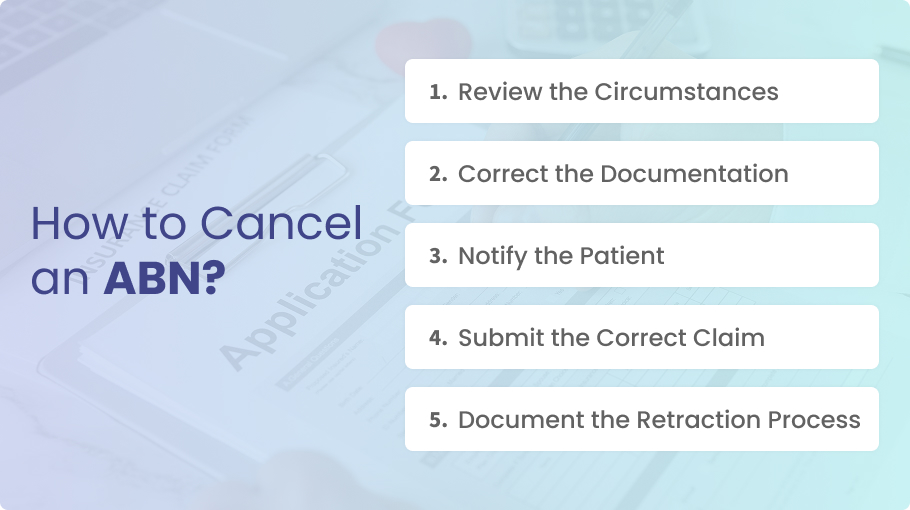

How to Cancel an ABN?

If you need to cancel an ABN or retract it, or if you’re dealing with patient disputes, here’s how to approach each scenario:

Review the Circumstances

- Verify that the ABN was issued erroneously. Sometimes, the service might not be covered by Medicare, which is why the ABN should stand.

- Ensure that there’s no misunderstanding regarding the patient’s eligibility or Medicare’s coverage guidelines.

Correct the Documentation

- If the ABN was issued incorrectly (for example, when the service is actually covered), you may need to update the patient’s records to reflect the accurate information.

- Inform the patient that the ABN was issued in error. Be clear about why it was issued, why it was incorrect, and what the correct process is.

Notify the Patient

- Send a written notification to the patient stating that the ABN is no longer valid. This should be done promptly to avoid confusion.

- Provide the patient with details about why the original ABN was retracted and explain the revised billing information.

Submit the Correct Claim

- Once you have retracted the ABN, proceed with submitting the claim to Medicare as usual. Ensure that the claim is submitted with accurate coding and documentation.

- Medicare will then review the claim, and if it’s covered, it will pay according to the guidelines.

Document the Retraction Process

- Keep detailed notes in the patient’s file about why the ABN was withdrawn. This can help in case of future audits or disputes.

How to Handle Patient Disputes Regarding an ABN

Patients might dispute the ABN because they feel they should not have to pay for the services rendered or they believe the ABN was issued unfairly. Here’s how to manage such disputes:

Address the Patient’s Concerns

Review the situation thoroughly to understand why the patient is disputing the ABN. It’s important to acknowledge their concerns and listen carefully.

Explain why the ABN was issued (e.g., Medicare might not cover certain items or services, and you were letting them know about potential out-of-pocket costs).

Educate the Patient

Provide a clear explanation of Medicare’s rules and the rationale behind issuing an ABN. Educate the patient about what services are typically covered and under what circumstances they may not be covered.

If the ABN was issued due to medical necessity or service limitations, make sure the patient understands those details.

Offer Financial Options

If the patient insists on not paying for the service, offer financial assistance options such as payment plans, charity programs, or other available support services.

Sometimes, a payment negotiation or financial assistance program can resolve the dispute amicably.

Appeal Process

If the patient still disagrees with the ABN, explain the Medicare appeals process. If they receive a bill and disagree with it, they can appeal through Medicare.

Provide the patient with the contact information for Medicare’s beneficiary helpline if they need further assistance with the appeal.

Resolve Through Clear Communication

Keep communication open and transparent with the patient. Having a written policy for how ABNs are issued and when patients should expect to receive them can help prevent disputes in the future.

Sometimes, patients may misunderstand the language used in the ABN, so clarifying the wording may help resolve confusion.

The Appeals Process for Medicare Denials

The appeals process for Medicare denials allows beneficiaries to challenge Medicare’s decision when they believe that a claim was incorrectly denied or that they are entitled to coverage for a service or item.

Before proceeding to the appeal process, let’s have a look at the patient’s rights in this regard:

Patient Rights in Case of Coverage Denial

Medicare beneficiaries have several rights when it comes to challenging a denial of coverage. These include:

Right to Receive a Written Notice

When Medicare denies coverage, the patient is entitled to receive a denial notice from their provider or Medicare. This notice explains why the service or item was not covered and may include the specific codes or reasons for the denial.

Right to Appeal

The patient has the right to formally appeal the decision if they disagree with the coverage denial. The appeal process is designed to allow patients to present their case and request a review of the decision.

Medicare provides a structured process that allows for several levels of appeal if necessary.

Right to Representation

Patients have the right to appoint someone (such as a family member, friend, or attorney) to act on their behalf during the appeal process. This is important if the patient is unable to handle the appeal themselves.

Right to Timely Decisions

Medicare is required to process appeals within a set time frame. Beneficiaries should expect decisions in a timely manner, and they can request expedited appeals if necessary (for example, in cases involving urgent medical needs).

Steps for Submitting a Medicare Appeal

If a Medicare claim is denied, the beneficiary has the right to appeal. The appeal process is broken down into five levels:

Step 1: Review the Denial Notice

- First, the patient should carefully review the denial notice to understand why the claim was denied. The notice should explain the specific reason for the denial (e.g., non-coverage of the service, lack of medical necessity, or coding issues).

Step 2: Request Reconsideration

- Reconsideration is the first level of appeal. The patient can submit a request for reconsideration through their Medicare plan or the contractor handling the claim (usually a Medicare Administrative Contractor or MAC).

- Time frame: A request for reconsideration must typically be submitted within 120 days of receiving the initial denial.

- How to file: A patient (or their representative) should submit a written request, including relevant details like the patient’s information, date of service, and explanation of why the denial should be overturned.

Step 3: Administrative Law Judge (ALJ) Hearing

- If the reconsideration is denied, the patient can request a hearing before an Administrative Law Judge (ALJ). This is the second level of appeal and usually involves a hearing where the patient can present their case.

- The ALJ will review the evidence and make a determination.

- Time frame: A request for a hearing must be made within 60 days of receiving the reconsideration decision.

Step 4: Medicare Appeals Council Review

- If the ALJ decision is unsatisfactory, the patient can request a review by the Medicare Appeals Council.

- This is the fourth level of the appeal process, and the Appeals Council reviews the case to ensure the decision is in accordance with Medicare regulations.

Step 5: Federal Court Review

- If all other levels of appeal are exhausted and the patient still believes the denial was incorrect, the final level is a federal court appeal. The patient can file a lawsuit in federal district court.

- Time frame: This must be filed within 60 days of receiving the decision from the Medicare Appeals Council.

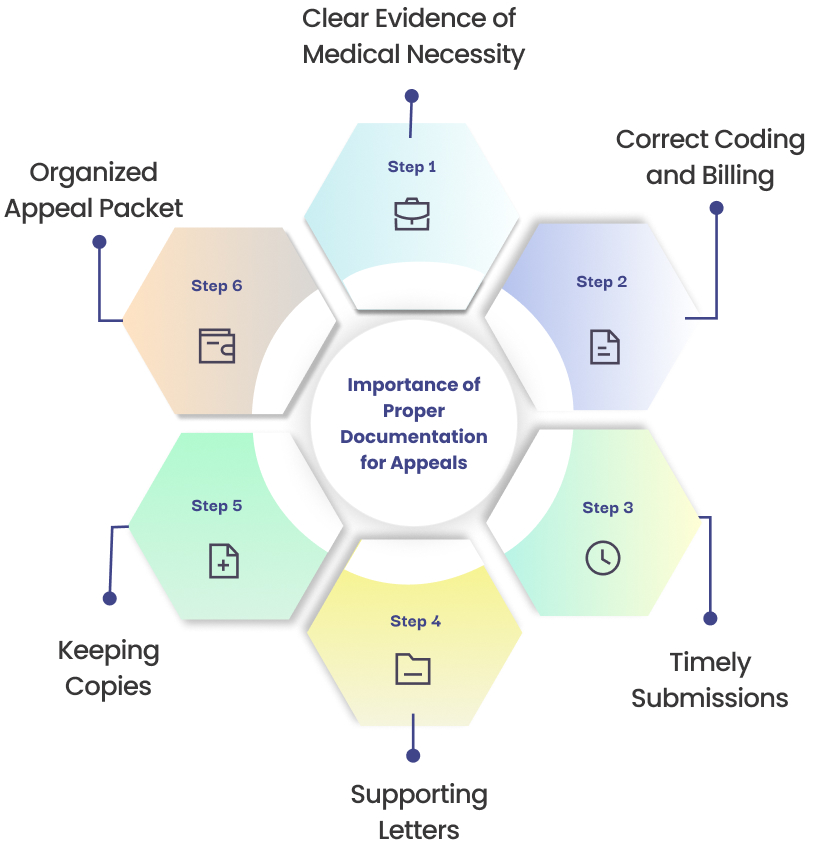

Importance of Proper Documentation for Appeals

Proper documentation is critical for the success of any Medicare appeal. The more thorough and clear the documentation, the better the chance of a successful appeal. Here’s why it’s so important:

Clear Evidence of Medical Necessity

For many Medicare denials, especially those involving medical services or items, the primary reason for denial is that Medicare deems the service not medically necessary. Providers should include detailed documentation that clearly shows the medical necessity of the service. This could include:

- Physician notes and detailed patient history

- Test results, imaging, or any other supporting medical documents

- Prior authorizations (if applicable)

Correct Coding and Billing

Denials often occur due to coding errors (incorrect ICD-10 codes, modifiers, or CPT codes). Ensuring that the appeal includes the correct codes and detailed billing information is crucial. This will demonstrate that the claim was correctly submitted, but Medicare’s coverage determination was wrong.

Timely Submissions

Documentation must be submitted on time in order to meet the appeal deadlines. Keep track of all deadlines and ensure that you submit any supporting documents before the deadline.

Supporting Letters

If applicable, include letters of support from treating physicians or specialists who can help clarify the necessity of the treatment or service. Having multiple experts in support of the appeal can strengthen the case.

Keeping Copies

Always keep copies of all correspondence, forms, documents, and evidence submitted. These copies are essential for tracking the progress of the appeal and providing any necessary information at subsequent levels of the appeal process.

Organized Appeal Packet

Organize the appeal packet in a clear and logical order, with a cover letter explaining the reason for the appeal, all supporting documentation, and any additional evidence that can help your case.

Conclusion

ABNs are a critical tool in the world of medical billing, ensuring that patients are informed about the potential costs of their healthcare.

These notices foster transparency, help prevent unexpected financial burdens, and protect healthcare providers from financial losses.

Healthcare providers should be diligent in issuing ABNs when necessary and always ensure they’re completed correctly to benefit both parties.

By understanding ABNs and their role in medical billing, both providers and patients can better navigate Medicare’s sometimes complex coverage decisions.

Frequently Asked Questions (FAQs)

What does ABN stand for in billing?

ABN stands for Advance Beneficiary Notice, a document that informs patients about the possibility of Medicare not covering certain services.

What is ABN in medical terms?

An ABN is a notice issued by healthcare providers to patients informing them that Medicare might not cover a particular service.

What is the function of the ABN?

The function of an ABN is to notify patients about potential non-coverage of a service by Medicare, allowing them to make informed financial decisions.

Why is ABN required?

ABNs are required to ensure that patients are aware of potential financial responsibility for services not covered by Medicare.

What is an ABN modifier?

An ABN modifier is a code used to indicate the status of a service in relation to Medicare coverage, such as GA, GX, GY, and GZ.

What is the ABN form in medical billing?

The ABN form is the document given to patients, explaining the potential non-coverage of a service and the estimated cost.

What is ACN?

An Advance Coverage Notification (ACN) is similar to an ABN, but it’s used for services where Medicare coverage is uncertain.

How do I cancel an ABN?

To cancel an ABN, the provider must inform the patient that the notice is no longer valid, often due to coverage changes or errors in the original notice.