Understanding the Role and importance of a superbill is crucial for healthcare practices. A superbill is a comprehensive document that details the healthcare services provided to a patient, including associated costs, CPT codes, diagnosis codes, and provider information. This guide explores the superbill in medical billing, highlighting its significance in the billing process, comparing it with the CMS 1500 form, and providing practical insights on its creation and submission. Whether you’re a healthcare provider or a patient, this guide will equip you with the knowledge to handle superbills effectively.

Understanding the Role and importance of a superbill is crucial for healthcare practices. A superbill is a comprehensive document that details the healthcare services provided to a patient, including associated costs, CPT codes, diagnosis codes, and provider information. This guide explores the superbill in medical billing, highlighting its significance in the billing process, comparing it with the CMS 1500 form, and providing practical insights on its creation and submission. Whether you’re a healthcare provider or a patient, this guide will equip you with the knowledge to handle superbills effectively.

What is a Superbill?

In medical billing, a superbill is a detailed document outlining the healthcare services provided to a patient and associated costs. It includes essential information such as CPT (Current Procedural Terminology) codes, diagnosis codes, and provider details.

While both superbills and CMS 1500 forms are used for medical billing, they serve different purposes. A superbill is typically given to the patient for insurance reimbursement, whereas a CMS 1500 form is a standardized form healthcare providers use to submit insurance claims directly to payers.

Let’s look at the significant differences between the superbill and CMS-1500 claim forms.

Superbill

- A superbill is an itemized receipt given to patients who pay out-of-pocket for services from out-of-network providers. Patients can submit this to their insurance company for potential reimbursement.

- Used by medical offices that do not accept the patient’s insurance plan.

- Superbills have looser formatting requirements and can be customized by providers. However, they must include specific identifiers like CPT and ICD-10 codes and NPI numbers.

- Patients submit superbills to their insurance companies.

CMS 1500 Form

- The CMS 1500 form is a standardized form doctors use to submit insurance claims directly to payers for in-network services.

- Submitting claims is usually known as direct billing.

- Used by physicians who are in-network with the patient’s insurance plan.

- CMS 1500 forms have strict formatting requirements and must be printed in a specific red ink. They are often submitted electronically for faster processing.

- Doctors submit CMS 1500 forms directly to insurance companies.

Superbill Vs CMS-1500: A Comparison Table

| Feature | Superbill | CMS 1500 Form |

| Purpose | Patient reimbursement | Direct insurance claims |

| Usage | Out-of-network billing | In-network billing |

| Flexibility | Customizable format | Standardized format |

| Submission | Submitted by patients | Submitted by healthcare providers |

| Required Codes | CPT, ICD-10, NPI | CPT, ICD-10, NPI |

| Printing Requirements | No specific requirements | Must be printed in red ink |

| Electronic Submission | Not typically used | Commonly used |

Some practices prefer using superbills because it simplifies the billing process, allows them to receive direct patient payments, and reduces administrative overhead. Additionally, superbills offer patients more flexibility in choosing out-of-network care without being constrained by the provider’s insurance network participation.

What is the Role of the provider in generating the superbill?

Provider’s Role:

- The provider is responsible for ensuring the superbill is accurate and complete. This includes documenting the services provided, the diagnosis, and any necessary procedural codes that align with the treatment.

- The provider will often be responsible for assigning the appropriate ICD-10 diagnosis codes and CPT procedure codes based on the services rendered during the visit. This is crucial for proper reimbursement.

- In many practices, providers or medical coders generate the superbill at the time of service or afterward. Some EHR (electronic health record) systems can automate parts of the process, but accuracy is still key.

Steps for Patient Submission:

Obtain the Superbill: The provider will give the patient a completed superbill after the healthcare visit. This document will have all the necessary codes and visit details.

Insurance Claim Submission: The patient will then submit the superbill to their insurance company and any required forms. The insurance company will process the superbill as an in-network claim, determining what portion of the service will be reimbursed based on the patient’s insurance plan.

Submission Options: Some insurance companies allow for online submission, while others may require physical mail or faxing. The patient should check with their insurer for instructions on submitting the superbill.

Digital Submission Options (E-Superbills):

As the healthcare industry moves towards more digital solutions, e-superbills offer a way for patients and providers to streamline the superbill process.

E-Superbill Submission:

EHR Integration: Many electronic health records (EHR) systems today have built-in functionality to generate and submit superbills electronically (e-superbills). These systems can directly integrate with insurance carriers for claims submission.

Patient Portal Submission: Some practices offer patient portals where patients can download their e-superbill and submit it directly to their insurance provider. This can be done via the insurer’s online portal or the patient’s insurance account.

Automated Submissions: Some third-party platforms enable automated submission of superbills to insurers. These services can streamline the process, reducing errors and speeding up provider and patient reimbursement.

Providers use superbills for several reasons:

Out-of-Network Provider Scenarios

Superbills are essential when patients receive care from healthcare providers outside their insurance network. They allow patients to submit claims for reimbursement directly to their insurance companies, making out-of-network care more accessible and affordable.

Credentialing Delays

Credentialing with insurance companies can be a lengthy process. During this time, medical offices can use superbills to ensure they get paid for their services without waiting for official approval. This helps maintain cash flow and allows providers to continue offering services to patients.

Avoiding the Complexities of Insurance Network Participation

Participating in insurance networks involves navigating complex billing and administrative processes. By using superbills, medical organizations can bypass some of these complexities, reducing the administrative burden and focusing more on patient care. This can be particularly beneficial for smaller practices or those who prefer not to deal with the intricacies of insurance billing.

A superbill is a detailed document used in medical billing, especially for out-of-network services. It includes several key components:

1. Patient Information:

- Full name

- Date of birth

- Residential address

- Contact details

- Insurance information (type, name, and ID number)

2. Healthcare Provider or Practice Information:

- Practice name and address

- Tax identification number (TIN) or employer identification number (EIN)

- Provider’s name and National Provider Identifier (NPI)

- Provider’s contact details and license number

3. Service/Treatment Information:

- Date and place of service

- Diagnosis codes (ICD-10-CM)

- Procedure codes (CPT or HCPCS)

- Relevant modifiers (if applicable)

- Time spent in units or minutes

- Cost of each service or procedure

4. Additional Information (if required by payers):

- Doctor’s notes on patient’s progress or treatment plans

- Rendering provider’s signature for validation.

Usually, there are two types of superbills, or we may categorize them as:

- Client Submitted Superbills

- Provider Submitted Superbills

Client-submitted superbills:

The client-submitted superbills refer to the receipts a physician gives to a patient, which the patient submits to the insurance payer. In this process, the patient receives the payment/reimbursements in their account.

Provider-submitted superbills:

Providers submit claims or superbills to the insurance companies on behalf of patients. This process is referred to as provider-submitted superbills. Here, the provider gets the reimbursements directly from insurance payers rather than patients for the services he delivered.

Below are some significant benefits of superbills for practice.

Simplifies the provider’s billing process:

Superbill streamlines the billing process by consolidating all necessary information into one document, making it easier for providers to manage and submit claims.

Allows physicians to receive direct payments from patients:

With superbills, providers can receive payments directly during service, reducing the dependency on insurance companies for reimbursement.

Reduces administrative overhead:

By using superbills, you can reduce the time and resources spent on administrative tasks related to billing and insurance claims, leading to more efficient operations.

Gives patients more flexibility in choosing out-of-network care:

Patients can use superbills to submit claims to their insurance companies for out-of-network services, giving them the freedom to choose providers who may not be in their insurance network.

Faster payments compared to waiting for insurance claims:

Since patients pay doctors directly when using superbills, providers can receive payments more quickly than waiting for insurance claims to be processed and reimbursed.

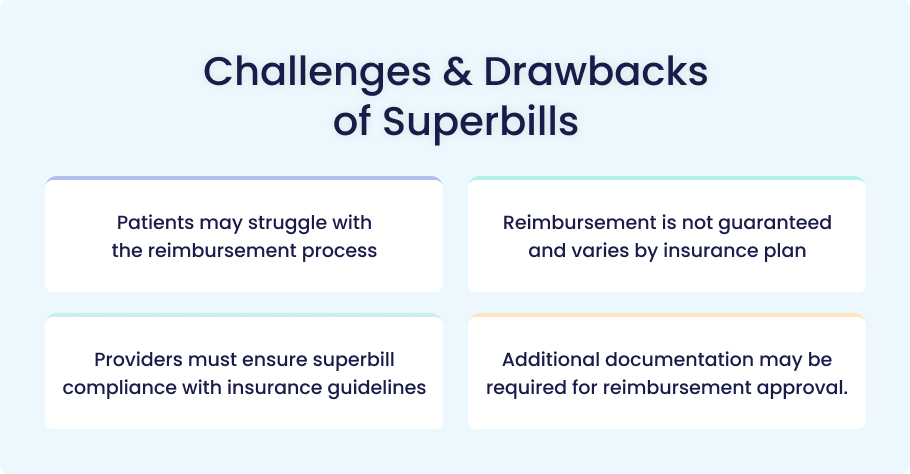

While dealing with superbills, medical practices, physicians, or patients may encounter various challenges.

Here are some drawbacks and challenges:

Patients may struggle with the reimbursement process

The paperwork during billing can be confusing and time-consuming for patients, especially if they are unfamiliar with the terminology and procedures involved. This may frustrate patients while dealing with the whole billing process and getting reimbursed successfully.

Reimbursement is not guaranteed and varies by insurance plan

Different insurance plans have varying policies on what they will reimburse, and some may not cover certain services. This uncertainty can be confusing. That’s why not all insurance payers are guaranteed to reimburse for the services mentioned in a superbill.

Providers must ensure superbill compliance with insurance guidelines

Each insurance payer has its own specific guidelines and reimbursement policies. To avoid claim denials, healthcare providers must stay updated on the latest insurance requirements and ensure that they accurately complete the superbills.

Additional documentation may be required for reimbursement approval

Insurance companies often request additional information or documentation to process claims, which can delay reimbursement and add to the administrative burden for patients and providers.

When you see a patient as a physician, and they ask for a superbill, you must know about generating a superbill.

Here’s how you will get this job done.

1. Enter Accurate CPT and ICD-10 Codes

CPT (Current Procedural Terminology) Codes:

CPT Codes describe the medical, surgical, and diagnostic services provided. Ensure you select the correct CPT codes that match the services rendered.

ICD-10 (International Classification of Diseases, 10th Revision) Codes:

ICD-10 Codes document diagnoses and conditions. Follow these steps to enter ICD-10 codes accurately:

Understand the Structure: ICD-10 codes are alphanumeric and can have up to seven characters. The first character is a letter, followed by numbers, and additional characters provide more specific details

Gather Information: Collect comprehensive patient information, including history, clinical documentation, and any relevant lab results

Identify the Diagnosis: Review the provider’s documentation to determine the specific diagnosis.

Use the Alphabetic Index: Look up the main term for the condition in the ICD-10 manual

Review the Tabular List: Confirm the code by checking the full description in the Tabular List

Verify Coding Guidelines: Ensure compliance with ICD-10 guidelines and payer-specific requirements

2. Include Provider and Patient Details

A superbill must include detailed information about both the provider and the patient:

Patient Information: Full name, date of birth, address, contact details, and insurance information

Provider Information: Practice name, address, tax identification number (TIN), National Provider Identifier (NPI), and contact details

Service/Treatment Information: Date of service, place of service, diagnosis codes, CPT or HCPCS codes, and the cost of each service

3. Choose Medical Billing Software or Using Templates

You can either use medical billing software or superbill templates to streamline the process:

Medical Billing Software: Software like Medesk or other EHR systems can help automate the creation of superbills, reduce errors, and enhance efficiency

Templates: Printable superbill templates are available online and can be customized to fit your practice’s needs

4. Submit the Superbill Electronically or via Paper

Once the superbill is complete, it needs to be submitted to the insurance company:

Electronic Submission: Use online portals or electronic data interchange (EDI) services to submit superbills electronically. This method is faster and reduces the risk of errors

Paper Submission: If electronic submission is not an option, you can mail the superbill. Ensure all required documents are included and use certified mail with tracking

Maximizing reimbursement success involves several best practices. Here’s a detailed look at each one:

1. Educate Patients About Submitting Superbills

Patients need to understand the importance of superbills and how to submit them for reimbursement:

- Provide clear instructions on how to submit superbills to their insurance companies. This can include step-by-step guides or informational brochures

- Emphasize the potential for reimbursement and reduced out-of-pocket costs

- Be available to answer questions and assist with any issues they may encounter during the submission process

2. Ensure Accuracy in Coding and Documentation

Accurate coding and thorough documentation are crucial for successful reimbursement:

- Ensure that all staff involved in coding are well-trained and up-to-date with the latest coding guidelines

- Conduct regular audits to identify and correct any errors in coding and documentation

- Encourage detailed and precise documentation from a doctor to support the codes used

3. Verify Insurance Policies for Out-of-Network Coverage

Understanding the specifics of a patient’s insurance policy can prevent claim denials:

- Verify the patient’s out-of-network benefits before providing services

- Know the specifics of what the insurance will cover, including any deductibles or co-pays

- Inform patients about their coverage and any potential out-of-pocket costs

4. Follow Up with Insurance Companies on Claim Status

Proactive follow-up can ensure timely processing and payment of claims:

- Use online portals offered by insurance companies or medical billing service providers to check the status of claims.

- Send a follow-up letter to the insurance company requesting an update if a claim is delayed

- Keep a record of all communications with the insurance company, including dates and the names of representatives spoken to

Conclusion

A superbill is a detailed invoice healthcare providers provide to patients, especially out-of-network patients. It includes essential information such as CPT and ICD-10 codes, provider and patient details, and service costs. Superbills play a crucial role in medical billing by enabling patients to seek reimbursement from their insurance companies for the services they receive.

Superbills offer a flexible and efficient alternative to traditional billing methods. They can streamline the billing process, reduce administrative burdens, and improve cash flow for healthcare practices. By adopting superbills, medical professionals can offer their patients a clear and organized way to handle out-of-network claims, enhancing patient satisfaction and financial transparency.

Proper usage of superbills benefits both patients and providers. Patients better understand their medical expenses and can reduce their out-of-pocket costs through successful reimbursement claims. On the other hand, providers can ensure accurate billing, minimize claim denials, and maintain a steady revenue stream. By educating patients, ensuring precise coding, verifying insurance policies, and following up on claims, both parties can maximize the advantages of superbills.

FAQs

What is a Superbill in medical billing?

In medical billing, a superbill is a detailed document outlining the healthcare services provided to a patient and associated costs.

Is a superbill the same as an insurance claim?

No, a superbill is not the same as an insurance claim. A superbill is a detailed document created by a healthcare provider that lists the services, including diagnosis and procedure codes. It is given to the patient, who then submits it to their insurance company to request reimbursement. An insurance claim, on the other hand, is a formal request submitted directly to the insurance company for payment.

How long does it take to get reimbursed from a superbill?

The reimbursement process for a superbill can vary, but it typically takes a few weeks. Suppose you haven’t received reimbursement after about a month. In that case, it’s a good idea to follow up with the insurance company to ensure they have all the necessary information and to check for any issues that might delay the process.

What information is required on a superbill?

A superbill must include several key pieces of information to ensure accurate processing:

- Patient Information: Full name, date of birth, address, and contact details.

- Provider Information: Provider’s name, National Provider Identifier (NPI) number, practice address, and contact details.

- Service Details: Date of service, place of service, diagnosis codes (ICD-10), procedure codes (CPT or HCPCS), and the cost of each service

Can any provider use a superbill for billing?

Yes, any healthcare provider can use a superbill for billing, especially those who are out-of-network. This includes doctors, therapists, dietitians, and other specialists. The superbill helps patients seek reimbursement from their insurance companies for services these out-of-network providers provide.

Do insurance companies always accept superbills for reimbursement?

Insurance companies do not always accept superbills for reimbursement. Acceptance depends on the insurance policy and the specific circumstances of the claim. Some insurance companies may deny claims or only partially reimburse them, especially for out-of-network services. It’s essential to verify the details of your insurance policy and understand the coverage for out-of-network service.