If you’re a physician, nurse practitioner (NP), physician assistant (PA), medical practice manager, compliance officer, or medical biller, incident-to billing is a topic you can’t afford to ignore.

If it is done right, it boosts Medicare reimbursement.

On the flip side, if done wrong, it risks compliance issues and Office of Inspector General (OIG) audits.

In addition to this, it can cause frustration among the providers due to revenue drains.

So, it is super crucial for healthcare providers and medical practices to understand the ins and outs of Medicare incident to billing.

Let’s walk through the Medicare incident to billing, why it matters, and CMS guidelines, etc.

What Is Incident To Billing?

Providers need to have a clear understanding of incident-to billing before entering the practical process.

Here’s the incident-to-billing definition, and from where this idea originates. And, when healthcare practices usually utilize it in the revenue cycle process.

Definition: According to Medicare

According to CMS:

Incident to billing Medicare means a service provided by a non-physician practitioner (NPP)—such as an NP or PA—that is billed under a physician’s Medicare Part B number for 100% reimbursement instead of the reduced 85% NPP rate. This applies only when the Medicare incident-to rules are met.

Origin in CMS Guidelines

The term comes from the Centers for Medicare & Medicaid Services (CMS) language, where certain services are considered “incident to” a physician’s professional services when they are part of the physician’s plan of care for an established patient.

In simple words, the Incident to billing allows non-physician practitioners (NPPs) to bill services as if a physician performed them.

This provision enables NPPs to receive reimbursement at the full fee schedule value, provided they meet specific requirements, such as direct supervision by a physician.

According to CMS incident-to billing guidelines, services must be integral parts of the physician’s professional services during diagnosis and treatment, and they must comply with applicable state laws.

Examples of Proper Incident To Billing

- Office visit follow-ups for stable chronic conditions.

- Chronic disease management visits are part of the physician’s ongoing plan.

- Post-procedure care is initiated and managed by the physician.

When to Use Incident To Billing

You use it when an NPP sees a patient for office-based services under a plan initiated by a physician, and the direct supervision requirement is met. This is often in follow-up care for an established diagnosis.

Incident to billing for new patients:

If the patient is new to the practice or hasn’t been seen by the supervising physician (or another physician of the same specialty in the group) within the last three years, you cannot bill Incident to.

- Even if an NP or PA sees the patient and the physician is onsite, the visit must be billed under the NPP’s NPI at the 85% rate.

- Why? Because there’s no established diagnosis or physician plan of care yet. The physician must first perform the initial visit and set that plan before any follow-up can qualify.

Established Patients — When Incident to Works

- The patient has been seen by the physician for the same condition before.

- The physician created a documented plan of care for that condition.

- The NPP is providing follow-up care that sticks to that plan—no significant changes, no new diagnoses.

- The direct supervision requirement is met: the physician is physically present in the office suite and immediately available during the visit.

Established Patients With New Problems

- If an established patient presents with a new problem that requires a new treatment plan, you can’t bill Incident to unless the physician personally sees the patient for that new issue and updates the plan during the visit.

- Without that physician involvement, the NPP must bill directly.

| Patient Type | Visit Scenario | Billing Method |

| New patient | Any reason | Direct bill under NPP |

| Established | Follow-up, no changes to plan | Incident to |

| Established | New problem, physician updates plan in person | Incident to |

| Established | New problem, physician not involved | Direct bill under NPP |

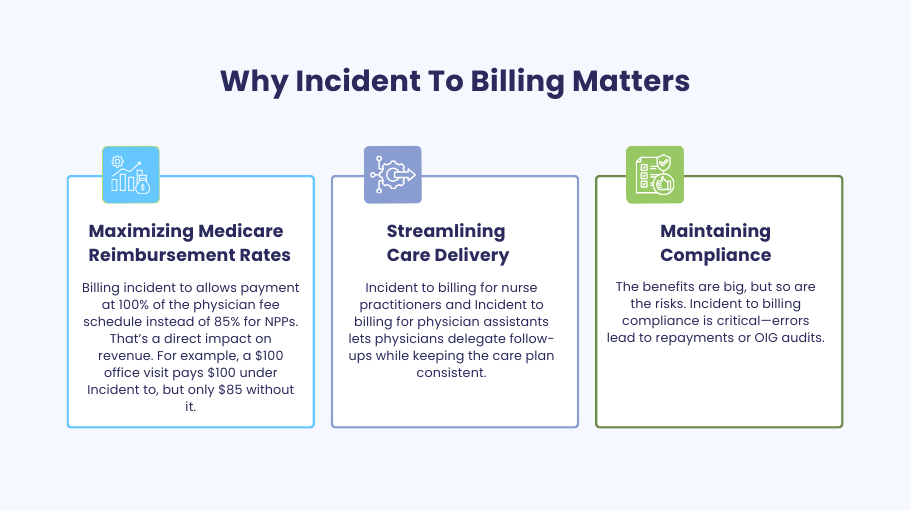

Why Incident To Billing Matters

Maximizing Medicare Reimbursement Rates

Billing incident to allows payment at 100% of the physician fee schedule instead of 85% for NPPs. That’s a direct impact on revenue. For example, a $100 office visit pays $100 under Incident to, but only $85 without it.

Streamlining Care Delivery

Incident to billing for nurse practitioners and Incident to billing for physician assistants lets physicians delegate follow-ups while keeping the care plan consistent.

Maintaining Compliance

The benefits are big, but so are the risks. Incident to billing compliance is critical—errors lead to repayments or OIG audits.

Incident to Billing Requirements

To bill Incident to Medicare at 100% of the physician fee schedule, you must meet all of these requirements every time: supervision, established patient status, active physician involvement, and airtight documentation. Missing even one turns it into a direct NPP bill at 85%.

Direct Supervision Rule Explained

The billing physician must be physically present in the office suite and immediately available to step in if needed.

This is a Medicare incident-to rule designed to ensure patient safety — if something goes wrong, the physician can intervene immediately.

- Not required: Being in the same exam room.

- Not allowed: Being offsite, “available by phone,” or in another building.

Any physician in the same group and specialty can provide the direct supervision, not just the one who initiated the care plan, as long as they meet the incident-to-supervision rules.

Established Patient & Treatment Plan

The physician must personally see the patient at the initial visit for the specific problem, perform the evaluation, and create a physician plan of care.

NPPs (nurse practitioners, physician assistants, etc.) can provide care incidentally only if they are following that established plan without significant changes.

Initial vs follow‑up care:

- Initial visit → Direct physician billing only.

- Follow‑up care for an established diagnosis → May qualify for Incident to billing if all other requirements are met.

Physician Involvement in Care

The physician’s role doesn’t end after the first visit. They must remain actively involved in the patient’s ongoing management.

This means:

- Reviewing progress notes.

- Adjusting the plan when medically necessary.

- It is essential to see the patient periodically to confirm that the care plan is still appropriate.

CMS incident to billing guidance stresses that the physician’s ongoing participation must be clear in the record — not just implied.

Documentation Requirements

Documentation plays a key role in incident-to billing. Providers must include everything in the chart to keep it as a record:

What to include in the chart:

- The established diagnosis.

- The physician created the original plan of care.

- Evidence that the service provided was part of that plan.

- Proof that the direct supervision requirement was met (e.g., note that the supervising physician was onsite).

According to the Office of Inspector General (OIG), missing or vague documentation is one of the top reasons incidents fail to meet billing compliance.

Use a standard template for Incident to billing documentation requirements so every provider captures the same key elements.

CMS Guidelines and Medicare Rules

Medicare Part B Eligibility

Only Medicare Part B patients qualify for incident-to billing. This is a core rule under Medicare incident to regulations.

Patients must be enrolled in Medicare Part B, which covers outpatient services, physician visits, preventive care, and certain medical supplies.

Medicaid, Medicare Advantage, and commercial payers have different policies. Even if they allow similar billing structures, their requirements may differ from CMS’s billing guidelines.

Always verify the patient’s coverage before applying the Incident to billing Medicare rules to avoid claim denials.

Covered Services Under Incident To

- Covered:

- Office-based services that are part of an established physician plan of care.

- Certain chronic disease management visits, such as hypertension or diabetes follow-ups, that are eligible for billing are considered Incident to billing requirements when all are met.

- Post-procedure follow-ups involve the physician initiating the care plan and remaining actively involved.

These services must:

- Be for an established patient.

- Follow the direct supervision requirement — physician present in the office suite and immediately available.

- Stay within the NPP’s scope of practice and comply with state-specific scope laws.

If all conditions are met, these services can be billed under the physician’s NPI for 100% of the Medicare Physician Fee Schedule.

Non-Covered Services

Not covered under Incident to billing:

- Services for new patients — these must be billed directly under the NPP’s NPI at 85% reimbursement.

- Visits addressing new problems for established patients are only necessary if the physician personally evaluates the latest issue and updates the plan of care during the visit.

- Services outside the NPP’s scope of practice under state-specific scope laws — even if the physician is onsite.

Attempting to bill these as Incident to services, Medicare can trigger Incident to billing compliance issues and potential OIG.

Common Mistakes in Incident To Billing

Avoiding these errors is critical to staying within Medicare incident to rules and CMS incident to billing compliance:

Billing for new patients under the Incident to

- Medicare incident to rules prohibit billing initial visits or new problems under the physician’s NPI.

- These must be billed directly under the non‑physician practitioner (NPP) — e.g., Incident to billing for nurse practitioners or Incident to billing for physician assistants — at an 85% Medicare reimbursement incident to rate.

Physician not present per direct supervision requirement

- Incident to supervision rules require the supervising physician to be physically present in the office suite and immediately available during the face‑to‑face encounter.

- Remote availability (phone only) does not meet Incident to billing requirements, except in limited Incident to billing for telehealth scenarios allowed by the Centers for Medicare & Medicaid Services (CMS).

Incomplete documentation

- Missing details on the physician plan of care, supervision, or established diagnosis can cause denials.

- Follow Incident to billing documentation requirements: note physician involvement, care plan, and CPT/HCPCS codes.

Billing services outside the NP or PA scope of practice

- Only bill incident to services Medicare if they are within the NPP’s scope of practice under state-specific scope laws and Medicare incident to rules.

Incident To vs Split/Shared Billing

Examples in Primary Care

Incident-To Example

- A nurse practitioner sees a patient for hypertension follow-up. The physician previously established the diagnosis and treatment plan. The physician is present in the office suite during the visit. → Bill under the physician’s NPI at 100%.

Split/Shared Example

- In a hospital setting, a physician and a PA both evaluate a patient with pneumonia. The PA documents history and exam; the physician performs the MDM. → Bill under the physician’s NPI if they performed the substantive Portion (e.g., MDM or the majority of the time)3.

Medicare Rule Comparisons

Incident-To Billing Rules

- Must be part of a physician’s established plan of care.

- A physician must be present in the office suite.

- This is not allowed for new patients or new problems.

- Services must be provided by employees or contracted staff.

- Cannot be used in facility settings.

Split/Shared Billing Rules

- Applies only in facility settings.

- Both providers must document their contributions.

- Substantive Portion is defined as more than half of the total time or key MDM elements.

- Modifier FS required on claims.

- As of 2024, CMS clarified that either time or MDM may be used to determine the billing provider.

Here’s a Quick Comparison Table

| Feature | Incident-To Billing | Split/Shared Billing |

| Setting | Office/Home | Hospital/Facility |

| Who Performs | NPCs or staff under MD | MD and NPP jointly |

| Supervision Required | MD must be present | Both must contribute |

| New Patients/Problems | Not allowed | Allowed |

| Billing Rate | 100% under MD | 100% MD / 85% NPP |

| Substantive Portion | Not applicable | Time or MDM-based |

Compliance and Audit Protection

OIG’s Role in Monitoring

- The Office of Inspector General (OIG) actively audits for incident to billing compliance issues.

- High‑risk areas: supervision lapses, improper incident to billing examples, and missing documentation.

Documentation Best Practices

- Always record:

- Physician plan of care and ongoing involvement.

- Direct supervision requirement met.

- Face-to-face encounter details.

- Use correct CPT/HCPCS codes and link to established diagnosis.

Staff Training and Policies

- Train qualified healthcare professionals — NPPs, physicians, billers — on CMS incident to billing rules.

- Maintain written incident to billing guidelines and workflow checklists.

State-Specific Considerations

NP/PA Supervision Rules

- State-specific scope laws define supervision levels for incident to billing for nurse practitioners and incident to billing for physician assistants.

- Some states require formal collaboration agreements; others allow broader autonomy.

Scope of Practice Alignment

- Only bill incident to services Medicare if the service is within both state law and Medicare incident to rules.

- Misalignment can trigger incident to billing compliance audits.

How a Medical Billing Company Can Help

Partnering with a specialized medical billing company like Medheave can transform how your practice navigates complex Medicare billing rules, especially around Incident-To services.

Here’s how:

- Ensure Correct Coding & Billing: Expert coders stay current with CMS guidelines to ensure every Incident-To service is billed accurately and compliantly.

- Prevent Audits with Proactive Compliance: Checks Through regular documentation reviews and workflow audits, a medical billing provider helps practices avoid costly errors and regulatory scrutiny.

- Maximize Revenue Cycle Performance: By identifying and capturing all eligible Incident-To opportunities, a billing services company boosts your Medicare reimbursements—without increasing workload.

Final Thoughts

Medicare billing isn’t just a box to check—it’s a strategic part of your practice’s success.

With complex rules around Incident-To and Split/Shared services, even small missteps can lead to lost revenue or unwanted audits.

As providers uncover hidden revenue opportunities, tighten up documentation, and stay ahead of regulatory changes.

Ready to take the guesswork out of Medicare billing?

Let Medheave handle the complexity—so you can focus on care, not codes.