Credentialing, contracting, and paneling all seem like steps in the same process, but they have distinct roles, and missing one of them can delay your ability to get paid, leave you off important provider lists, or create unnecessary financial headaches.

Imagine you’re a licensed therapist, ready to expand your practice and help more clients.

You know that insurance companies are a major source of client referrals, but when you start the process of joining insurance networks, you quickly get bogged down by confusing paperwork and terms that seem to overlap.

- Credentialing is about proving you’re qualified to provide services.

- Contracting is negotiating your terms and fees with the insurance company.

- Paneling is what allows you to officially be listed as a provider in the network, enabling clients to use their insurance benefits to pay you.

Each step is critical to ensure that you get reimbursed on time, attract more clients, and avoid costly delays or denials.

In this article, we’ll break down the differences between credentialing, contracting, and paneling, explain how they connect.

Consider a therapist completes credentialing with Aetna but doesn’t realize they still need to sign a contract before they can be paneled.

They keep seeing clients, submit claims, and wonder why payments are delayed—only to find out they were never officially in-network.

Professionals need to understand the differences between all three terms. Otherwise, things can go against them.

Because lack of knowing these terms may lead to consequences like:

Delayed or Denied Reimbursements

Insurance companies won’t pay until you’re fully credentialed and contracted.

Example: A LCSW submits claims to Cigna but hasn’t finished the credentialing process for mental health providers—resulting in months of unpaid sessions.

Fewer Clients & Referrals

If you’re not paneled, clients using insurance won’t find you in their insurer’s directory.

Example: A psychologist specializing in trauma isn’t listed in Medicare’s provider network, so potential clients go to in-network providers instead.

Administrative Headaches

Each insurer (Aetna, UnitedHealthcare, Medicaid) has different rules. Missing a step means rework.

Example: A group practice forgets to update their CAQH profile, delaying their contracting with insurance companies for months.

- Out-of-Network vs. In-Network: If you skip paneling, you can still bill insurance, but reimbursement rates are lower, and clients pay more out-of-pocket.

- Cash Flow Disruptions: Waiting 90+ days for credentialing means no insurance payments during that time.

- Lost Opportunities: Many clients filter searches for in-network providers only—so if you’re not paneled, you miss out on referrals.

Credentialing is the process where insurance companies verify your professional qualifications. Think of it as a background check for healthcare providers.

Who’s Involved?

- You (the provider).

- Insurance companies (Blue Cross Blue Shield, Aetna, Cigna, Medicare/Medicaid).

- CAQH (Council for Affordable Quality Healthcare) – A central database where insurers pull your info.

- Your state licensing board (to confirm your license is active).

What You’ll Need:

- NPI (National Provider Identifier) – Your unique ID for billing.

- State license & DEA (if applicable).

- Malpractice insurance.

- CAQH profile (must be kept updated).

How Long Does It Take?

Typically, 90-180 days (yes, really). Some insurers move faster than others.

Once you’re credentialed, contracting is where you negotiate terms with the insurance company. This includes:

- Fee schedules (how much you’ll get paid per session).

- Timely filing limits (how long you have to submit claims).

- Compliance rules (HIPAA, CMS regulations).

Key Questions to Ask:

Is this fee schedule negotiable? (Sometimes, yes—especially for high-demand specialties.)

What’s the appeals process for denied claims?

Are there any hidden requirements?

How Long Does It Take:

About 30-60 days after credentialing is complete.

Paneling means you’re officially listed as an in-network provider in the insurer’s directory. This is how clients find you when they search for covered therapists.

Why It Matters:

- More referrals (clients prefer in-network providers).

- Steadier cash flow (since claims are processed faster).

- Better visibility (you’ll appear in online directories).

When It Happens:

Automatically after contracting—but sometimes insurers take weeks to update their directories. Follow up.

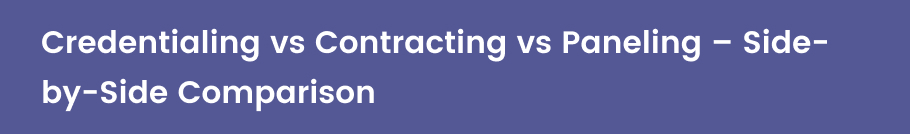

| Aspect | Credentialing | Contracting | Paneling |

| Purpose | Verify your qualifications | Set payment terms & rules | List you as in-network |

| When It Happens | First | After credentialing | After contracting |

| Can You Negotiate? | No | Sometimes (fee schedules) | No |

| Handled By | CAQH, insurers | You + insurer | Insurer (automatically post-contract) |

- Believing paneling happens immediately after application

“Paneling happens right after I apply.” → Nope. Credentialing + contracting come first.

- Forgetting to follow up post-credentialing

“I can start billing insurance as soon as I’m credentialed.” → Not until contracting is done.

- Mistaking out-of-network billing for credentialing

“Out-of-network billing is the same as credentialing.” → No—you can bill OON without credentialing, but reimbursement rates differ.

Tools to Track Credentialing and Contracting Statuses

Tracking credentialing and contracting statuses manually can be overwhelming, especially when dealing with multiple insurance companies and complex requirements. Fortunately, several tools and platforms can help healthcare providers stay organized and ensure they meet critical deadlines:

- Credentialing Software: Specialized credentialing software like Modio Health, CPS (Credentialing Provider Solutions), or TruBridge offers an intuitive dashboard where you can track the status of credentialing applications, expirations, and renewals. These platforms often integrate with CAQH, making it easy to submit and update credentials to multiple insurance companies.

- Spreadsheets: If you’re looking for a low-cost, DIY option, using Excel or Google Sheets can be a simple and effective way to track credentialing and contracting statuses. You can create columns for different insurers, the status of each application, upcoming renewal dates, and any necessary follow-ups. It’s a manual process, but with careful organization, it can keep you on track.

- Task Management Tools: Platforms like Trello, Asana, or Monday.com can help manage tasks and deadlines related to credentialing and contracting. You can create boards and set reminders for when actions need to be taken (e.g., following up with insurers, submitting renewals, etc.).

- Contract Management Software: To keep track of your contracts, platforms like DocuSign or ContractSafe can store and manage contracts securely. They allow you to review, track deadlines, and set up reminders for renewals or renegotiations.

- Credentialing Services: Some third-party credentialing services offer comprehensive tracking tools for clients. For example, Medheave, a credentialing and contracting partner, provides detailed tracking and progress reports that help healthcare providers stay on top of their applications and statuses without manual effort.

If you’re ready to streamline your credentialing and contracting process, Medheave can handle all the paperwork for you. With our expert team, we ensure faster approvals, no missed deadlines, and reduced stress. Contact Medheave today to get started on simplifying your credentialing process and growing your practice efficiently.

What to Automate:

- Deadline Tracking: Use software or task management tools to automate reminders for credentialing renewals, licensing expirations, and insurance contract deadlines. Tools like Asana or Modio Health can send you automated notifications when important dates are approaching.

- Submission of Applications: Automation tools can help you submit updated credentials to multiple insurers at once. Platforms like CAQH allow you to submit your information to numerous insurers simultaneously, which reduces the need for manual paperwork.

- Data Entry: Credentialing software often has automation features for filling out forms, updating information, and tracking the status of applications. This minimizes manual data entry and reduces the risk of human error.

- Contract Renewals: Set up automated reminders or notifications through contract management software (e.g., DocuSign or ContractSafe) to alert you when a contract is about to expire, ensuring that you never miss a renewal window.

What to Manage Manually:

Negotiations and Contract Reviews: Contract terms, such as reimbursement rates, billing processes, and other clauses, should be carefully reviewed before signing. While the process can be assisted by technology, negotiations should be handled manually to ensure favorable terms for your practice.

- Follow-Up Communication: Regular follow-up with insurers to ensure applications are processed is an area where personal communication can make a difference. Although automated reminders can help track deadlines, sending personalized emails or making phone calls to ensure that your credentialing status is progressing is often necessary.

- Initial Documentation: Although credentialing software can help manage ongoing updates, the initial paperwork and document gathering, such as licensure, educational qualifications, and malpractice insurance, often require manual collection. Keeping these documents up to date and ensuring accuracy is key.

- Personalized Problem Solving: If an issue arises (e.g., missing documents, delayed approvals), resolving the problem often requires a personal touch. Being proactive in addressing these issues can help avoid long delays.

By combining automation for repetitive tasks and manual management for negotiation and personalized follow-ups, healthcare providers can balance efficiency and attention to detail in their credentialing and contracting processes.

Final Thoughts:

Understanding credentialing, contracting, and paneling is essential for healthcare providers who want to accept insurance and grow their practice.

Each step of the process is vital to ensuring you’re qualified, compensated fairly, and visible to potential patients.

From proving your qualifications through credentialing, agreeing on payment terms via contracting, to being listed as an in-network provider through paneling, every stage requires attention to detail.

Missing any of these steps can lead to delays in patient care, payment issues, or even missed revenue opportunities.

Managing all of this on your own can be time-consuming, stressful, and prone to error, especially if you’re juggling other aspects of your practice.

That’s why many providers choose to outsource this responsibility to credentialing experts who can streamline the process, keep you organized, and ensure you meet critical deadlines.

Whether you opt for a DIY approach or partner with a credentialing service like Medheave, getting these processes right means smoother billing, more clients, and a healthier bottom line.

Final Takeaway:

- Credentialing → Prove you’re qualified.

- Contracting → Agree on payment terms.

- Paneling → Get listed in-network.

Miss a step, and you’ll face delays. Get it right, and you’ll have smoother billing + more clients.

Need help? Don’t drown in paperwork—get expert support from Experts at Medheave.

Frequently Asked Questions (FAQs)

What is the difference between credentialing, contracting, and paneling?

- Credentialing is the process of proving that you meet the qualifications required by insurance companies to be an in-network provider.

- Contracting involves agreeing to the terms and conditions of working with each insurer, including reimbursement rates and billing processes.

- Paneling refers to getting approved and listed as an in-network provider by insurance companies so that their beneficiaries can see you for services.

How long does the credentialing process take?

The credentialing process can take anywhere from 60 to 180 days, depending on the insurer and the complexity of your application. Some insurance companies can take longer to approve, especially if additional documentation is required.

Can I handle credentialing, contracting, and paneling on my own?

Yes, but it requires a significant amount of time, organization, and attention to detail. You’ll need to track deadlines, follow up regularly with insurers, and ensure your paperwork is up-to-date. If you’re willing to put in the time and effort, DIY can work, but many providers prefer outsourcing this work to experts.

Why is it recommended to outsource credentialing and contracting?

Outsourcing saves you time, reduces stress, and ensures accuracy. Credentialing and contracting experts know how to navigate the process quickly, understand insurer-specific requirements, and ensure you meet all deadlines. This helps you avoid delays in getting approved and being added to insurance panels, ensuring a steady stream of patients and revenue.

How can Medheave help with credentialing and contracting?

Medheave specializes in streamlining the credentialing and contracting processes. By working with us, you can enjoy faster approvals, avoid missed deadlines, and eliminate the headache of dealing with insurance paperwork. Our expert team will handle all the details so you can focus on what matters most—caring for your patients.